On eToro, you won’t rack up debt the way you would with a credit card or bank loan, but your balance can drop below zero in certain situations.

Here’s what happens: Using leverage or holding trades overnight can trigger fees or fast market swings that push your account into the red. For instance, if a leveraged trade moves sharply against you, the loss can eat through all your funds and more. When this happens, the funds in your ‘Available Balance’ can show a negative number.

Using leverage means every profit, and even every loss, gets amplified.

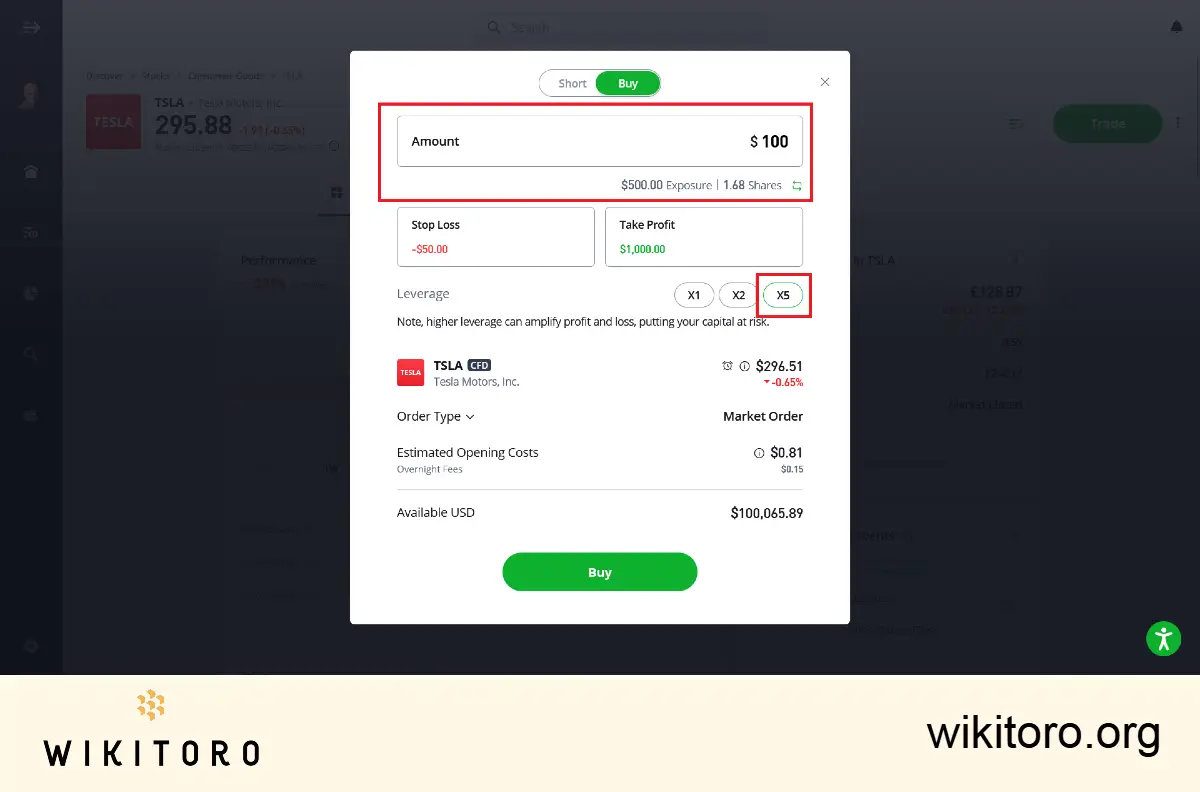

Take this: you open a $100 trade on Tesla stocks with 5× leverage. That’s $500 of market exposure. If the market dives 20%, you’re down the full $100. Your entire stake, gone in one move.

eToro puts safeguards in place. For leveraged CFD positions, stop-loss levels typically kick in around the –50% mark of your margin. If the market swings too far, margin calls and auto-closures step in to limit how much you can lose.

In rare cases, a sudden overnight gap might jump past your stop. Even then, negative balance protection means your account balance can’t dip below zero.

eToro uses margin calls and automatic stop-outs to shut positions down before losses eat through your entire deposit. So, unlike a credit card, you’re not stuck with lingering debt.

If your account balance dips below zero, eToro might cover the gap themselves or ask you to top it up. This usually happens when markets swing wildly and price moves outrun the system’s safeguards.

I can say this confidently: as a retail client on eToro, you can’t rack up real debt. Any momentary “negative cash available” from fees or losses gets absorbed by the broker itself. If that happens, your balance snaps back to zero. You won’t get a bill, a repayment demand, or a debt collector knocking.

Still, just because that’s sorted, I always tell people to watch their leverage. Use the stop-loss and margin tools eToro gives you. They exist for a reason: to keep your account in check.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman