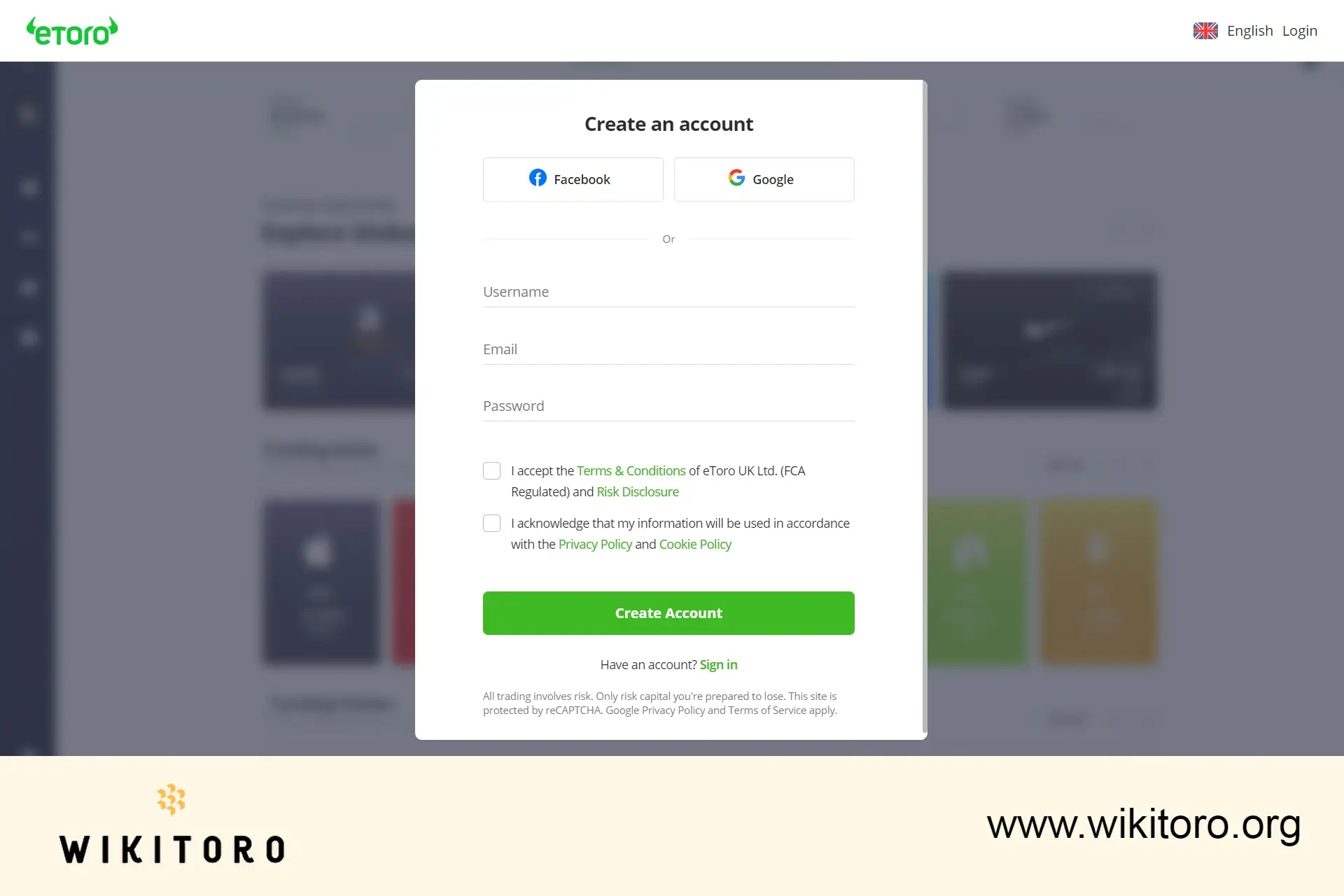

Getting started with an eToro trading account is simpler than most newcomers expect. You can open an account with as little as $50 (depends on your country of residence), trade thousands of assets, practice first with a $100 000 virtual portfolio, and even mirror the moves of seasoned investors through CopyTrader, all on a platform that is regulated in several major jurisdictions and protected by two-factor authentication.

Here, you will learn exactly how this account works and all relevant information that you need to know, so you can decide whether eToro fits your first steps into the markets.

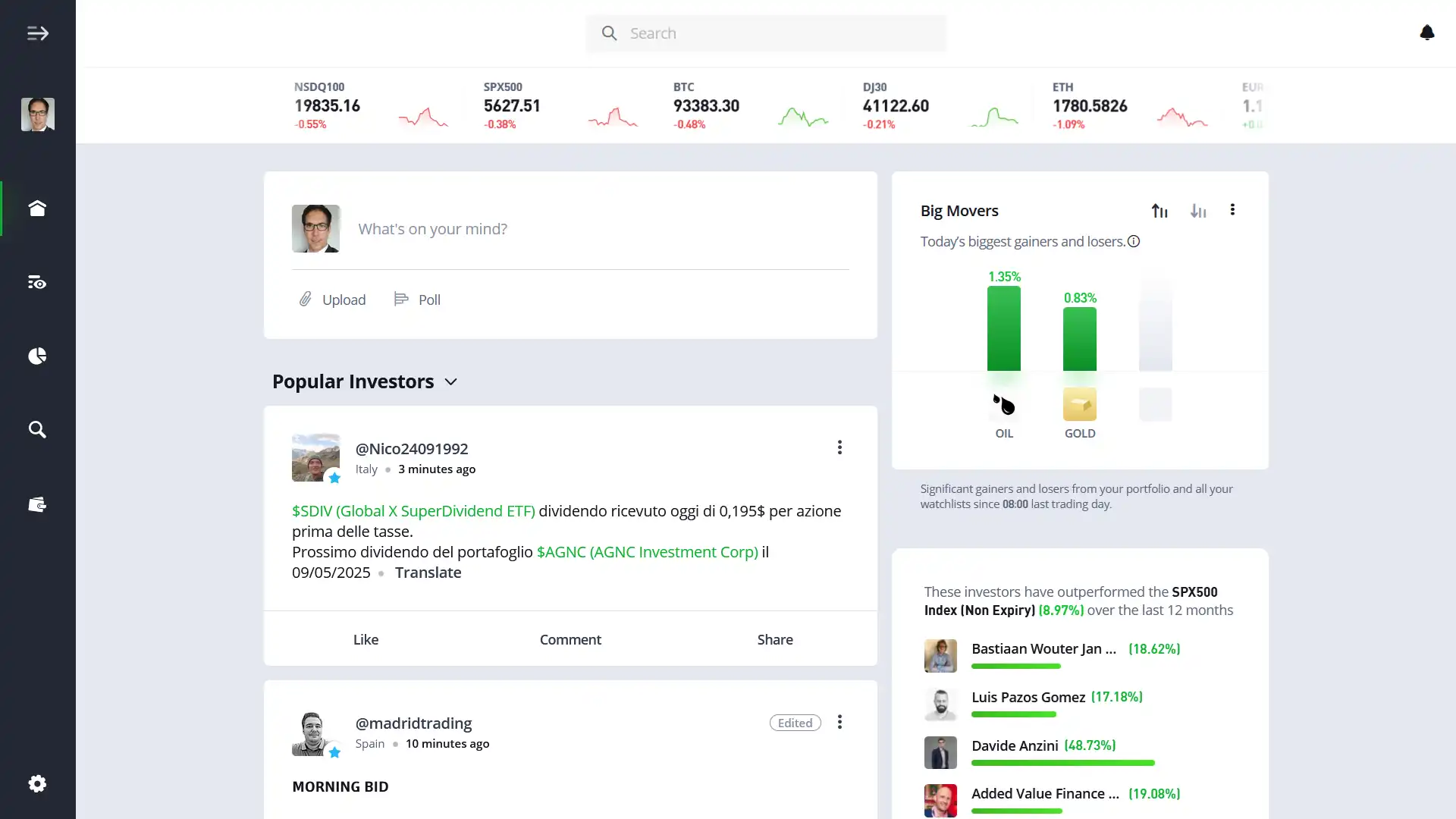

An eToro trading account is a brokerage profile that lets you (availability of activities will depend on your country of residence) buy stocks, exchange-traded funds, crypto, commodities, currencies, and contracts for difference (CFDs) from the same dashboard.

Most new users open a retail account, which provides negative-balance protection and access to the full suite of social features. Traders who meet certain experience and capital thresholds can request a Professional Client upgrade that relaxes leverage caps.

eToro operates in more than 100 countries under licenses from the UK FCA, CySEC in Europe, ASIC in Australia, and several other regulators.

During registration ,you must supply proof of identity and address to satisfy “know-your-customer” rules. Residents of a few US states and territories are still excluded from crypto trading, so check local availability first.

Personal Tips for First-Time Users

If this is your first time to open an online trading account, here are some of my recommendations for you:

- Set learning goals. Spend a week in the virtual portfolio testing basic orders before wiring larger sums.

- Start with one asset class. Forbeginners, I suggest focusing on familiar stocks first, then branch into ETFs or crypto once you get a grasp of their price fluctuations.

- Use CopyTrader selectively. Review a trader’s risk score, drawdown history, and the number of months they have been profitable before copying. Invest small amounts across several profiles instead of going all-in on one.

- Keep an eye on fees. If your home currency is not USD, consider a low-cost FX service to top up your account and avoid the conversion spread.

- Stay compliant with tax rules. Download the yearly account statement from the Settings → Account section and hand it to your accountant or local tax authority.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver

Related Articles

We've compiled a list of related articles

Learn how to open an eToro trading account with simple, step-by-step instructions and some useful tips to avoid any delays or issues.

Need to verify your eToro account? Learn the exact documents to upload, avoid delays from common mistakes, and get your profile approved.

Find out how much an eToro account really costs. From zero sign-up fees to trading spreads, we'll clear everything you need to know.

Curious about eToro’s account limits? Learn what’s allowed, what’s not, and why sticking to the rules matters for trading, verification, and safety.

Changing your eToro account currency isn’t automatic. Find out the steps involved, what limitations apply, and how to properly make the change.

Thinking of trading futures on eToro? We'll discuss what’s possible, what’s not, and the best ways to get futures-style exposure.

Looking for your eToro account number? Learn where to find your username instead, and understand how eToro identifies users without numeric IDs.

Find out how to change your eToro address step-by-step. Keep your trading account updated to meet verification requirements and avoid service disruptions.

Wondering what happens to your eToro funds after death? Discover how inheritance works, who can access your assets, and what legal steps are required.

Wondering how to view your full eToro history? Follow this step-by-step guide to check all your trades, transactions, and account activity.

Open your eToro account by meeting key requirements such as verified identity, compatible country, minimum age, and terms of use.