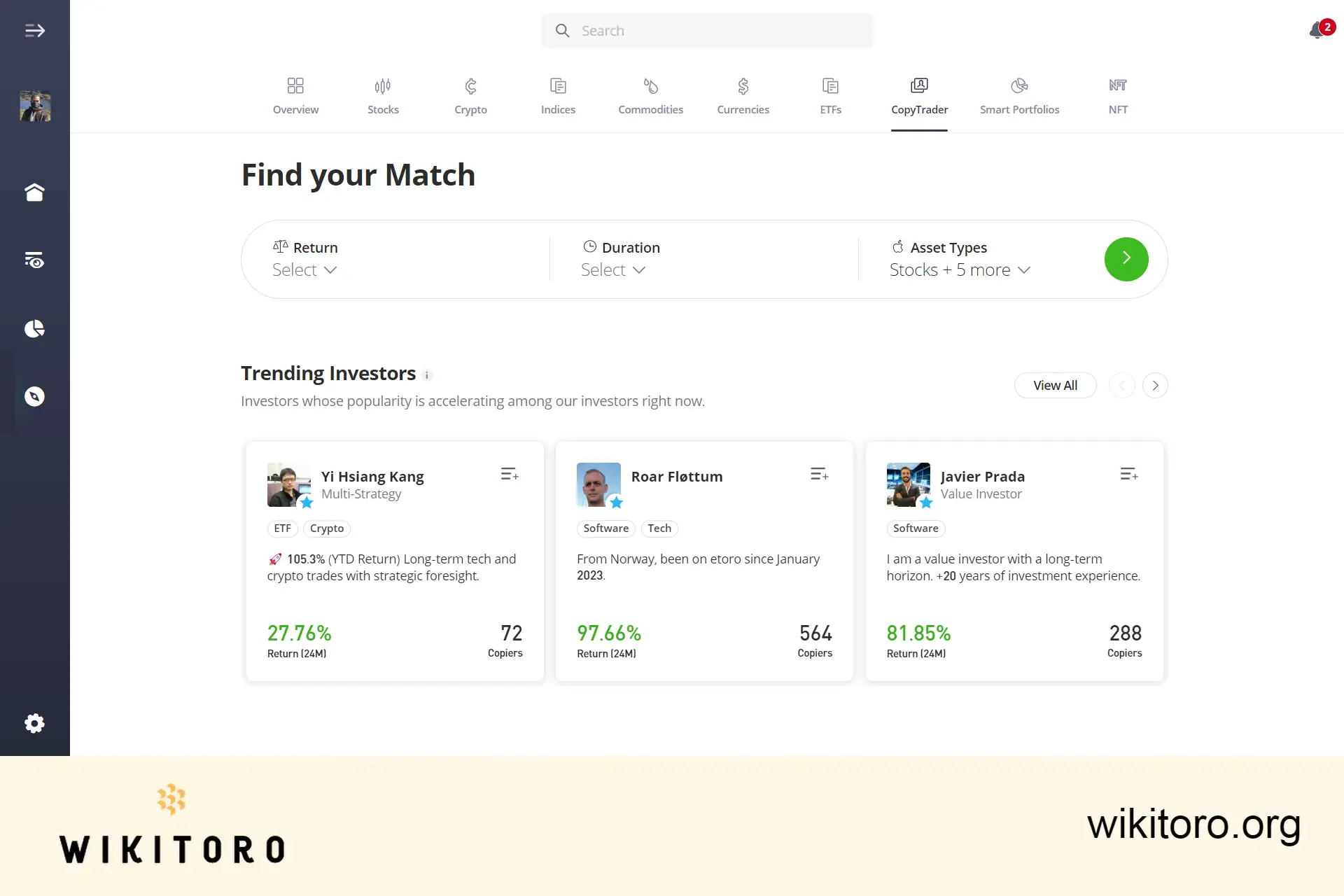

To select which Popular Investors to copy on eToro, utilize the CopyTrader filter on the Discover People page. Here, you can refine your search based on various criteria, including your risk tolerance, anticipated copy timeframe, the asset classes the investor trades in, and more. This tool aids in aligning your investment preferences with suitable Popular Investors.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

I remember the first time I stumbled upon the eToro copy trading feature, a groundbreaking shift in my investment journey. Suddenly, I could tap into the strategies of seasoned investors. But who to choose? With over 30 million registered users on their social investment network, the challenge was discerning whom to emulate. With such an abundance of skilled investors, making a choice can be overwhelming. If you're as baffled as I was, here’s my personal guide based on firsthand experiences.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

It took me a few missteps to realize the importance of aligning with an investor who mirrors my financial aspirations. Are you seeking rapid growth or a conservative path? Reflect on your risk tolerance and align them with potential investors, just as I did.

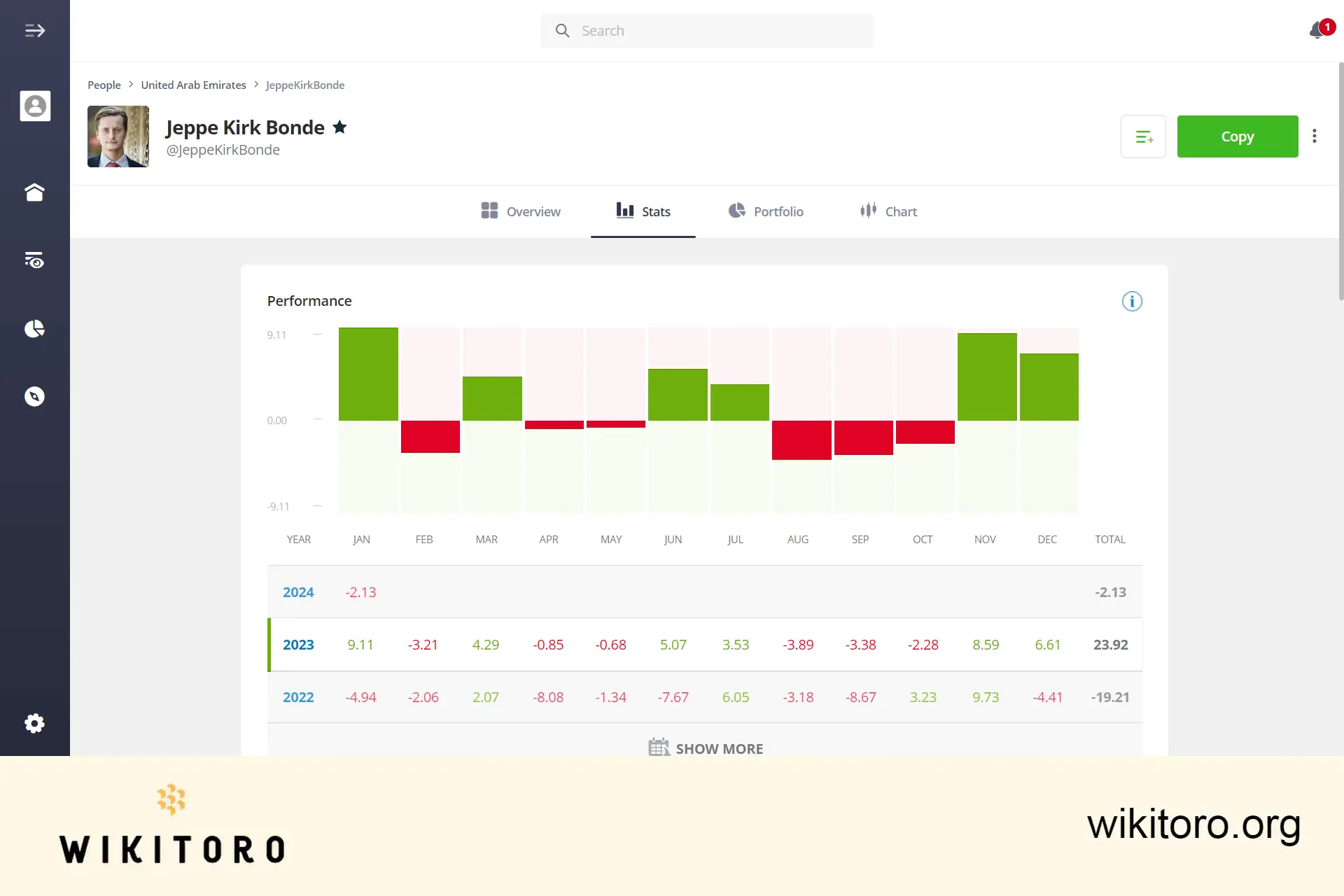

I've been burned before by simply chasing high returns. It's essential to dig deeper. Look at how consistent an investor has been, their risk-adjusted returns, and their maximum drawdown. I learned the hard way that understanding these can save you from potential financial pitfalls.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

I've followed investors with a varied asset focus—from stocks to crypto. Pay attention to their trading frequency, and if they use leverage. It's all about aligning with someone who resonates with your style.

I can't stress enough the importance of diversification. Through trial and error, I've found that copying a blend of investors shields my portfolio from unexpected downturns. Don't put all your faith in one strategy.

One invaluable lesson I’ve learned is to always listen to the community. The insights, feedback, and even the criticisms they provide about investors are gold mines of information.

An investor’s historical performance can offer many insights. I've always kept an eye on how my chosen investors responded to economic crises or market volatility, ensuring I'm paired with those who are resilient.

Hidden fees were a nasty surprise during my initial foray into copy trading. Always read the fine print, and be wary of platforms that aren't transparent about costs.

Over the years, I've realized that true investing success comes when there's a synergy between your beliefs and your chosen investor's strategy. It's not just about the numbers; it's about shared financial philosophies.

I've always gravitated towards investors who are transparent. Their willingness to share insights, rationale behind trades, and responsiveness to queries speaks volumes about their credibility.

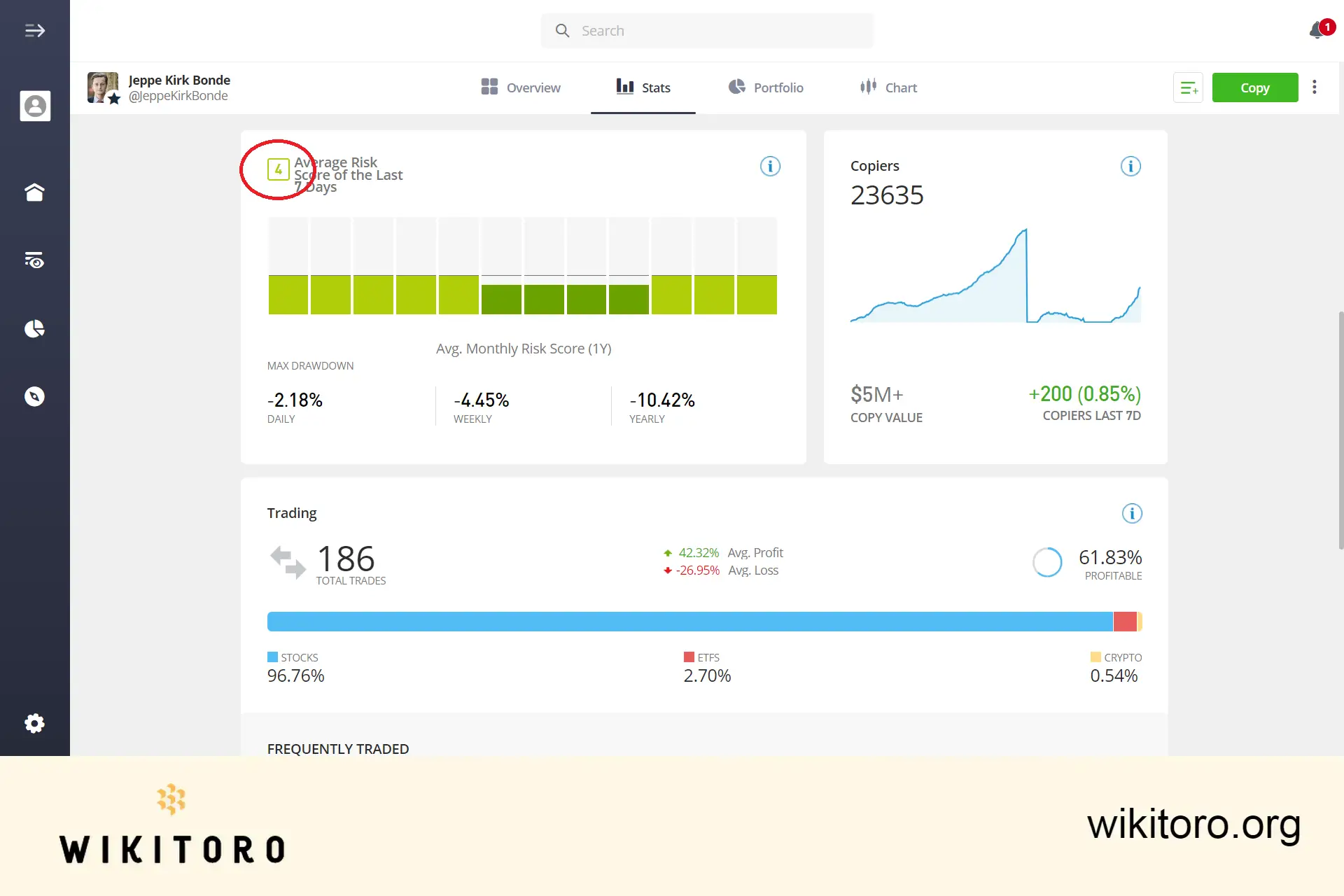

Risk scores, in my experience, are an often overlooked yet crucial metric. On eToro's platform, understanding these scores has been pivotal in shaping my investment strategy, ensuring I always operate within my comfort parameters.

⭐New to the concept? Let's delve into what a risk score is. At its core, risk is used by investors to gauge an investment's past performance, which in turn helps predict potential future gains or losses. On eToro, this risk is quantified and presented as a Risk Score on an investor's user page, with a scale ranging from 1 (indicating low risk) to 10 (signifying high risk).

So how is this score determined? It's primarily based on the standard deviation of an investment's value. In simpler terms, it measures the extent to which the value of an investment fluctuates over a period. A higher deviation, whether positive or negative, indicates greater volatility, making the investment potentially riskier.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

While risk can be assessed for individual assets, eToro's Risk Score represents the collective risk of all assets within an investor's portfolio. This score provides a snapshot of the portfolio's maximum volatility, expressed as a percentage range. So, when using the copy trading feature, keeping an eye on this score can offer valuable insights into the potential ups and downs of your investments.

Adaptability is key. My investment goals and strategy have evolved, and yours might too. Always be in the know about how you can pivot if necessary.

Copy trading has been an enlightening journey for me, full of lessons, triumphs, and occasional missteps. If I can part with one piece of advice, it's this: always be diligent and never stop learning. Here's to your copy trading success!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman