Commodities serve as fundamental elements in industrial activities. As an eToro trader, you have the opportunity to invest in a range of commodities, including oil, gold, and wheat. Your investment decisions can be based on your predictions about whether their prices will increase or decrease. Additionally, incorporating commodities into your portfolio is a strategic approach to diversification.

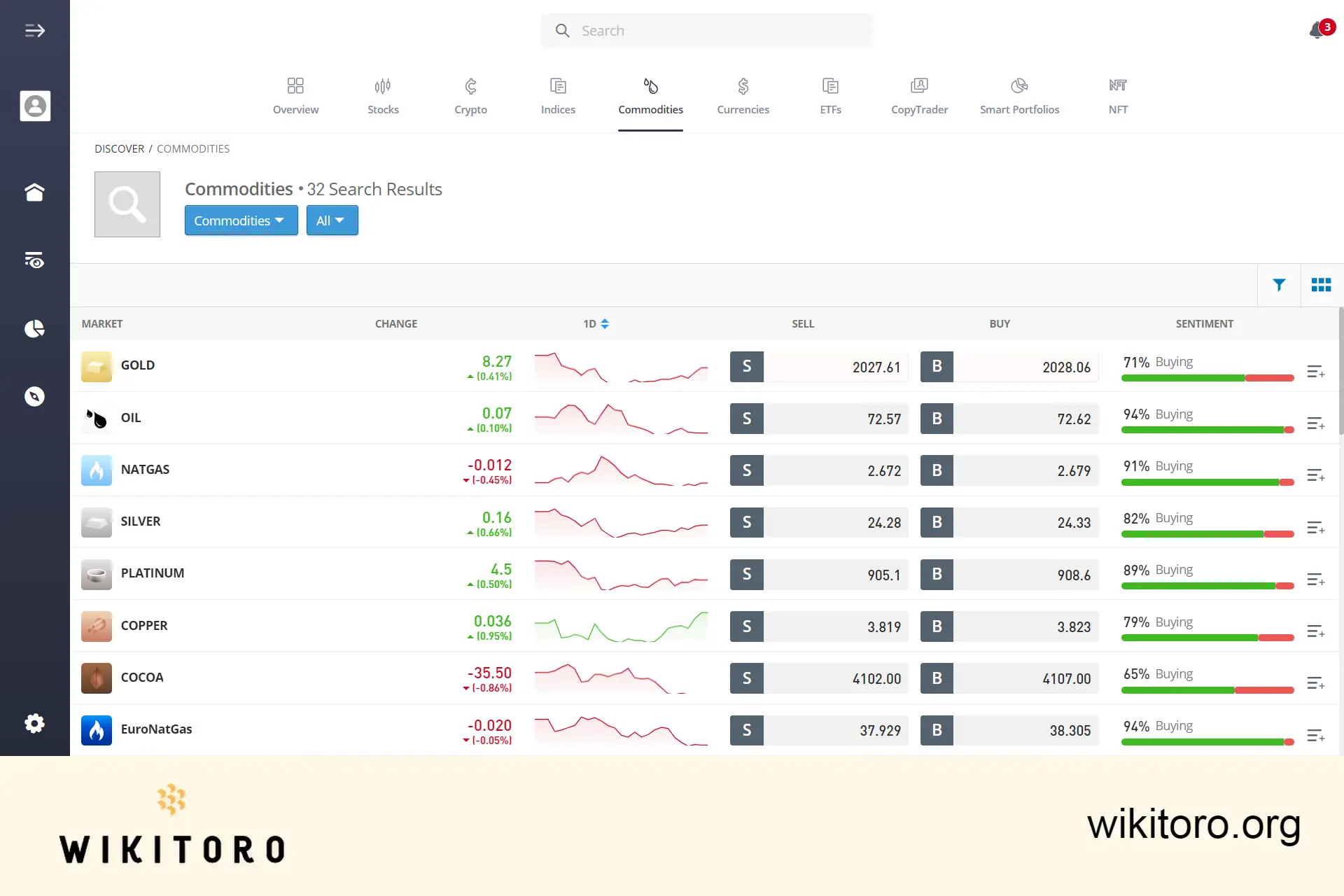

The platform simplifies the process, allowing you to execute Buy or Sell orders on various commodities. It also offers the unique advantage of observing and emulating the strategies of seasoned traders, all within a unified interface.

