The Stop Loss feature on eToro is a crucial instrument for traders, designed to mitigate losses in unfavorable market conditions. To ensure you can effectively utilize this tool, I have thoroughly examined its functionalities and risk management aspects. This guide is crafted to enhance your understanding of how the Stop Loss (SL) feature operates and how you can leverage it to optimize your trading strategy.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| ⚙️ Options | Amount, Rate |

| 📉 Minimum | 1 pip away from current market price |

| 📈 Maximum | 50% of position amount (except non-leveraged Buy positions) |

| 🔚 Close Automatically | ✔️ |

The Stop Loss tool or SL is a fundamental risk management strategy, that enables you, the trader, to establish a specific price point at which a trade will be automatically terminated to curtail potential losses.

This automated order is a safeguard that activates when the market price hits the defined level. eToro incorporates the Stop Loss feature across its platform, making it available for a wide array of tradable assets, including stocks, currencies, and cryptocurrencies.

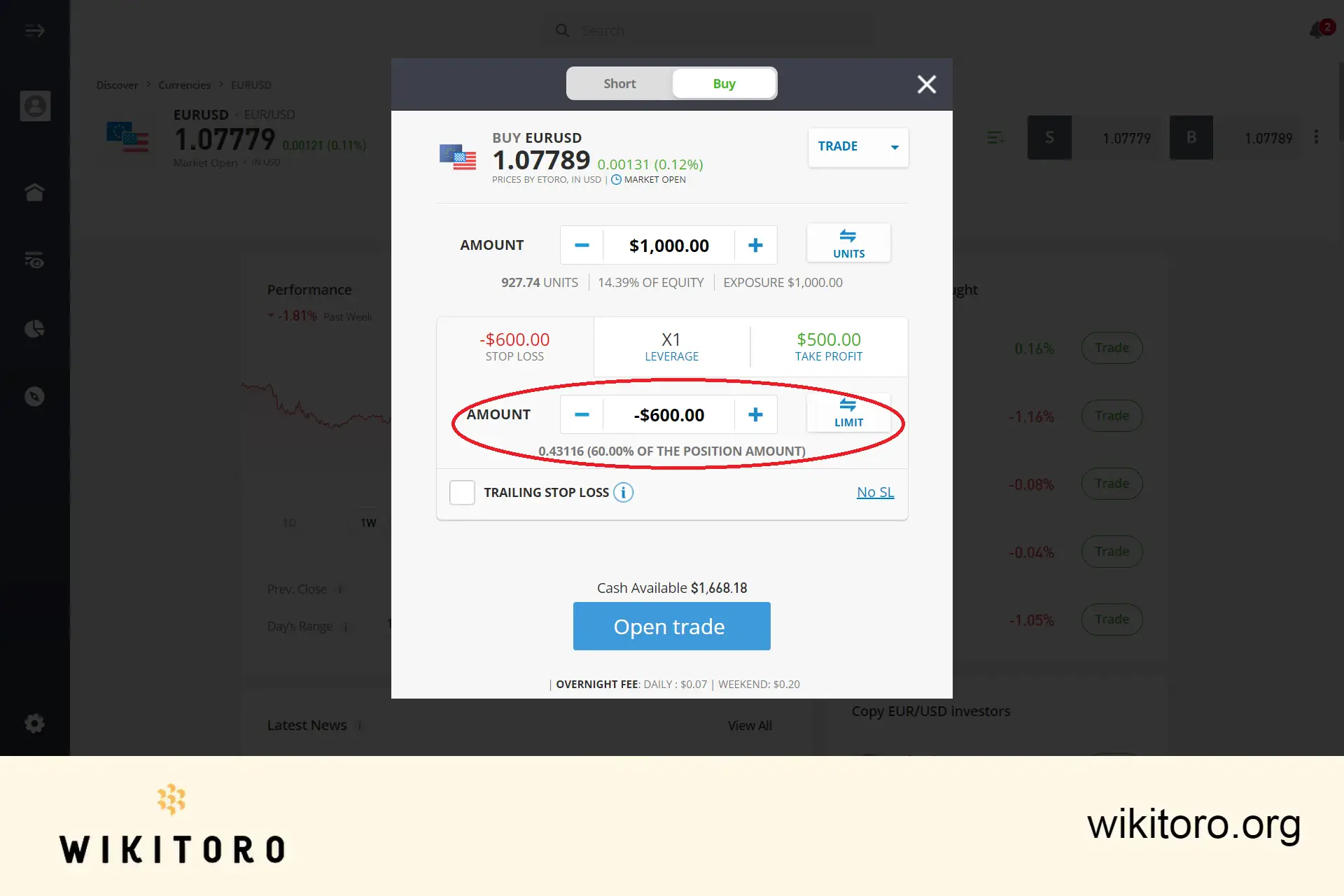

Upon initiating a trade on the platform, you'll already have the opportunity to set a Stop Loss order. This involves specifying a price at which the trade should automatically close.

For instance:

If you purchase a stock at $100, you might place a Stop Loss order at $95. Should the stock's price fall to $95, the trade will automatically close, thereby limiting your loss to $5 per share.

It's crucial to understand that a Stop Loss order comes into effect only when the market price reaches the predetermined level. If the asset's price never hits your Stop Loss threshold, the trade will continue to be active until you decide to close it manually.

After extensive experimentation with the Stop Loss (SL) order on eToro, I've gathered several insights and tips to help you make the most of this tool:

The platform will give you thee choice of three distinct types of Stop Loss orders, each catering to different trading strategies and risk management needs: Basic, Guaranteed, and Trailing Stop.

Each of these SL orders offers unique benefits and can be strategically used depending on your trading goals and risk management preferences on eToro's platform.

Stop Loss and Take Profit are two crucial tools that you can use to manage you trades on eToro. Stop Loss and Take Profit are not guaranteed and trading with leverage involves high risk.

⚠️ I can't emphasize this enough...Using SL and TP together can help you manage your risk and create a trading plan that fits your style and preferences. However, it's important to remember that these tools DO NOT guarantee that your desired price level will be executed.

Also keep in mind that they only trigger the order to be executed if the asset's price reaches the specified level. So, it's essential to set realistic Stop Loss and Take Profit levels based on the asset's volatility and your risk tolerance.

Just like me, probably your first question is how do I set a Stop Loss order on eToro? This query is actually quite common and to answer that, the process is pretty simple.

After accessing the platform, select your desired asset and then initiate a trade. Then configure your order, set your Stop Loss level, decide on your your SL type, and then click “Submit” to finalize it.

After your order is active, you can keep track of it under the “Portfolio” tab in your account together with the SL parameters you just set.

As we conclude this guide, I'd like to share my personal insights on the importance of the Stop Loss (SL) feature in trading. Based on my experience, I can affirm that the SL tool is indispensable for every trader. It has been instrumental in mitigating potential losses that could have occurred without its use, thereby enabling effective risk management.

I strongly encourage you to incorporate Stop Loss orders into your trading strategy on eToro. This practice will not only bolster your confidence in trading but also significantly diminish the adverse effects of market volatility on your portfolio. Remember, smart trading is as much about managing risks as it is about seizing opportunities.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman