eToro Funds

- Supports various deposit options

- Instant deposits with eToro Money

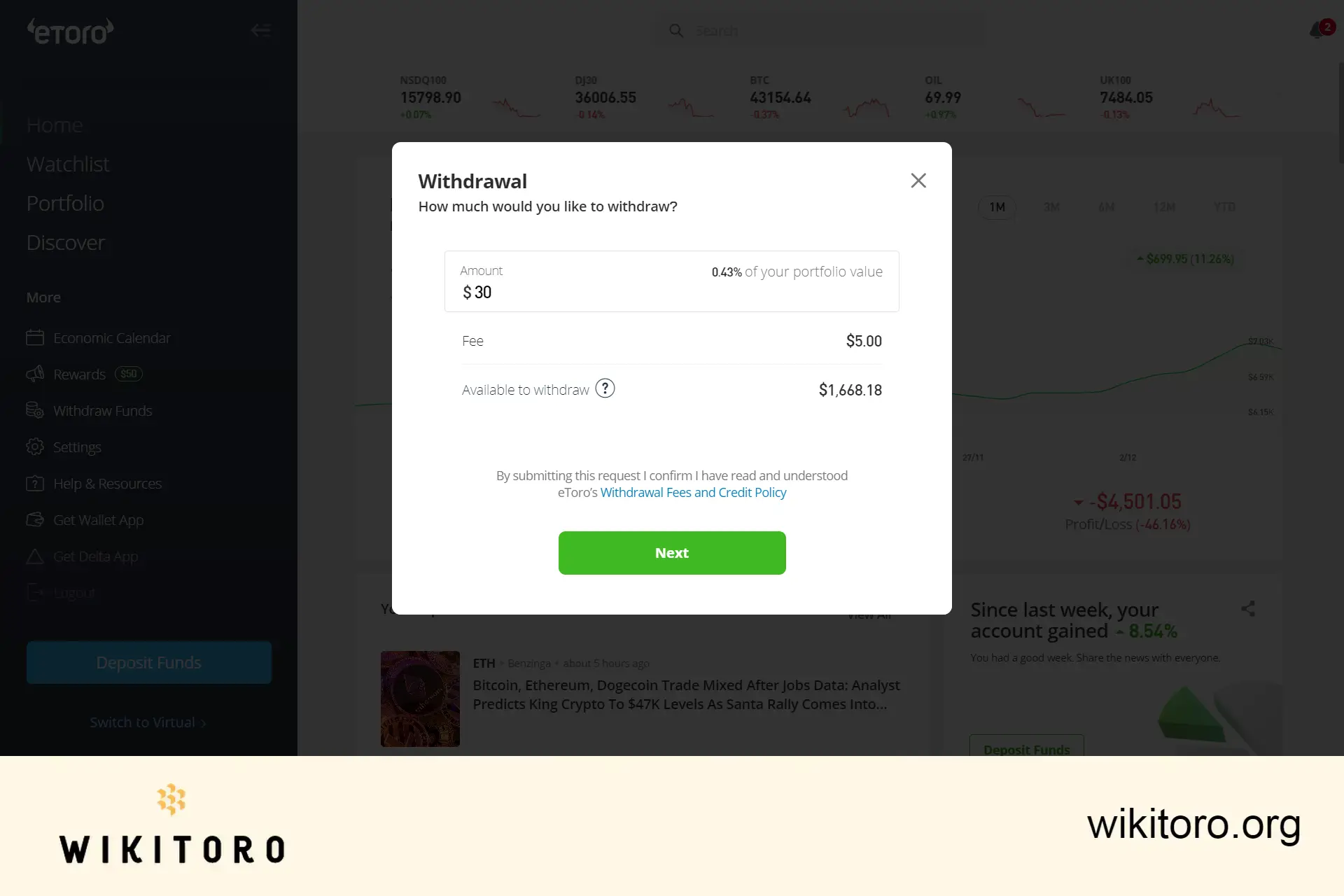

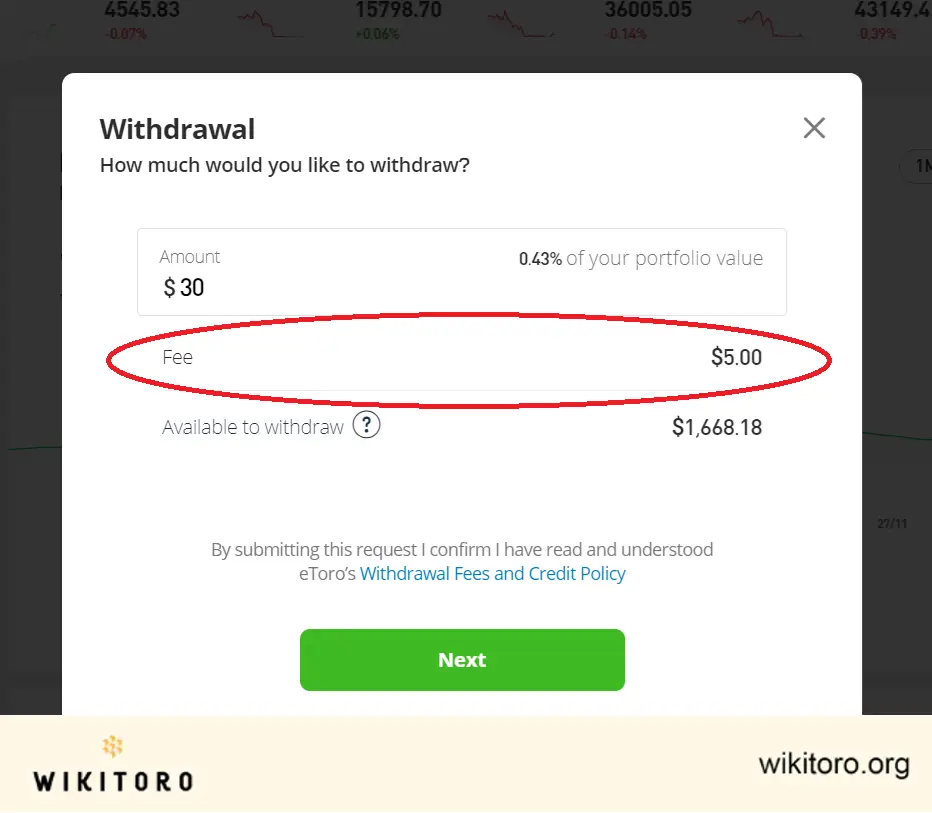

- Flat $5 standard withdrawal fee

- Minimum withdrawal amount of $30

- Transparent fee structure

61% of retail investor accounts lose money

Before you start trading, you’ll need to get familiar with how your money moves around inside your eToro account.

Deposits. Withdrawals. Profits. Losses. It all counts.

And if you don’t understand how the fund flow works, you’re going to run into some issues, especially when it’s time to cash out or scale up.

Here, I'll give you a clear detailing of the common financial transactions you’ll deal with when managing funds on eToro.

Let’s get started.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

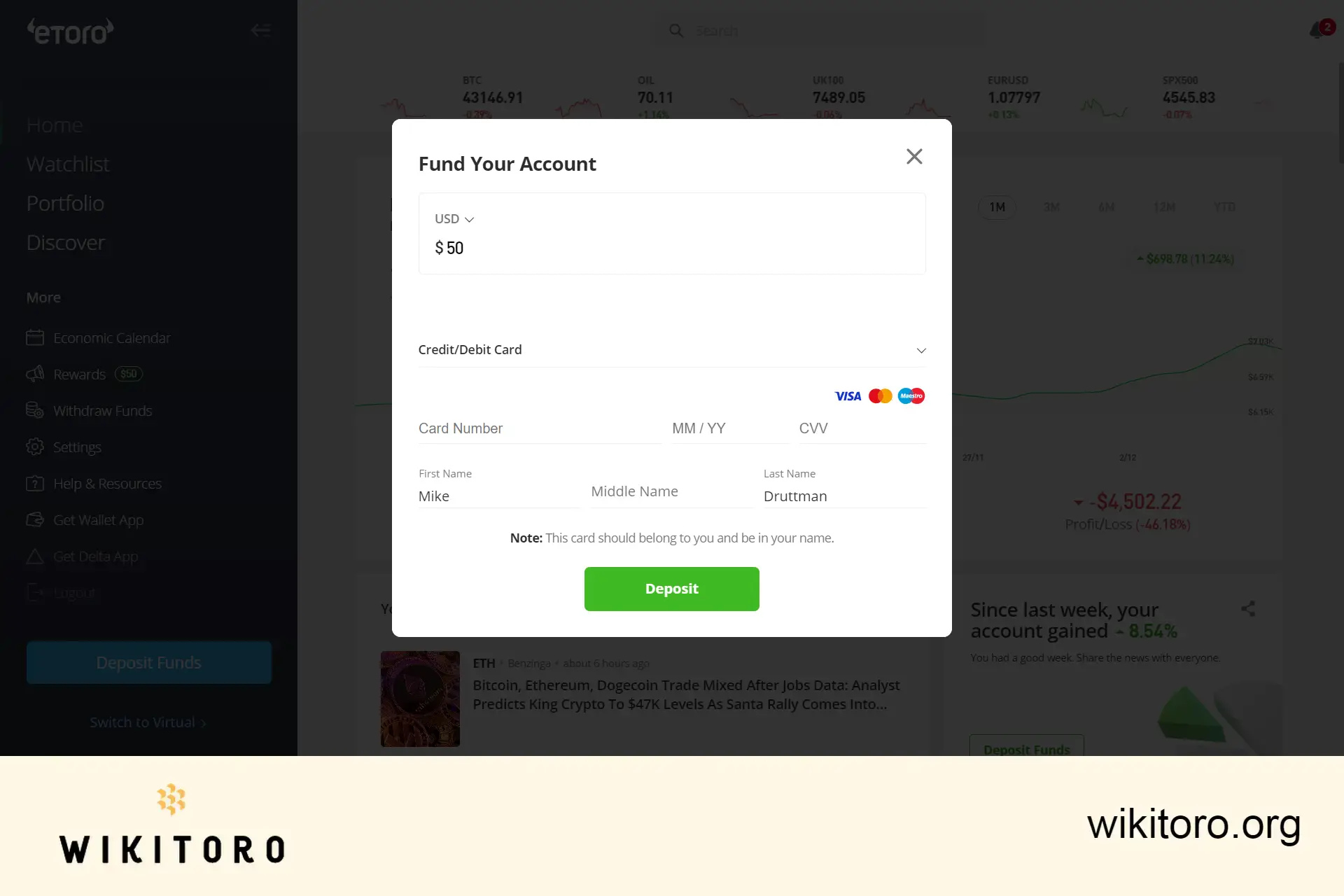

You can’t start trading without funding your account and eToro makes this step pretty painless.

The platform accepts a wide range of deposit methods, which means you can choose the one that suits you best. But here’s the thing: the minimum deposit amount depends on where you live.

In the US or UK? You’re good to go with just $50.

Elsewhere, the required deposit typically ranges between $50 and $200 depending on your country.

So before you jump in, check the local minimum to avoid any surprises.

When it’s time to cash out, eToro keeps the process simple but there are a few rules you need to know.

First, you’ll need to have a verified account. That means uploading your ID and confirming your details. Once that’s sorted, you can withdraw funds whenever you want. There’s no holding period or timing restriction.

Just make sure you’re aware of eToro’s withdrawal policies so everything runs smoothly.

If you’re trading dividend-yielding assets (think stocks, ETFs, or indices), eToro doesn’t leave you out of the loop.

When the underlying company pays out, so do they. Hold the asset directly, and eToro credits the dividend straight into your account on the official payout date. No delays, no guesswork. It’s matched with the asset’s dividend schedule, just like it would be in a traditional brokerage setup.

Let’s talk about fees because yes, they’re part of the equation.

Trading fees on eToro include spreads, overnight (rollover) fees, and, depending on the asset, a commission. These apply while you're actively buying or selling positions.

Then there’s the non-trading side. These fees come from account-related actions, like:

They don’t show up in your portfolio chart, but they can eat into returns if you’re not paying attention.

Open an eToro trading account and you get access to eToro Money, a digital wallet service built into the platform.

It’s more than just a perk. You can deposit instantly (and for free), skip the currency conversion fees, and withdraw faster than the standard method.

And here’s the kicker: there’s no subscription fee. You’re not paying monthly charges or usage-based extras. It’s built to make fund transfers smoother and cheaper with no strings attached.

On top of managing your funds, eToro also offers a built-in crypto wallet via the eToro Money app. This lets you store, send, and receive real cryptocurrency tokens—right from your phone.

But here’s the catch:

The wallet isn’t available everywhere. It’s limited to certain countries, so double-check if yours is supported before you download the app and expect full functionality.

And that wraps up all the important details on fund management with eToro, based on my own experience using the platform over the years. Just keep in mind that some limits and requirements may differ depending on where you live.

Want the most accurate info? Always go straight to the source. Head over to eToro’s official website or help center for the latest updates.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman

Related Articles

We've compiled a list of related articles

Simplify your eToro withdrawals: Learn about fast, hassle-free methods to access your trading profits in our guide.

Get clarity on eToro dividend payments: Learn about tax liabilities, payment schedules, and potential changes. A concise guide for traders.

Know the possible fees that you might incur from using eToro's trading platform. Find out if their charges are lower or higher than other brokerages from this detailed guide.

Efficiently manage your eToro Money: Learn about instant transactions, no FX fees, and daily financial tools in our guide.

Looking to trade big amounts on eToro? See how strong regulation, client fund separation, and compensation schemes help protect your large investments.

Get the facts about going into debt on eToro, including how negative balances happen, risk management tools, and how to avoid unwanted losses.

Understand how eToro keeps trading funds separate, secures accounts, allows withdrawals, and what protections exist if financial problems ever occur.

Discover the level of money protection eToro offers its clients, how segregated accounts work, and what happens to your funds if eToro becomes insolvent.