Taking money out of eToro is simple enough, but it pays to know the rules before you hit that button. A quick look at their withdrawal policies will save you from unnecessary delays or rejected requests.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

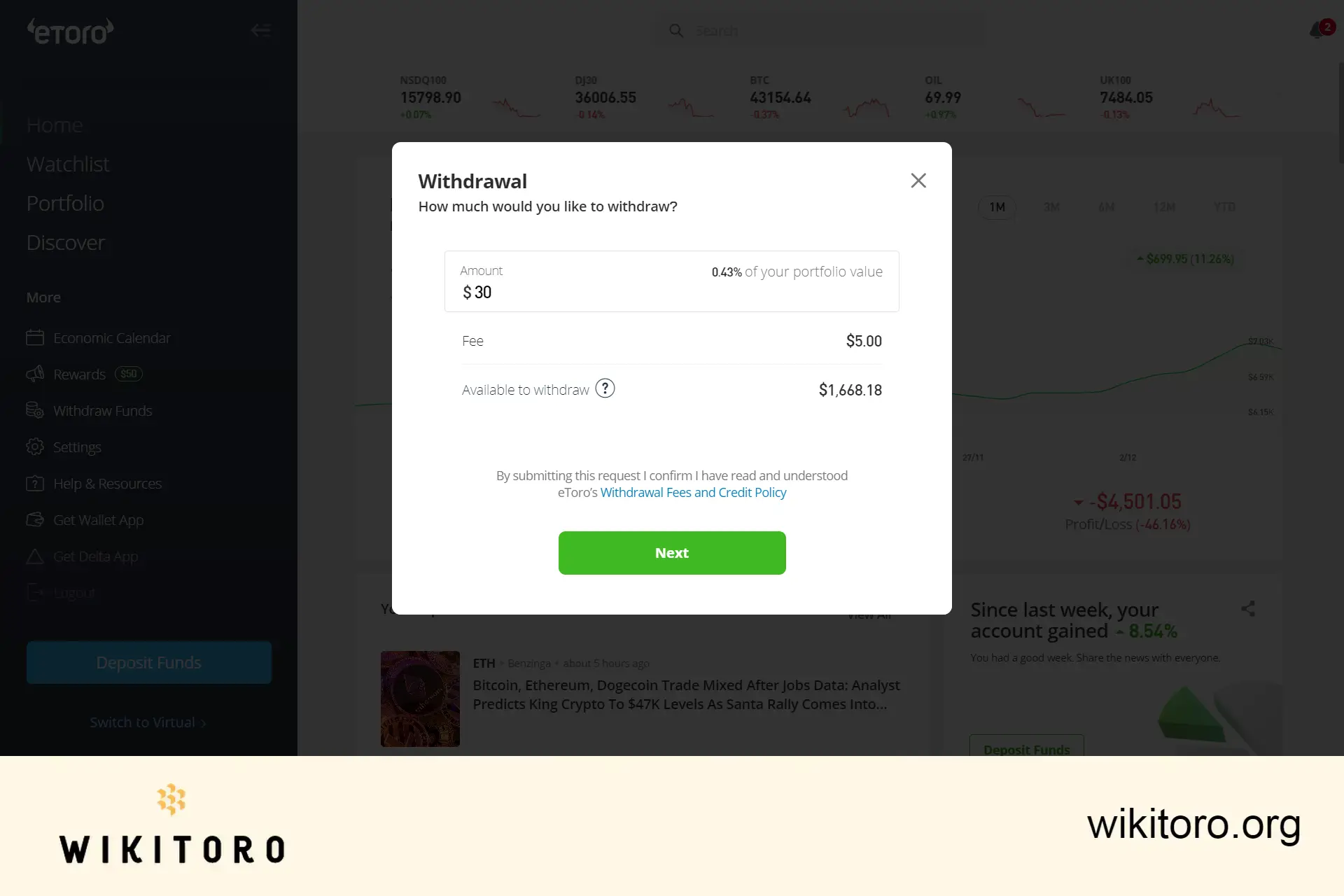

| 💵 Minimum Amount | $30 |

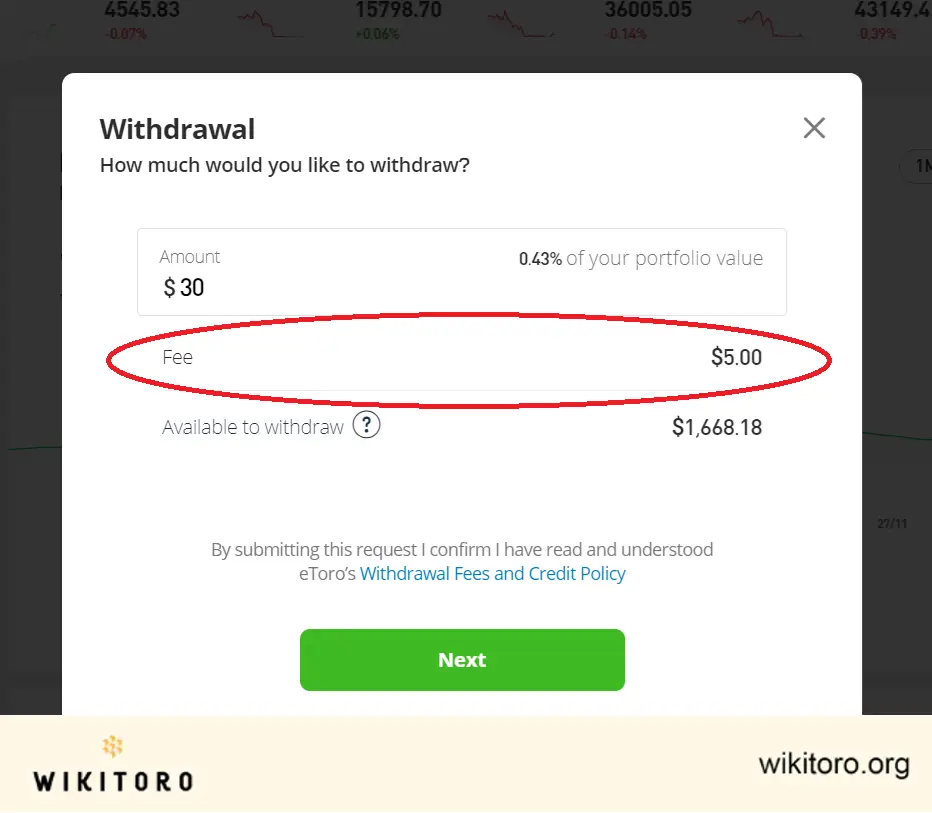

| 📤 Withdrawal Fee | $5, Free for US residents |

| 💳 Withdrawal Methods | Credit/Debit Cards, PayPal, Bank Transfer |

| 🕙 Processing Time | 1 business day |

| 📅 Cutoff for Same-Day Processing | 11:00 am Eastern European Time |

As long as your account is verified, you can request a withdrawal whenever you like. There are no limits on timing from eToro’s side. Feel like cashing out at midnight, in the morning or while you're riding the bus? You can do so, as long as you have a verified account.

These are the things that you should be aware of:

Withdrawals are sent back through the same payment method you used to deposit. If you’ve used multiple funding sources, eToro follows this order:

This order stays fixed, no matter what sequence you originally deposited in. For example, if you funded with PayPal first, then a card later, the card still comes first when withdrawing.

The same card you used to deposit is the one that receives your withdrawal. Funds are issued as a card refund, not a fresh cash transfer. Also, the card must be yours personally. Joint accounts or third-party cards won’t be accepted.

You can only send funds to PayPal if that PayPal account was previously used to deposit. No exceptions here.

If you go with a bank transfer, eToro needs your full account details, including an ABA routing number that’s Fedwire eligible. Double-checking the information you provide matters a lot. Any mistake could mean a delayed or failed transfer.

eToro applies a flat $5 fee to every withdrawal request. The amount doesn’t matter. Whether you take out $30 or $1,000, the deduction is the same $5.

These are additional charges you should know about:

The exchange rate depends on two things: your eToro account currency and the withdrawal method you choose. eToro uses the current market rate at the moment you process your withdrawal.

Important points to keep in mind:

For USA traders, If you’re registered under eToro USA LLC or live in the United States, there’s no withdrawal fee. Zero.

That said, your bank may still apply charges on their side. It’s best to check with them in advance so you’re not surprised by extra deductions.

Club members at these levels don’t pay withdrawal fees either. It’s one of the added benefits of being in the upper tiers.

Here’s how the process works on the platform:

First things first, let’s clear up a common confusion. There’s a difference between eToro’s processing time and the time it takes for your bank or payment provider to release the funds.

Changed your mind? You can cancel a withdrawal, provided eToro hasn’t already processed it. Here’s how to do it step by step:

Once confirmed, your balance updates instantly. Any fees tied to that withdrawal are also reversed.

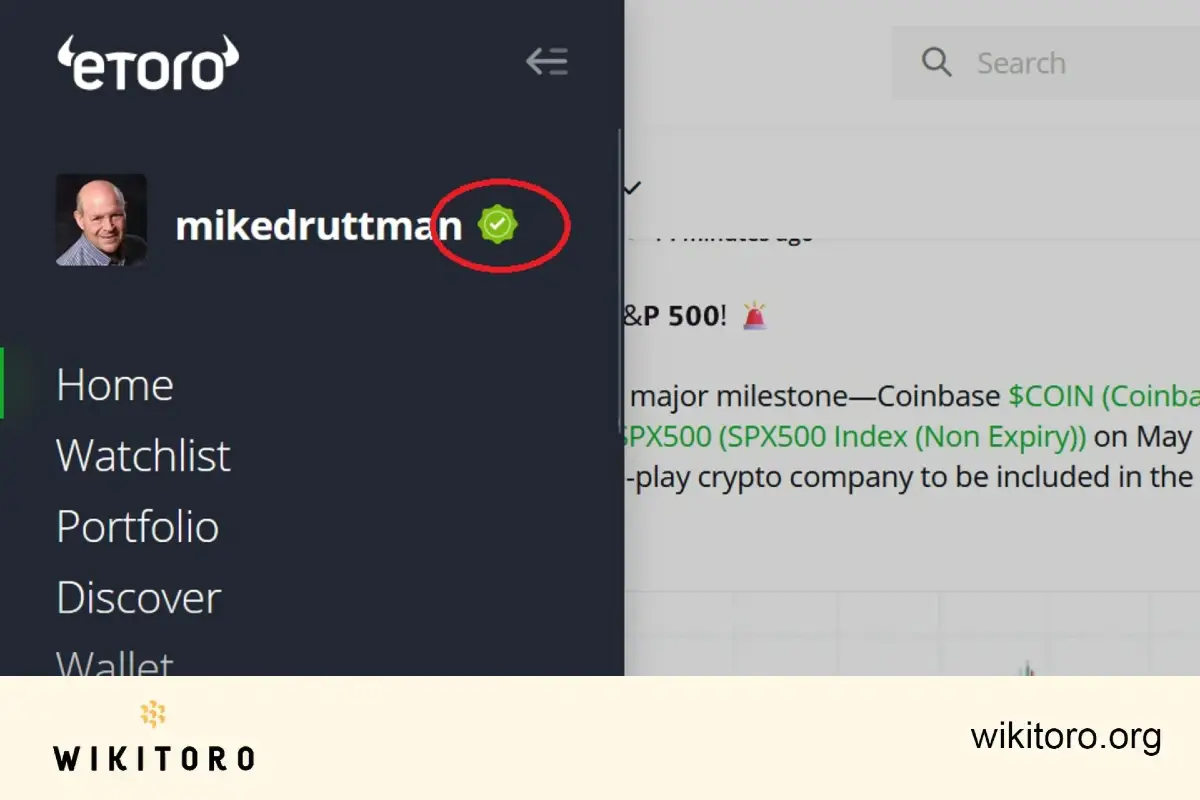

No verification, no withdrawal. To take funds out, your eToro profile needs to be verified. Look for the green tick next to your username.

If it’s missing, you’ll need to submit additional documents. Still stuck? Contact eToro’s support team for guidance.

So what's with all these paperworks? You see, licensed financial companies are legally required to collect this information. It’s both a regulatory and security measure to protect your funds and validate every request.

Crypto withdrawals work a little differently. You can’t move these types assets straight out of the trading platform. First, they have to go through the eToro Money wallet.

Login: Use your existing eToro account credentials.

Transfer Steps:

Once it’s in your eToro Money crypto wallet, you’re free to send it on to an external wallet of your choice.

If your withdrawal request on eToro gets knocked back, don’t panic. There are a few common reasons this can happen.

Want to see what’s going on with your withdrawal? eToro makes it pretty straightforward:

You’ll see all the details you need, including:

Tip: This page shows both processed and pending transactions, so you can track everything tied to your account.

Every region has its own playbook. Fees, minimums, and conditions vary depending on where you live: UK, Australia, Europe, and beyond. The fine print lives in eToro’s Terms and Conditions, so make sure you check what applies in your location before moving money.

No shortcuts here. Your account has to be verified before you can withdraw. This rule protects both you and eToro.

Your withdrawal cap equals your account balance minus any margin you’re using. Margin is the portion of your funds tied up in open trades, so it reduces how much you can actually withdraw.

Profits are only available once they’re in your account balance, not while they’re still tied to an open position. That means if you’ve got profitable trades running, you’ll need to close them first.

Take note that closing a trade doesn’t lock in a win every time as market conditions can change quickly. In addition, leveraged trades may come with extra fees. So always factor in the risks of leverage before opening or closing positions.

Need quick access to your trading funds? eToro supports same-day withdrawals when moving money from your trading account into the eToro Money wallet.

That said, don’t be surprised if it occasionally takes until the next business day. Security checks or back-end processes can add a small delay.

Try to pull out more money than you actually have in your account and the system won’t let it happen. Withdrawals are capped at your available balance, minus anything already tied up as margin on open trades.

If you go over that limit, the platform will reject the request automatically and throw up an error message. The quick fix? Always double-check your available balance before you hit withdraw.

Effect on Open Trades

Be careful here. If you attempt to withdraw money that’s already serving as margin, you could trigger the automatic closure of those trades. Margin is what keeps your open positions alive. Remove it, and you’ll fall short of the requirements. This forces the system to close them out.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman

Related Articles

We've compiled a list of related articles

Know eToro's withdrawal intricacies with firsthand accounts and expert insights. Learn factors affecting speed and best practices.

Having trouble withdrawing your full balance on eToro? Discover common obstacles and how to overcome them for a smooth withdrawal process.

Learn how to transfer money from your eToro account to your bank safely and easily. Step-by-step guide with tips on fees, timing, and processing period.

Can you take out $100K from eToro? Discover the rules, fees, and steps needed to withdraw high amounts for smooth fund transfers.

Find out if eToro charges fees when you withdraw funds, how much it costs, and what you need to know before making a withdrawal from your account.

Wondering if eToro withdrawals are instant? Learn the actual withdrawal times, what affects processing, and how to avoid delays when cashing out.

Get clear answers on when withdrawals are allowed on eToro. Discover eligibility rules, timing guidelines, and what to do for fast access to your funds.

Find out how easy or complicated it is to withdraw funds from eToro, including processing time, fees, and what steps you need to take.

Explore eToro’s withdrawal rules and whether it’s possible to access your funds before finishing identity checks required by the platform.

Withdrawing from eToro doesn’t trigger taxes, but your trades might. Understand how capital gains and income rules apply when using eToro.

The minimum withdrawal on eToro is $30 with a $5 fee. Exceptions, currencies, methods, requirements, and processing times vary depending on the account type.

Explore how long a withdrawal on eToro might take based on payment method, business days, account verification, and steps to avoid common delays.