eToro Risk Management

- Manage risk directly from the platform

- Several built-in order types and portfolio options

- Set stop-loss and take-profit orders

- Limit orders to avoid slippage in volatile markets

61% of retail investor accounts lose money

Stepping into trading means facing gains and losses side by side. That’s the deal. For beginners trying out eToro, a platform known for its social trading tools and easy-to-grasp portfolios, knowing how to handle risk is non-negotiable. If you want to stick around long enough to see your wins compound, you need a plan to keep losses in check.

So, what does smart risk management look like on eToro? Let me discuss each of the tools that you can use and how you can take advantage of them.

Risk management means spotting where things might go wrong in an investment, choosing which risks are worth it, and putting guardrails in place for the ones you can control.

It’s about weighing possible losses against potential gains and protecting your capital so you stay in the game for the long haul.

New traders deal with plenty of nerves when markets swing without warning. Without clear exit plans or the right capital allocation, one bad move can wipe out weeks of progress.

A practical risk plan cuts down the stress and gives you a clear system to follow, so you can learn, adjust, and build up your experience with less drama.

eToro packs in a handful of straightforward tools to help you control risk right from your dashboard. Here’s how each one works in practice:

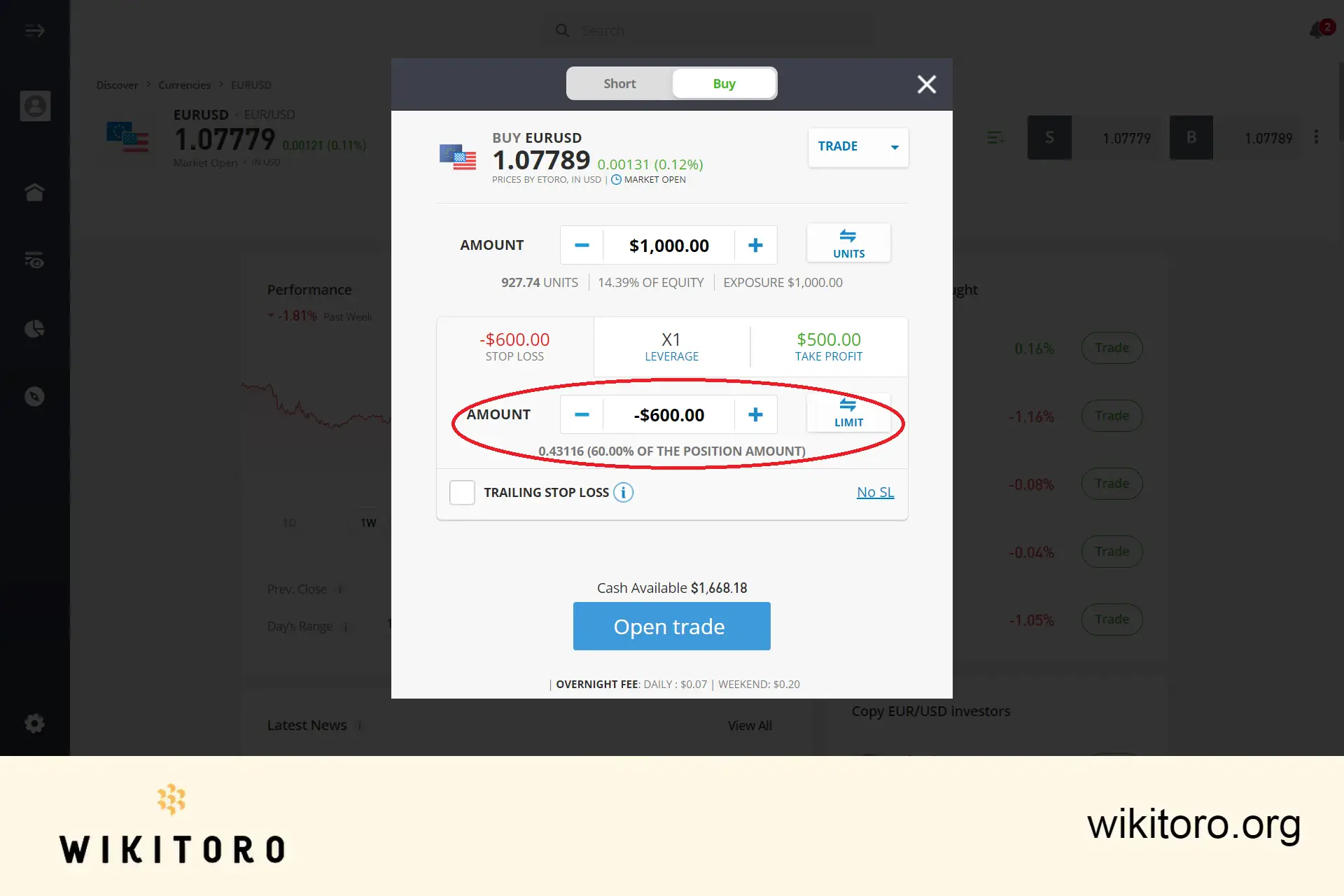

A stop-loss automatically shuts down your trade when it hits a loss limit you’ve set. This protects you from deeper damage.

Say you invested $1,000 on EURUSD. Drop in a stop-loss at 60% of the position amount and you cap your potential loss at -$600, no matter what happens next.

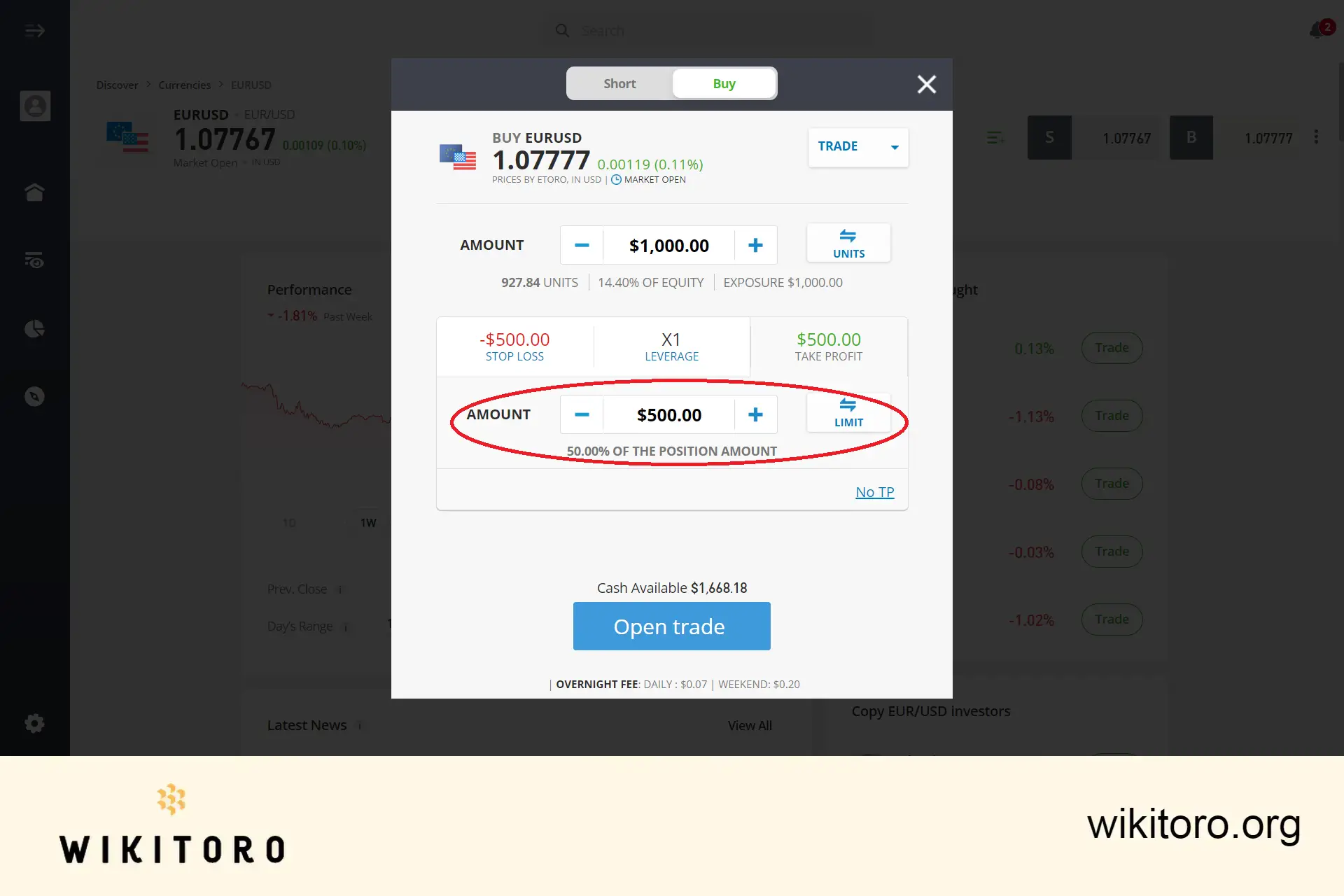

Take-profit flips the logic. It locks in a win if your position reaches a target you pick in advance. Using the same example, set a take-profit at 50% of the position amount and the platform will cash you out for a $500 gain when the price lands there.

Combine both and you know your max loss and hoped-for profit before you even click ‘Open trade.’

A trailing stop-loss is like a regular stop-loss with a twist. It follows the market upward but freezes if things slide.

Imagine you place a trailing stop-loss at 5%. If your stock jumps from $10 to $12, your stop creeps up from $9 to $11.40. If the price drops back, your position closes when it hits that trailing mark. This locks in some of the upside along the way.

Market orders get you in or out immediately at the going rate. They’re quick but give you no price promise.

Limit orders are more picky. They’ll only trigger at your chosen price or better. No guarantee they’ll execute, but you won’t get surprises in a jumpy market either.

New traders often lean on limit orders to keep control when prices swing fast. Market orders are better when speed outranks precision.

Smart Portfolios (once called CopyPortfolios) bundle assets by theme, like “BigTech” or “Green Energy”, and spread your money across multiple picks. Each portfolio is overseen by eToro’s team, so you don’t have to babysit every stock.

Instead of betting everything on a single tech stock, for example, a Smart Portfolio might hold a basket of ten big players. That spreads your risk and smooths out rough patches in any single share.

eToro’s social trading feature lets you follow other traders’ moves automatically. Copy trading simplifies the process, but you still need guardrails.

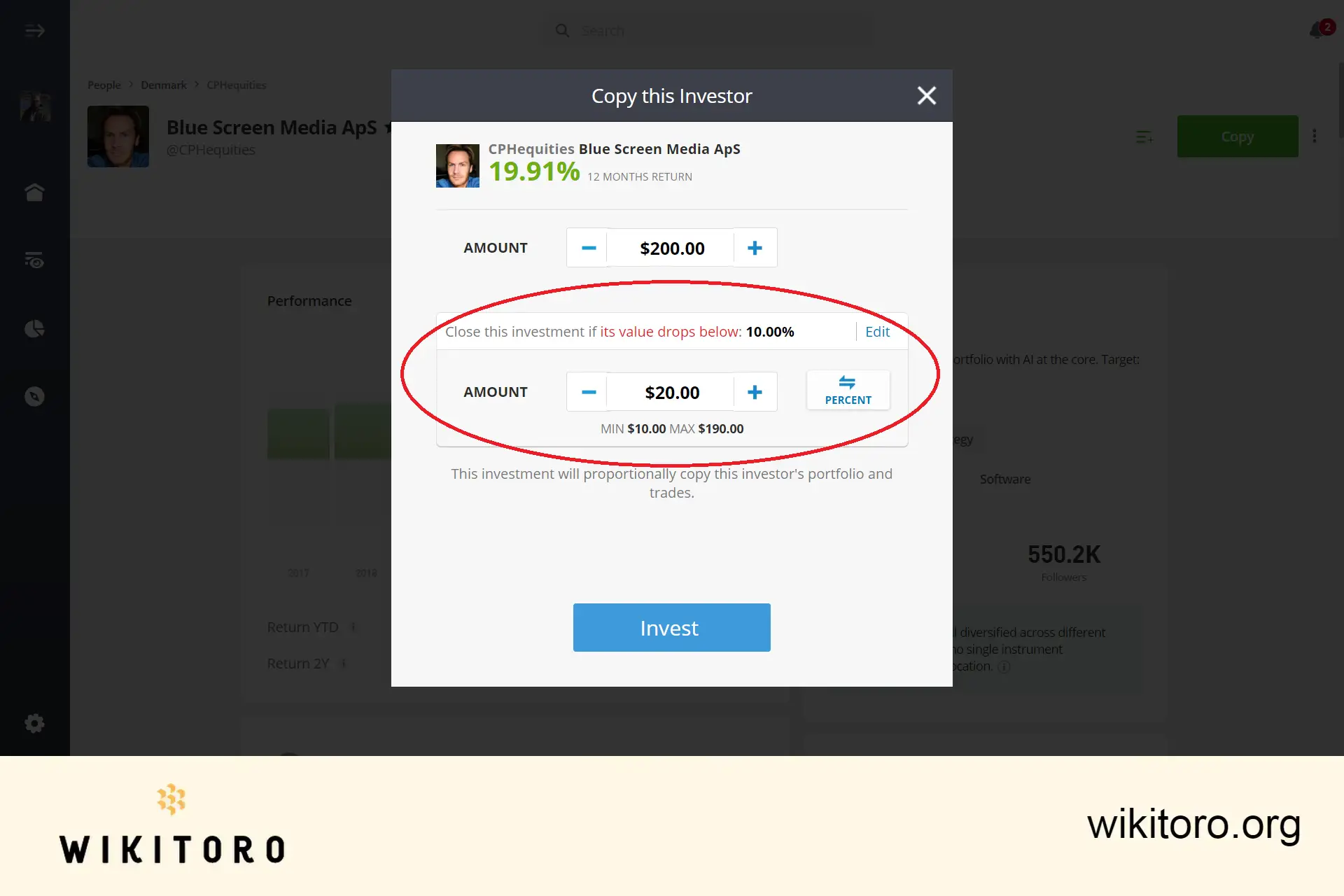

CopyTrader lets you pick experienced eToro traders and mimic their trades in real time. Every time they open or close a position, your account does the same and it's scaled to whatever amount you’ve put in.

By default, eToro puts a stop-loss at 40% for copied portfolios. So if total losses hit 40%, the system stops copying that trader. You can tighten this to 20% if you’d rather pull out earlier. It’s a simple way to shield yourself from a single trader’s rough patch.

For this trading feature, I suggest that you spread your risk. Copy a mix of traders with different styles, like pairing a patient investor with an active day trader. This blend helps smooth out sharp losses if one strategy hits a bump.

Platform tools help, but here are a few habits I stick to and you should explore them, too:

Stick to the “one-percent rule.” Risk no more than 1% of your total trading capital on any single position.

Got $10,000 to trade? That means you’re risking a maximum of $100 each time. Even if you hit a losing streak, your balance stays intact enough to keep you in the game.

Don’t invest everything on one market. Mix it up with stocks, crypto, commodities, and ETFs. Each one responds differently to news and events, which smooths out bumps and keeps your portfolio steadier.

Know what you want: growth or income. This shapes how much risk you can handle. If your aim is long-term growth, you can stomach more ups and downs than if you need consistent payouts.

Write down every trade:

Looking back at your record shows you where you slip up, like selling too late or trading too often.

One thing I appreciate about eToro Academy is the free courses and webinars. They cover risk management, technicals, and the basics.

Make a habit of dipping back in. You’ll pick up new tools and techniques you might’ve missed.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver