eToro Copy Trading

- Copy up to 100 traders simultaneously

- Real-time position mirroring

- Proportional investment allocation

- Access to Popular Investor portfolios

- Detailed trader performance analytics

61% of retail investor accounts lose money

Launched back in 2010, eToro’s CopyTrader has grown into one of the platform’s most widely used features, particularly among new investors testing the waters.

If you’ve landed on this page, you’re probably looking for a full info of how it works, what it offers, and whether it’s worth your time.

You’re in the right place.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| 🔽 Minimum investment in a trader | $200 |

| 🔼 Maximum investment in a trader | $2,000,000 |

| 👥 Maximum number of traders to copy simultaneously | 100 |

| 💰 Minimum amount for a copied trade | $1 |

| 🛑 Default copy stop-loss | 40% |

Think of CopyTrader as your shortcut to learning by doing, without having to make every call yourself.

You start by browsing through eToro’s top-performing traders and Popular Investors. Each profile gives you a full run down: returns, open trades, risk score, and even how long they hold positions.

Found someone whose style you like? Click ‘Copy.’

From there, you’re automatically mirroring their trades live: same entries, same exits, same stop-loss and take-profit levels. If they go long on gold with 10x leverage, you’re right there with them.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

You’re not handing over control. You can stop copying, pause, or adjust your exposure at any time.

It’s like standing next to a pro on the trading floor. You're watching every move and matching it, click for click. Except you’re doing it from your laptop or phone.

After spending time with eToro’s CopyTrader feature, I picked up a few things that might save you time, and a few headaches. If you’re thinking of jumping in, here are the main points to know:

To copy a trader, the minimum investment is $200. That’s your entry ticket.

That said, this number isn’t set in stone. At one point, eToro raised it to $500, so it’s worth checking for the most up-to-date threshold before you fund anything.

Copying isn’t just about how much you invest but also about how much gets copied per trade. The minimum per trade is $1. If the trader you’re copying places an order that equates to less than $1 on your side, it won’t execute.

Quick heads-up: eToro temporarily bumped this to $2 in the past. Another reason to keep an eye on platform updates.

Let’s say you manually close a position from your copied trader. What happens?

The proceeds go straight back into your copy balance. That’s the portion of funds allocated to copying a trader but not tied up in active trades. Knowing how this works makes it easier to track available capital and manage risk without disrupting the overall strategy.

CopyTrader isn’t just for passive investors. It’s a front-row seat to how the best traders think and act.

You can review their performance stats, check historical returns, analyze drawdowns, and then choose to follow their trades in real time. It’s part learning, part mimicking, and often a lot more insightful than just reading theory.

Markets are complex. Studying them takes time, sometimes more than most people can give.

With CopyTrader, I found I could learn while watching seasoned investors in action. You’re still gaining knowledge, just in a more hands-on, time-efficient way.

Not confident picking stocks or crypto on your own? That’s fine. Copying different traders across asset classes is an easy way to diversify your portfolio without overthinking it.

I followed a mix: one trader focused on US tech, another on commodities, and one on short-term forex plays. And the result? A broader exposure and lower single-trade risk.

One of the most useful features? The way the platform neatly organizes traders into groups and categories.

It’s not just a random list of profiles. You get structure, which are filters that actually help you zero in on the kinds of investors you’re looking for. Whether you want trend-setters, steady performers, or low-risk thinkers, it’s all there.

Here’s what you'll find:

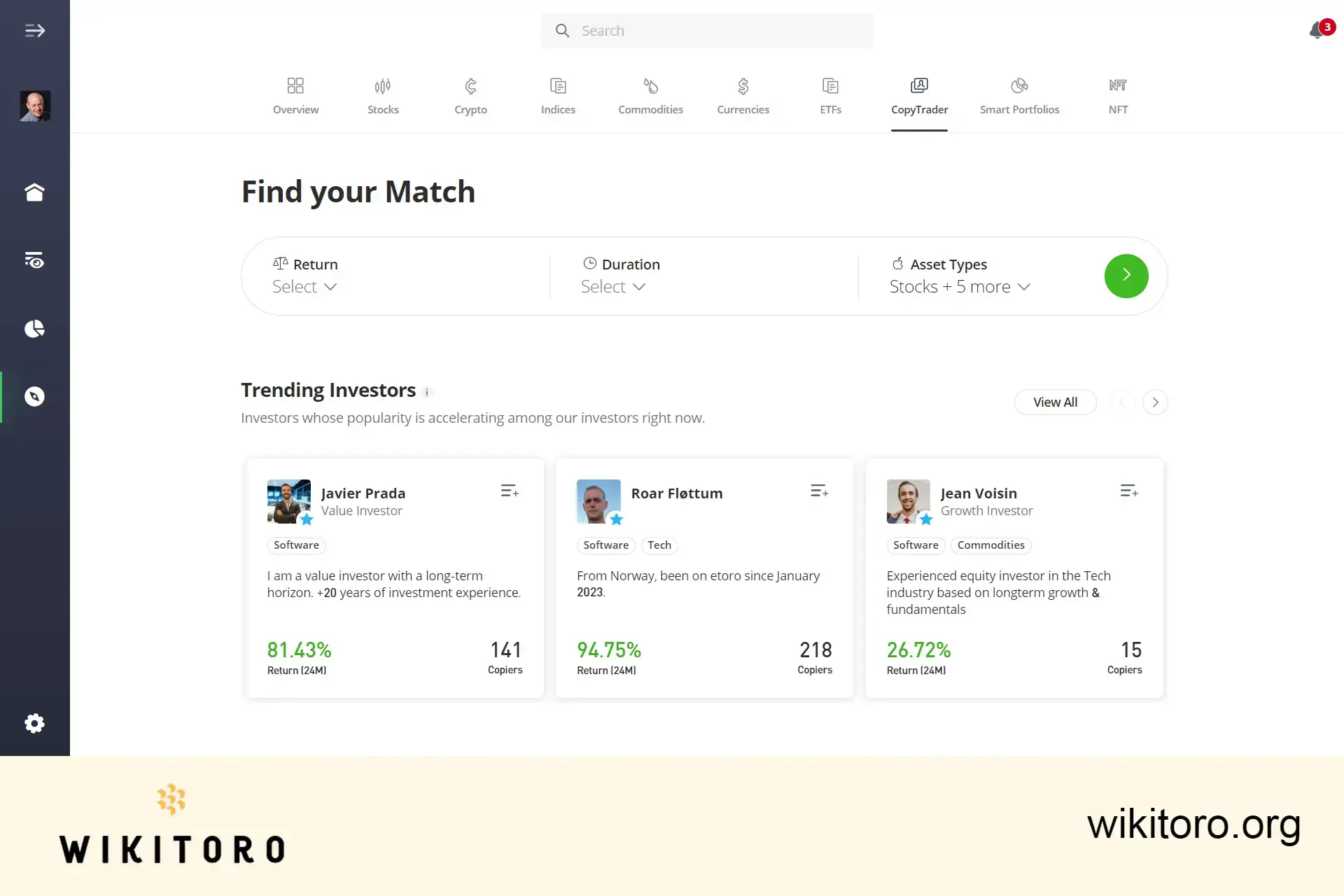

Traders who’ve seen a sharp rise in copiers recently. Think of them as the platform’s momentum plays; something caught attention, and others are following.

The popularity contest. This group highlights investors with the highest number of copiers. Want to refine the view? You can filter by timeframe:

This is helpful for spotting long-term consistency versus short-lived hype.

These are the top performers when it comes to pure returns. If ROI is your north star, this group’s worth a closer look.

It’s not just about big gains. This filter surfaces those with the highest percentage of profitable months. The kind of steady hands that tend to perform even in shaky markets.

Here you’ll find traders who combine profitability with a diversified, low-risk portfolio. Ideal if you’re looking to grow without riding every market wave.

This is for followers of the big picture. These traders focus on currencies (forex) and commodities to give you exposure that moves independently of typical market trends.

This one's pretty straightforward. These are the investors who’ve outpaced the S&P 500 over the past 12 months.

If you’re into funds over individual stocks, this one’s for you. Traders here hold portfolios where ETFs make up more than 30%.

Looking for fossil fuel exposure? This filter highlights those with at least 20% of their portfolio in energy. Think oil, gas, and other related assets.

It’s a simple way to explore a wide range of strategies without endlessly scrolling. You set the direction, and the filters do the rest.

Not sure who to copy? Let’s fix that.

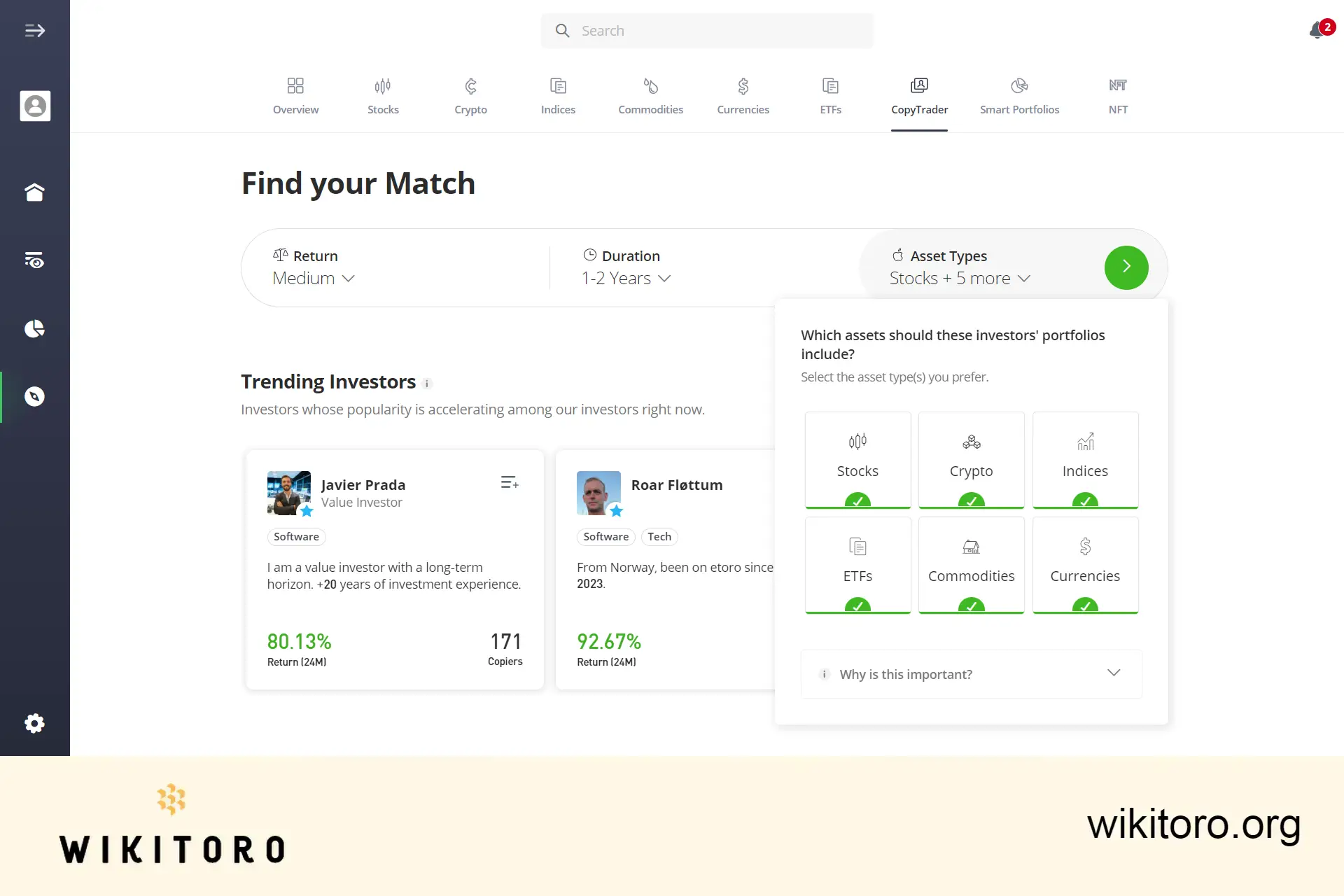

eToro’s "Find Your Match" filter is your shortcut to discovering traders who actually suit your goals, not just the ones trending today. It’s a simple tool that asks a few questions about your preferences, risk tolerance, and investing style.

Answer them honestly. Think of it like setting up your trading profile before heading into the real game.

| Question | Choices | Skippable |

| What risk level are you comfortable browsing? | Low, Medium, High | ✔️ |

| What's your expected timeframe for this copy? | 0-1 years, 1-2 years, 2+ years | ✔️ |

| Which assets should these investors' portfolios include? | Stocks, Crypto, Indices, ETFs, Commodities, Currencies | ❌ |

Once you're done, just hit “Find Investors” and let the platform do its thing. You’ll get a personalized list of traders that match your criteria so you can stop guessing and start copying with intent.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

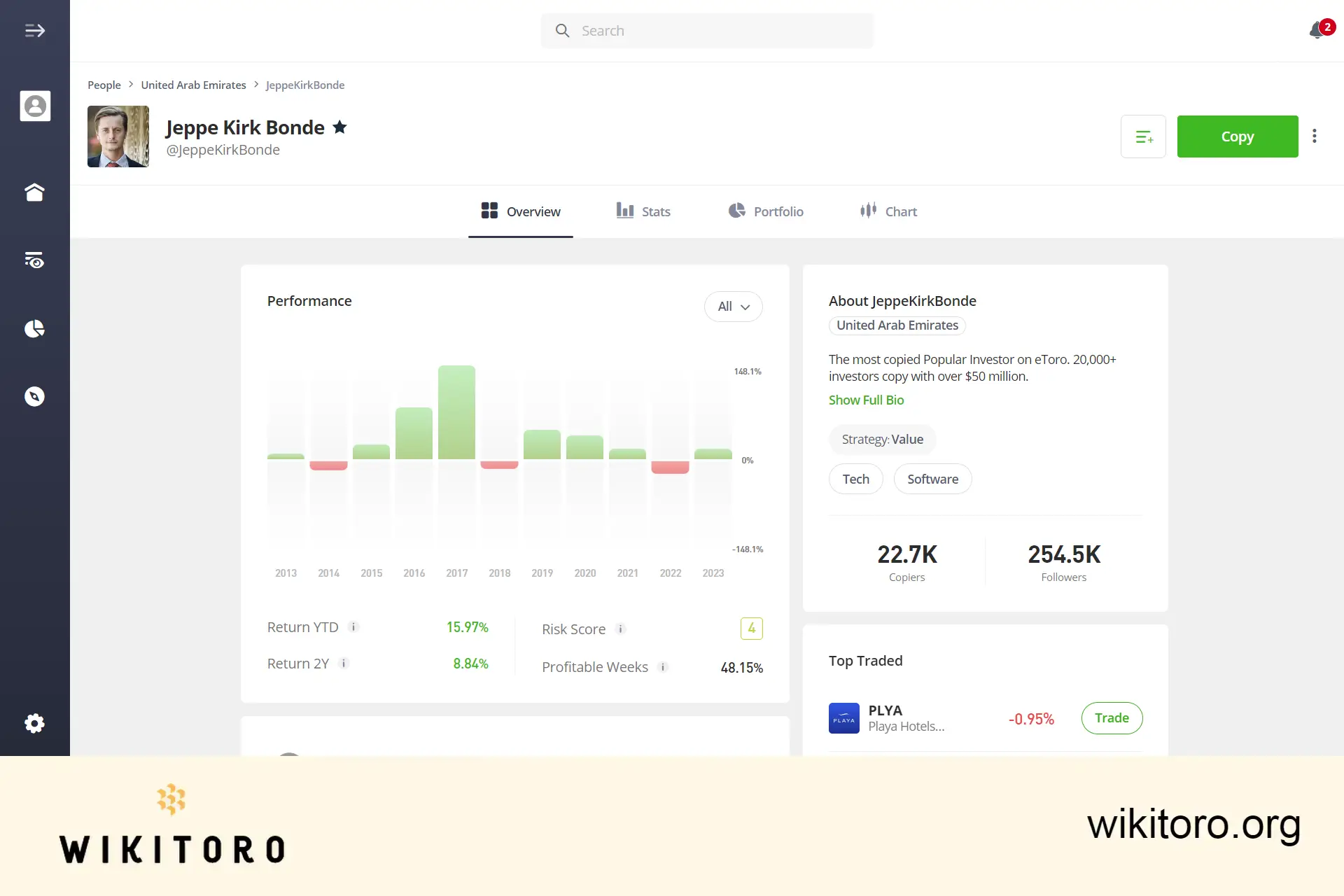

Want to know if a trader is worth copying? Start by checking out their public profile. It’s broken into four primary sections and each one will give you a clear look at how they trade, what they hold, and how they’ve been performing.

This is the trader’s front door. You’ll get a quick intro: bio, trading focus, and maybe some personal notes.

Right below that? The Feed. Think of it like a Facebook wall. Traders use it to post updates, share thoughts, or comment on market moves. You can jump into the conversation too. Like, comment, or share anything they post.

Here’s where it gets interesting.

The Stats section displays all the numbers. You’ll see a full history of their trading performance month-by-month returns, risk score, average holding time, number of trades, and more.

If you want to spot consistency (or red flags), this is where you look.

This section shows everything the trader currently holds and it's laid out with all the important info:

You’ll also see Buy and Sell buttons next to each position, updating live with market movements.

Basically, you get a transparent view of where their money is and how it’s performing.

Want to see the big picture? The Chart section visualizes the trader’s performance over time.

But this isn’t just any graph. It shows simulated copy results using historical data. It's based on a $10,000 starting investment and a 60% copy stop-loss.

It’s a quick way to see how a trader’s strategy would’ve played out had you copied them from the start.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

So you’re ready to make your very first copy trade?

Good news: it’s a smooth ride. But let’s walk through it step by step.

The first time you copy another trader, eToro pops up a one-time notification. This isn’t just some throwaway popup. It introduces how copy trading works and asks you to confirm that you’re okay with the terms.

Pay attention to this bit.

You’ll be asked to review the CopyTrading Risks section and the platform’s terms and conditions. It’s not the most thrilling read, but it matters. This is where you get the full picture of how copy trading works and what could go sideways.

Once you’ve scrolled through, understood the risks, and you're confident it’s the right move?

Hit Confirm, and you’re in.

You’ve just started your first copy trading strategy. Welcome to the game.

Here’s a common question: can you copy multiple traders on eToro at the same time?

Short answer: yes, you can.

eToro’s CopyTrader lets you follow more than one trader simultaneously. So if you’re thinking about diversifying across strategies (swing traders, long-term holders, etc.) you’re not stuck choosing just one.

That said, there’s a cap. You can only copy a certain number of traders at once. It’s not unlimited, and eToro sets that limit for system performance and risk control. Still, it’s enough to build a balanced portfolio and get a feel for different trading strategies without jumping between accounts manually.

Copying multiple traders is a great way to observe different styles in action. One trader might focus on forex. Another might stick to tech stocks. You get to see how each handles market changes, risk management, and entry points, all in real time.

You’ve now got all the info you need on how CopyTrader works, and specifically how to copy multiple traders without breaking a sweat.

Hopefully, this guide gave you a clearer picture of how to use the tool like a pro. If it helped, feel free to pass it along to someone else figuring out their way through eToro’s copy trading setup.

And if you're ready to build a more diversified strategy, you know where to start.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver

Related Articles

We've compiled a list of related articles

Unravel the art of choosing top eToro investors for copy trading with our detailed article. Based on personal experiences, we help you navigate the choices to maximize returns and align with your strategy.

Ever wondered if mirroring multiple eToro traders at once is a good strategy? Explore the nuances, learn from real experiences, and get actionable insights to make informed decisions in the realm of copy trading.

Unlock the secrets of eToro's copy trading with our detailed guide. Drawing from real-life experiences, we break down the steps, strategies, and essential tips to help you copy top eToro traders successfully.

Discover the minimum amount needed to start copy trading on eToro, including how it works, key limits, and tips for maximizing your investment strategy.

Discover what happens when someone copies your trades on eToro, from synced portfolios and risk controls to how you earn as a Popular Investor.