eToro Jeppe Kirk Bonde

- eToro's most copied Popular Investor

- Average annual return of 25%

- Uses a long-term and fundamentals-based investment strategy

- Over 26000 copiers

- 2024 investor performance up at 20.95%

61% of retail investor accounts lose money

Jeppe Kirk Bonde isn’t just another investor on eToro. He’s the platform’s most copied Popular Investor. Since joining in 2013, he’s consistently delivered an average annual return of 25% and has attracted over 35,000 copiers who collectively mirror his trades with over $100 million in assets under management.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| Name | Jeppe Kirk Bonde |

| Born | June 20, 1987 |

| Nationality | Danish |

| Based In | London, UK |

|

Alma Mater |

Copenhagen Business School, Finance and Strategic Management (Master of Science, Cand Merc) Copenhagen Business School, BS International Business and Politics |

| Title |

Popular Investor, eToro Managing Director, BondeCapital Ltd |

| eToro Username | |

| Trading with eToro Since |

July 22, 2013 |

| eToro Popular Investor Performance |

⬆️ +20.95% (2024) |

| Website | bondcapital.com |

| Social Media |

LinkedIn: linkedin.com/in/jeppekirkbonde X (Twitter): x.com/jeppekirkbonde YouTube: youtube.com/c/JeppeKirkBonde Instagram: instagram.com/jeppekirkbonde |

Before going full-time into investing, Jeppe worked as a strategy consultant by advising major banks and tech firms on their financial and business strategies. That experience laid the foundation for his improved knowledge of global markets and corporate structures.

He holds a Master of Science in Finance & Strategic Management from Copenhagen Business School, a strong academic background that complements his hands-on investment expertise.

Back in 2019, Jeppe took to Reddit for an "Ask Me Anything" (AMA) session, giving investors a rare chance to pick his brain. His message? Play the long game.

He championed long-term investments in stocks and property while warning against the pitfalls of short-term trading. He also underscored the power of diversification, across geographies, industries, and even different stages of the value chain, as the secret to managing risk.

Jeppe doesn’t just study markets, he talks about them in real time. On X (Twitter) and Instagram, he actively shares market analysis and investment strategies to keep his followers plugged into major financial trends.

Case in point? His recent deep analysis into how AI advancements are shaping companies like Nvidia. This proves he’s always got an eye on the tech sector’s rapid transformation.

For those who want a front-row seat to his investment philosophy, Jeppe’s YouTube channel is a goldmine. He drops quarterly investor updates and breaks down secret market movements, offering sharp analysis into his strategic thinking.

Following Jeppe across these platforms isn’t just about staying informed, it’s about gaining a better learning of how a top investor approaches the market. Whether it's a tweet, a video, or a Reddit thread, his analysis help traders on eToro make more informed decisions.

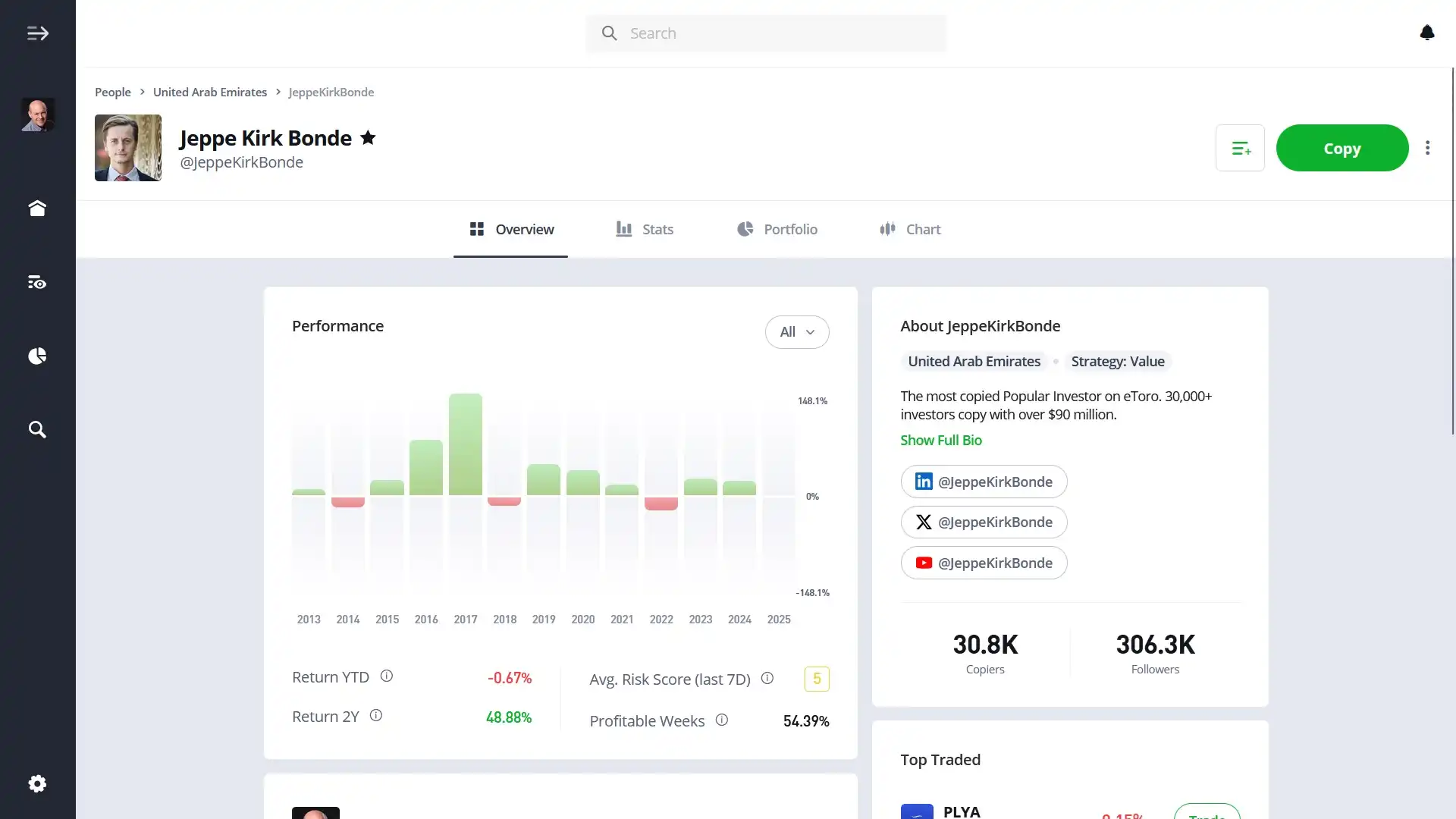

Since 2013, Bonde’s trading record has mostly landed in the green. He hit a distinct high in 2017 with a whopping +150.89% return, his best year on record.

More recently, 2024 wrapped up strong at +20.95%. The only stumbles came in 2014 (-14.31%), 2018 (-10.92%), and 2022 (-19.21%). But even then, the broader trend is hard to ignore: this guy knows how to stay above water.

| Year | Popular Investor Performance |

| 2024 | 20.95% |

| 2023 | 23.92% |

| 2022 | -19.21% |

| 2021 | 15.88% |

| 2020 | 36.89% |

| 2019 | 45.13% |

| 2018 | -10.92% |

| 2017 | 150.89% |

| 2016 | 81.08% |

| 2015 | 22.37% |

| 2014 | -14.31% |

| 2013 | 8.88% |

*source: https://www.etoro.com/people/jeppekirkbonde/stats

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Jeppe isn’t chasing quick wins. His trading tactic is grounded in fundamental analysis and long-term value creation. Here’s what drives his strategy:

Jeppe doesn’t just look at stock prices, he looks deep into a company’s strategy, management, financial statements, and market position to identify stocks trading below their true value.

He tracks global macroeconomic trends (from political shifts to tech innovations) to inform his investment decisions. To manage risk, he diversifies across industries, regions, and different stages of the value chain.

Jeppe plays the long game. He invests in undervalued companies with strong fundamentals and expects their market value to reflect their true worth over time.

Want to stay updated on Jeppe Kirk Bonde’s latest trades? Easy. Just add him to your watchlist.

Here’s how:

That’s it. Once Bonde is on your watchlist, you’ll see his latest moves every time you check your newsfeed or watchlist. No more missing key updates.

Copying Bonde’s trades means your portfolio mirrors his strategies automatically. But first, you need an eToro trading account.

That’s it. Bonde makes a move? Your portfolio follows. Welcome to automated investing, the smart way.

Want to mirror Jeppe’s strategy? I suggest that you follow these strategies:

Forget day trading and short-term speculation. Jeppe favors stocks and property over fleeting trends. As he puts it, technical analysis is nothing more than "chart astrology."

Reduce risk by spreading investments across different regions, industries, and value chain stages. Whether through Exchange-Traded Funds (ETFs) or carefully selected stocks, diversification is important.

Jeppe avoids leverage and short positions, both of which increase risk and incur high fees. Instead, he focuses on companies with strong fundamentals and clear growth potential.

Markets change. Stay ahead by following global economic trends, industry developments, and tech advancements. The more informed you are, the better your investment decisions.

Jeppe Kirk Bonde’s strategy isn’t about chasing hype. It’s about staying patient, informed, and disciplined. And judging by his track record, it’s working.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman