Yes, swing trading is allowed on eToro and it fits right in with how the platform works.

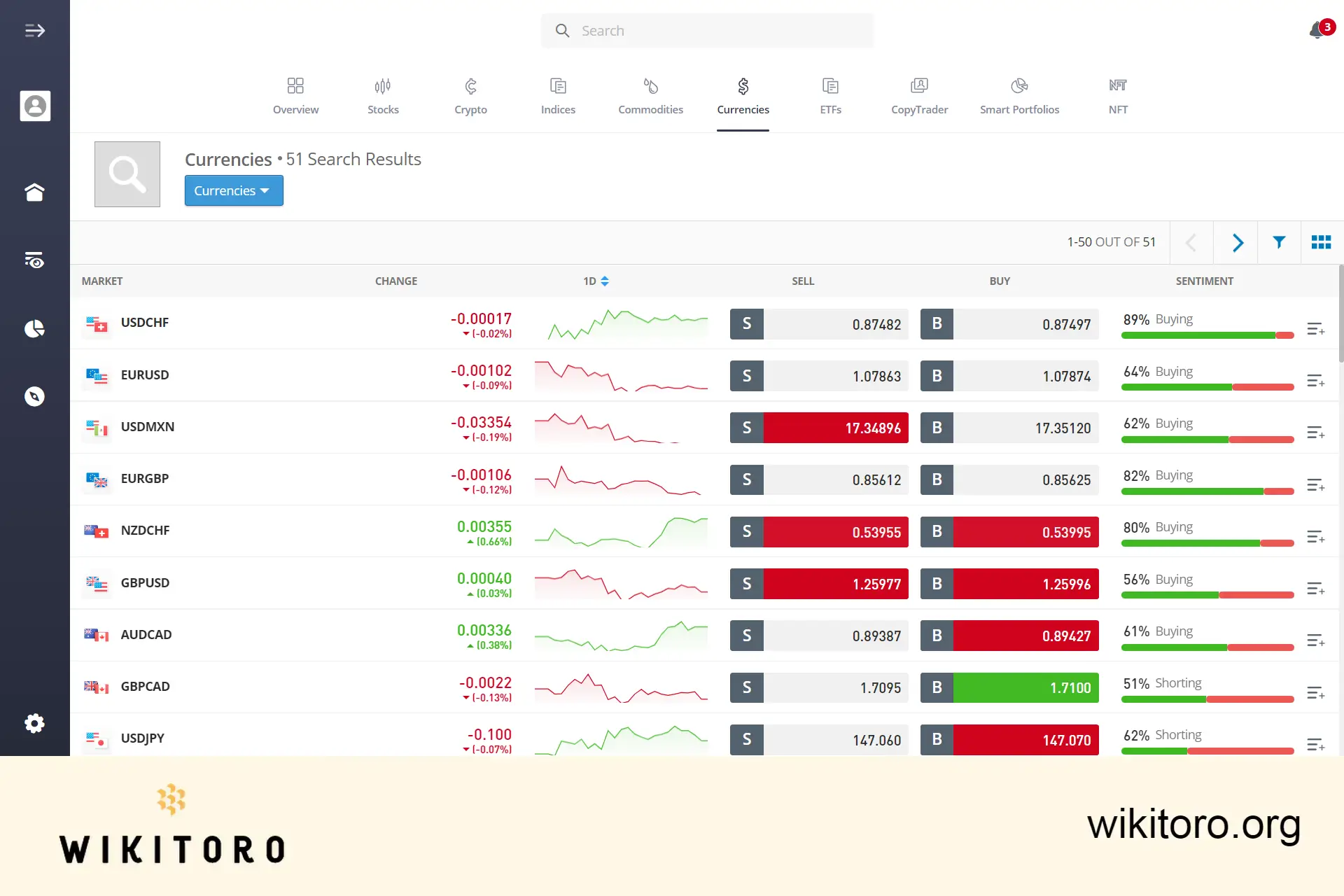

You can swing trade across multiple markets: stocks, ETFs, forex, commodities, and even crypto. The idea is simple: hold a position for a few days or weeks and take advantage of medium-term price shifts. This strategy aligns well with eToro’s setup.

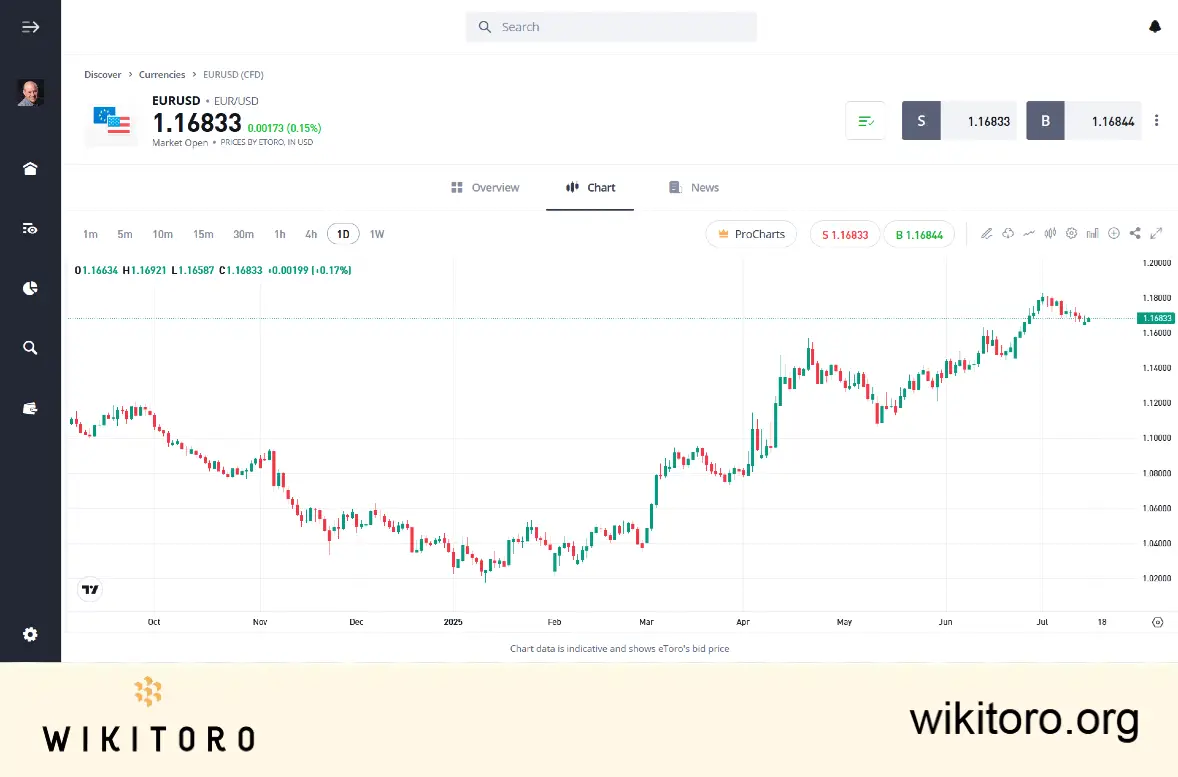

You can make use of technical indicators like RSI, moving averages, and trendlines built into the platform. You can also set stop-loss and take-profit levels to stay in control if the market moves fast.

eToro leans into short- to mid-term strategies. On their official pages, swing trading gets its own spotlight, separate from day trading or scalping. The emphasis is on holding positions for a few days to ride out price moves.

You get the essentials: charting tools, RSI, moving averages, and multiple timeframes (4H, daily, weekly). Perfect setup for spotting breakouts or pullbacks.

Swing trading works across forex, stocks, ETFs, and even crypto (where available). Forex gets special attention, with example trades and guidance outlined on eToro’s platform.

Because swing trades are less frequent, you avoid racking up spreads and overnight charges. eToro even calls this out: mid-range trading, which often means lower cost per position.

Let me be clear: eToro does allow swing trading. You’re fine as long as you stick to their trading rules and steer clear of anything that looks like scalping. So if your technique means holding positions for a few days (or even longer), you’re good to go.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman