eToro Trading

- Execute trades instantly with a single click

- Wide range of financial instruments

- Zero commission on real stocks and ETF

- User-friendly mobile app for iOS and Android

- Purchase fractional shares

61% of retail investor accounts lose money

New to trading on eToro? You’re in the right place.

On this page, I'll show you how trading works on the platform (web-based or app). Think of it as your go-to reference for knowing the tools, terms, and techniques that matter. Doesn't matter if you're dipping a toe into the markets or exploring beyond casual investing, this guide has you covered.

It’s written with beginners in mind. No jargon, no confusion. What you'll find here is clear and practical information to help you get started and feel confident using eToro from day one.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Let’s say you’re away from your desk but want to check your portfolio, open a new trade, or close a position before the market shifts. That’s where the eToro mobile app steps in.

It’s built for both iOS and Android, and it delivers the same experience that mirrors the desktop platform; just optimized for smaller screens and swiping. Checking charts or copying a trader on the move? Everything you need can still be done on your phone or tablet.

💾 Want to install the app? Here’s the deal:

There’s no need for a traditional .exe file or software installer. Instead, you download it directly from the App Store (iOS) or Google Play (Android). Quick, simple, secure.

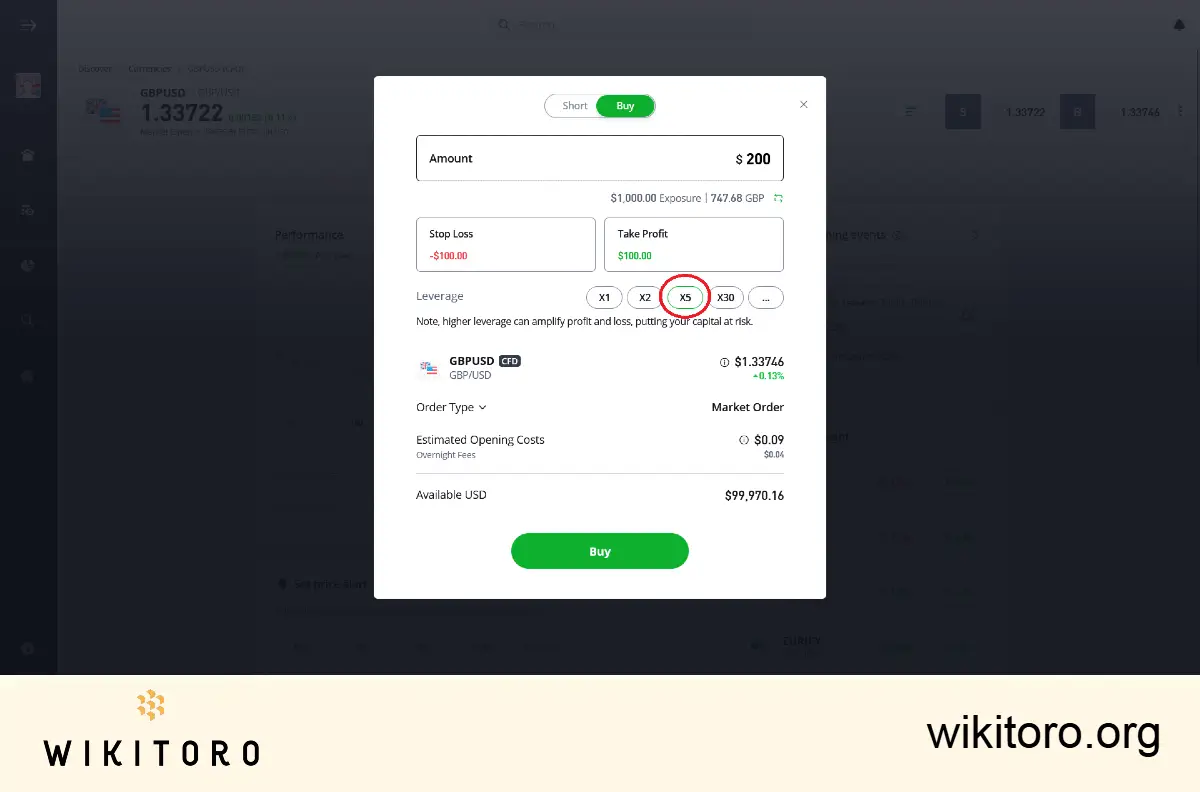

Leverage is one of those tools that can either accelerate your gains or magnify your losses. So, it’s worth taking a minute to get it right.

At its core, leverage lets you open a larger position than your actual balance would normally allow. Think of it as temporary buying power. For example, if you apply x5 leverage to a $200 investment, you’re now trading as if you had $1000 in the market.

That means bigger exposure and bigger swings. Yes, your profit potential increases. But so does your risk, so use it wisely.

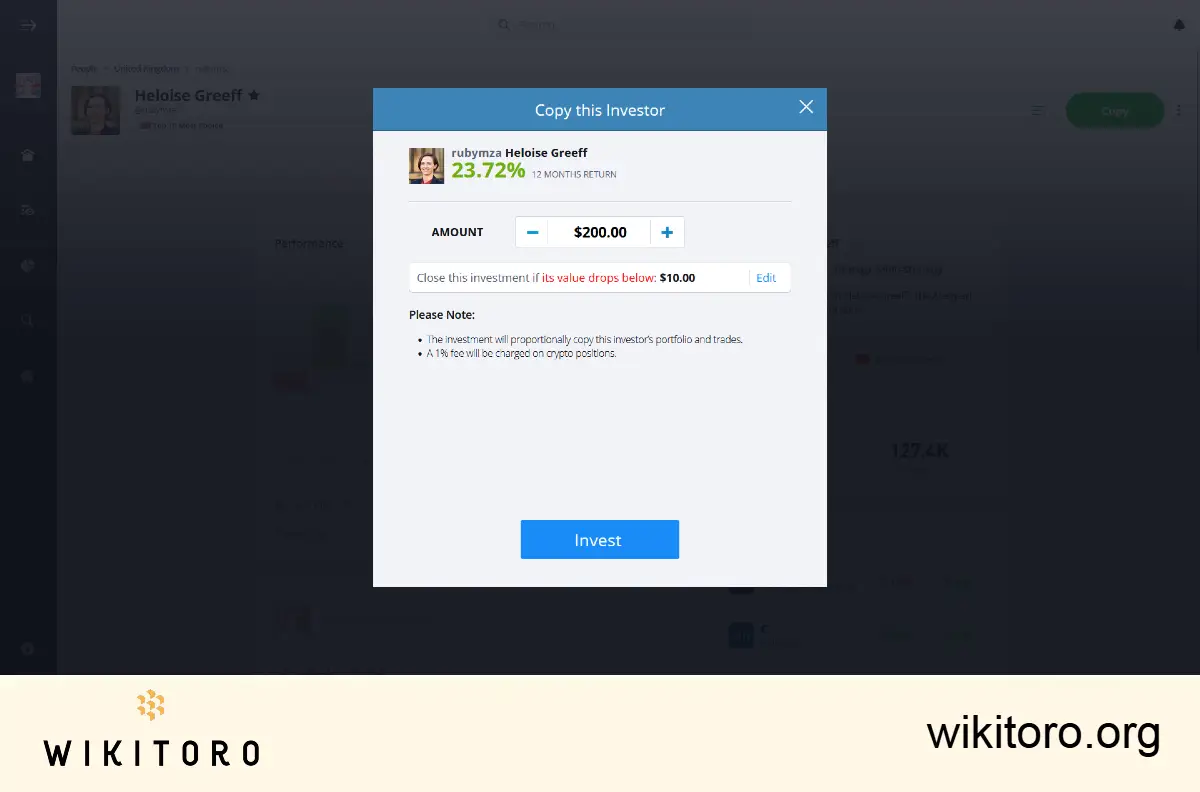

One of eToro’s distinct features is Copy Trading and it’s a new way to trade, particularly for beginners.

Here’s how it works:

You scroll through a list of proven traders, check out their stats (performance history, risk score, number of copiers), and choose to copy them. Once you hit “copy,” their trades are mirrored in your portfolio automatically, down to their leverage, stop-losses, and take-profit targets.

You’re not just watching trades happen. You’re learning in real time.

It’s hands-on exposure to live strategies without needing to be an expert yourself.

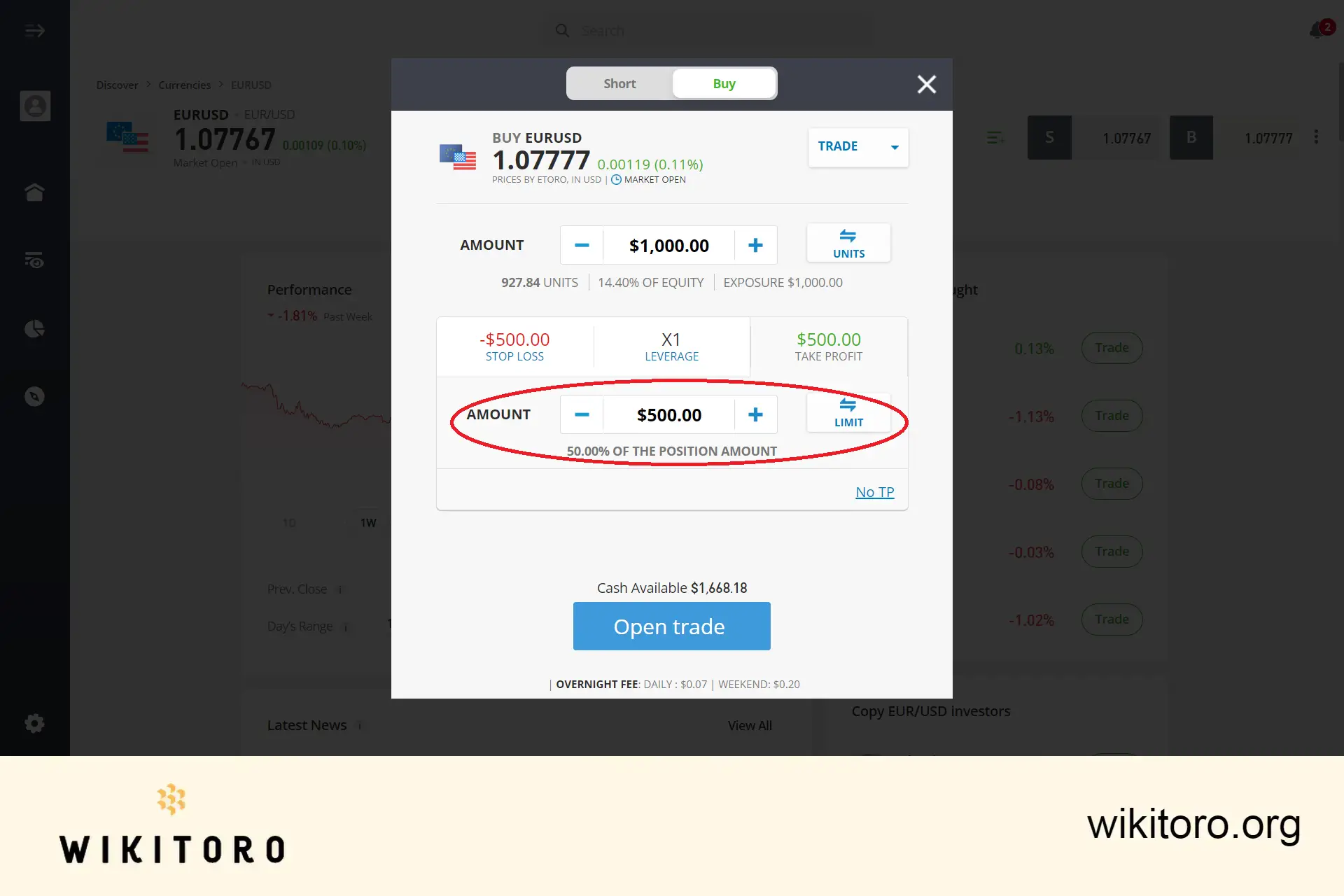

Let’s say your trade is doing well, and you want to cash out once it hits a certain price, without staring at charts all day. That’s where eToro’s Take Profit (TP) becomes very useful.

TP is a risk management tool that lets you set a price level where your position will automatically close once it reaches your chosen profit target. It’s a simple way to secure gains, especially if you’re not glued to the market 24/7.

Just one thing to keep in mind: during periods of high volatility, your TP might not trigger at the exact price you set. That’s because market conditions can cause slight slippage. So it’s worth factoring this in when planning your exits.

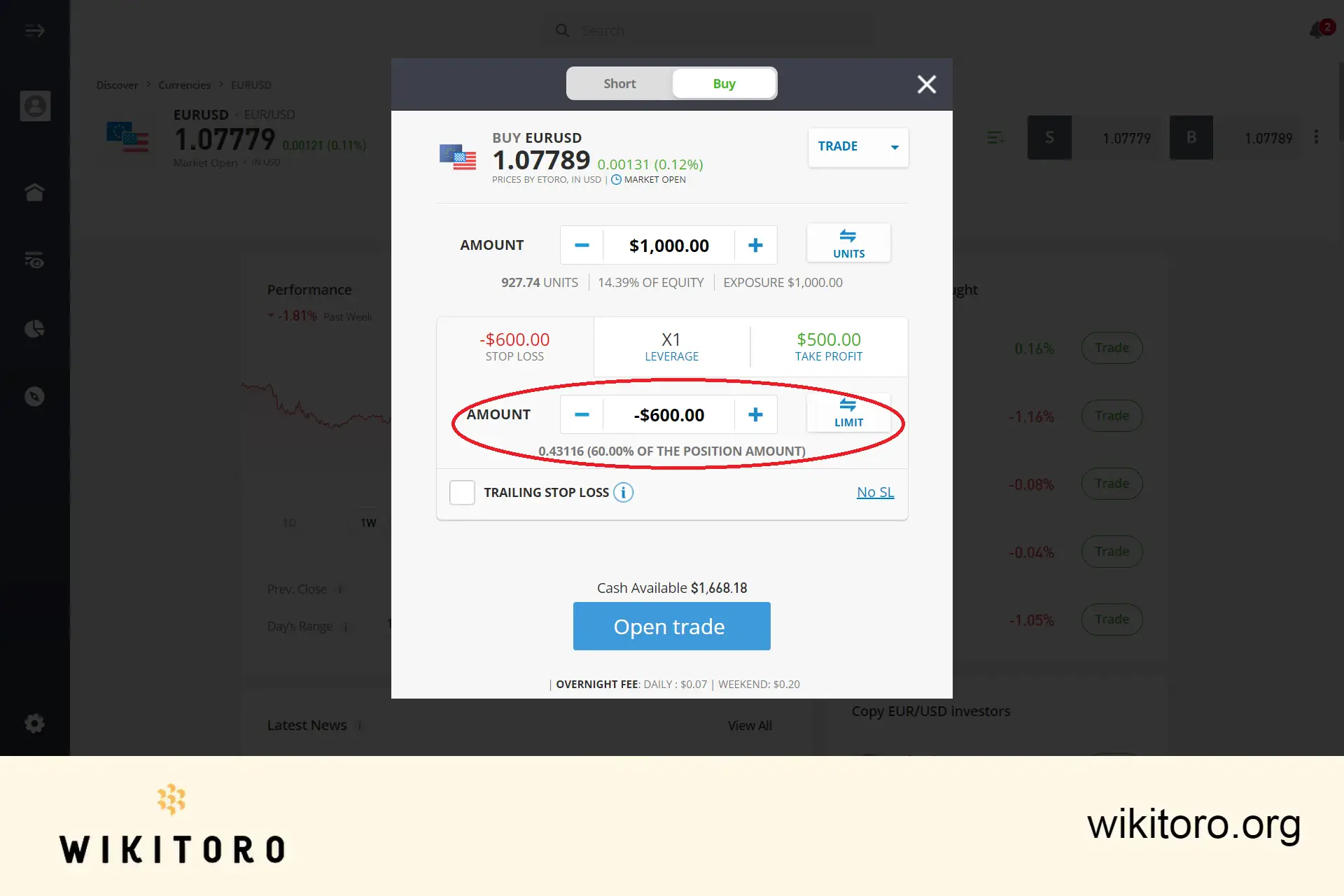

Now flip the script. What if a trade turns south? That’s where Stop Loss (SL) becomes your ally.

This tool lets you define a price level where your trade will automatically close to limit losses. It works across all assets on eToro: stocks, crypto, forex, the lot. Once the market hits your Stop Loss level, the order kicks in and the trade shuts down.

But here’s the key bit: your SL only activates if the market actually reaches that price. If it doesn’t, your position stays open until you close it manually.

Both TP and SL are significant for managing trades efficiently, particularly when markets move fast and unpredictably.