In this guide, I will provide a comprehensive overview of the different types of commodities accessible for investment and explain how to navigate these markets using eToro. This insight is based on my personal experiences and practices on the platform. You will gain an understanding of what commodity trading entails and explore various reasons why investing in commodities can be a wise financial move.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| 🧈 Commodities | 29 |

| 📈 Spread | From 2 pips |

| 🕟 Market Hours | Mondays to Saturdays (different times per commodity) |

| 📊 Leverage | Up to x20 for Gold, Up to x10 for other commodities (for eToro (Europe) Ltd, eToro (UK) Ltd, and eToro AUS Capital Limited clients) Up to x100 (for eToro (Seychelles) Ltd clients) |

| 💰 Minimum Trade | $1,000 |

When participating in commodities trading via eToro, it's essential to understand that you are not dealing with physical assets. Instead, your engagement is with commodity derivatives, more specifically, Contracts for Difference (CFDs).

A CFD is a sophisticated financial instrument that allows you to speculate on the price fluctuations of an underlying asset, such as gold or crude oil, without the necessity of owning the actual asset. Engaging in a commodity trade on eToro equates to entering into a CFD contract. The profit or loss you incur is determined by the difference in the CFD's price at the time of opening and closing the contract.

One of the key advantages of CFD trading is the ability to capitalize on asset price movements without the complexities and expenses involved in managing physical commodities. However, it's imperative to acknowledge that CFD trading is not without risks, including the potential for substantial losses, possibly extending to your entire investment. Therefore, employing risk management strategies, like stop-loss orders, is crucial in mitigating these risks.

My journey into commodities trading on eToro has led me to several key observations:

To enhance your understanding of the range of commodities available for trading on eToro, I have categorized them into four distinct types:

It's important to note: This classification is not actually visible on the platform itself; it's a framework I've developed to provide clearer insight into the types of commodities they offer.

| Precious Metals | Energy | Agriculture | Meat & Livestock |

| Gold | Crude Oil | Wheat | Lean Hogs |

| Silver | Brent Crude Oil | Cocoa | Live Cattle |

| Copper | Natural Gas | Sugar | |

| Aluminum | European Natural Gas | Cotton | |

| Platinum | Carbon Emissions | Coffee Arabica | |

| Palladium | Gasoline | Corn | |

| Nickel | Heating Oil | Oats | |

| Lead | Rice | ||

| Zinc | Soy Meal | ||

| Soybeans | |||

| Orange Juice |

Engaging in commodity trading on eToro is a streamlined process. To begin, simply use the search bar to find the desired commodity. Once located, you can place your investment and set the trade parameters. The final step is to click the "Open Trade" button to initiate the transaction.

Before starting, it's crucial to ensure that your account is both verified and sufficiently funded to trade in commodities. Also, be mindful that your position in commodities will remain active until one of the following occurs:

The platform offers real-time data, news updates, and live price charts, which are essential tools for traders at all levels. These resources are particularly valuable for analyzing both historical and current price trends.

📈 Are the live charts accurate?

My thorough evaluation of eToro's live commodity rates and charts has demonstrated their remarkable accuracy and timeliness. To validate this, I conducted a comparison between the figures displayed on eToro's platform and those from reputable commodity market data sources, specifically CNN, Bloomberg, and CNBC. Indeed, the commodity prices on eToro's platform consistently aligned with these three sources. However, it's worth noting that I did encounter minor price delays on a few occasions.

If you're new to commodities trading, I highly recommend starting with the demo account. Upon registration, you'll gain access to this account, which is loaded with virtual funds. This feature allows you to practice trading various commodities like gold and crude oil on the platform, all within a completely risk-free setting.

That covers everything you need to know about trading commodities on this platform. Given the potential for significant returns, it's crucial to make well-informed decisions and effectively employ the tools and strategies outlined in this guide. I hope this guide has deepened your understanding and that my personal experiences have offered valuable insights into navigating commodity trading on eToro.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.