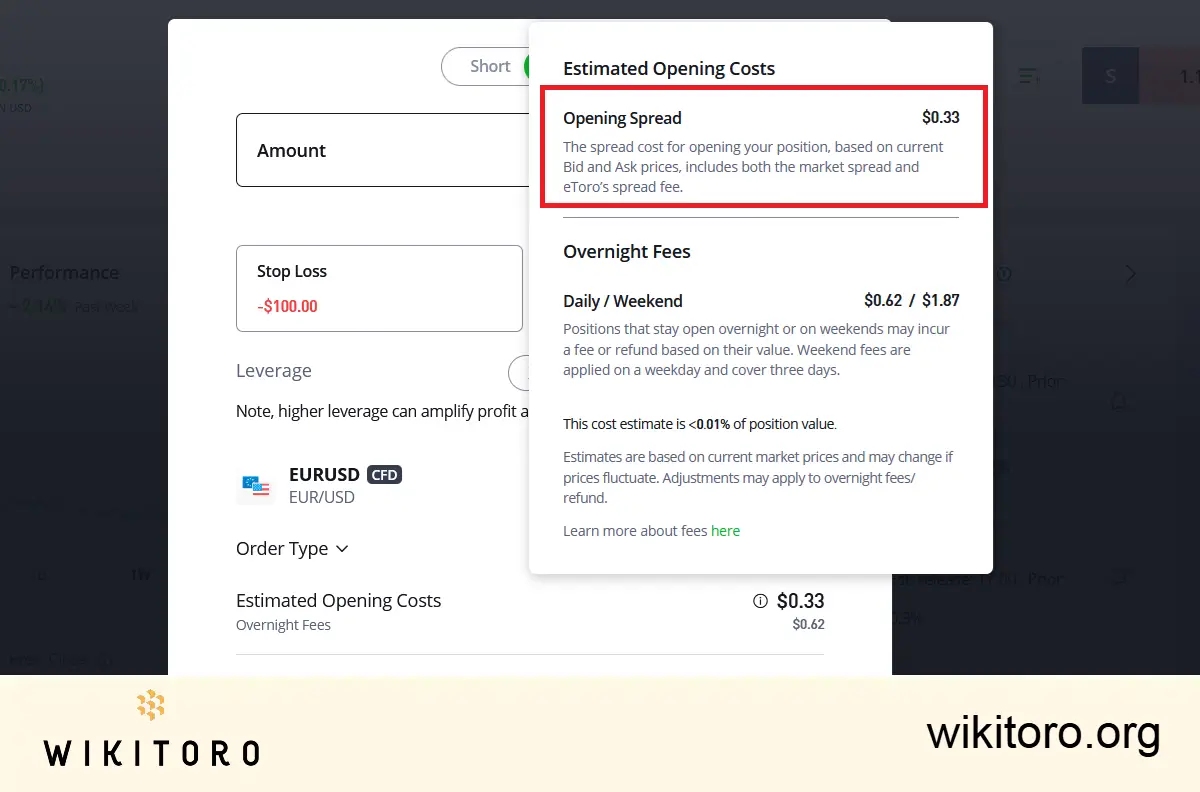

When you trade on eToro, the platform applies a spread. That’s the difference between the buy and sell price of an asset. This isn’t a fixed fee. It’s a dynamic cost built into each transaction and varies depending on the asset you’re trading.

The takeaway? eToro doesn’t set the market spread. It reflects live market conditions. Some days it’s tighter. Other days, not so much.

Assets don’t behave the same. Some are stable. Others are known for their wild swings. The more volatile the asset, the more likely the spread will change while your trade is open.

What this means is that you won’t always know the exact spread at the moment you open or close a position. It’s part of the game. Just keep that in mind when trading more unpredictable instruments.

eToro isn’t small-time. Over 35 million traders across more than 100 countries are using the platform and that number keeps rising. They’re logging in via web and mobile to execute millions of trades every month.

Why the growth? A big reason is accessibility. Financial markets are more popular than ever, and eToro makes jumping in easy for beginners and experienced traders alike. The global community you’re joining is active, diverse, and expanding fast.

That wraps up the guide I put together for you.

If you’ve made it this far, you’ve got a better knowledge of how eToro works, from spreads to trader tools to what kind of community you’re stepping into. I built this to give you a clearer path forward, so you can use this platform (regardless if you're using the web-based version or the mobile app) with more confidence.

I hope you found it useful. Personally, I think the more you explore. The more you’ll see what the platform can offer. Use what you’ve learned here and take your next steps on your own terms.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman

Related Articles

We've compiled a list of related articles

Step up your eToro game with our Copy Trading guide. Essential advice for beginners and seasoned traders alike.

Uncover the essentials of the eToro app. From testing with a demo account to app compatibility, our guide covers it all.

Unlock the secrets of leverage on eToro. This guide covers everything from CFD trading to smart risk management strategies.

Learn to maximize your trades with eToro's Take Profit tool. This guide shows you how to effectively use it to lock in profits on your positions.

Navigate eToro trading confidently with our guide on Stop Loss - the key tool for managing risks and protecting investments.

Demystify eToro's spreads: Learn about trading fees and spreads in our clear, concise guide, perfect for new and seasoned traders.

Unlock the potential of CFD trading on eToro with our comprehensive guide, covering essential tips, risks, and effective trading practices.

Step into eToro's trading community: Understand trader levels, follow top performers, and start your journey with our easy account setup guide.

Start trading with confidence on eToro by using risk management tools to keep potential losses in check.

You can use eToro for day trading, but limitations apply depending on your location. See how regulations affect trading strategies.

eToro has specific rules on trading behavior. If you're considering scalping, it's important to know if this method is aligned with their terms.

Understand how eToro handles swing trading, what durations are acceptable, and how it compares to other short- and medium-term trading strategies.