Tesla's shares often spark heated debates among investors, but there's no denying the impact of Elon Musk's leadership. Under his guidance, Tesla has transformed from a bold dream into the premier electric vehicle manufacturer, significantly benefiting its shareholders.

Great news for those interested in investing in Tesla (TSLA): the eToro online investment platform offers online trading options. To help you navigate this opportunity, I've compiled a comprehensive guide, complete with personal insights to enhance your investment understanding and trading strategy.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Having traded Tesla stocks on the platform for quite some time, I've identified several key advantages:

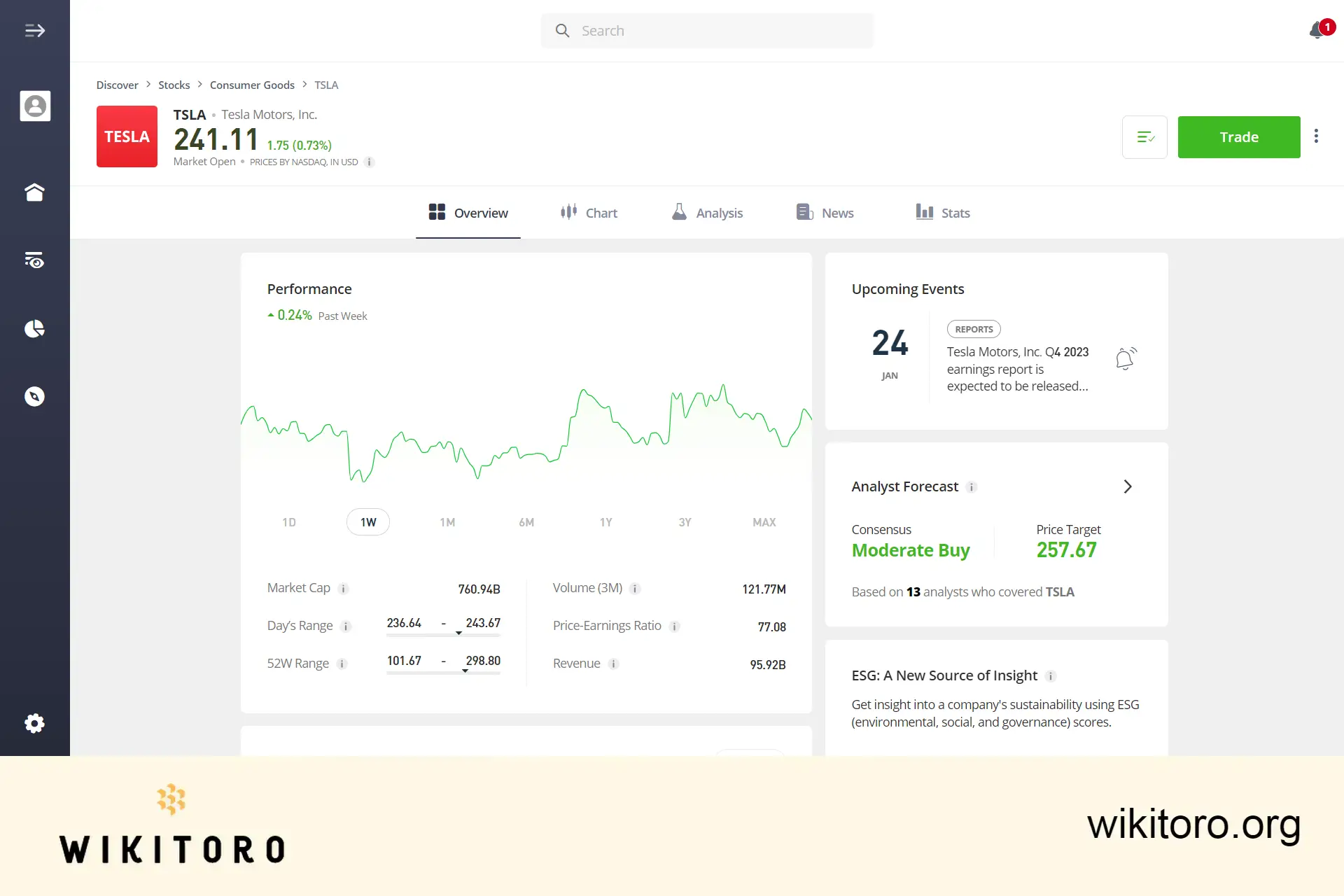

Navigating to the Tesla stock asset page on eToro, you're greeted by the Overview section, which is set as the default view. This section features several informative elements to aid your investment decisions:

The platform's integrated technical analysis tools have greatly enhanced my experience trading Tesla (TSLA) stocks:

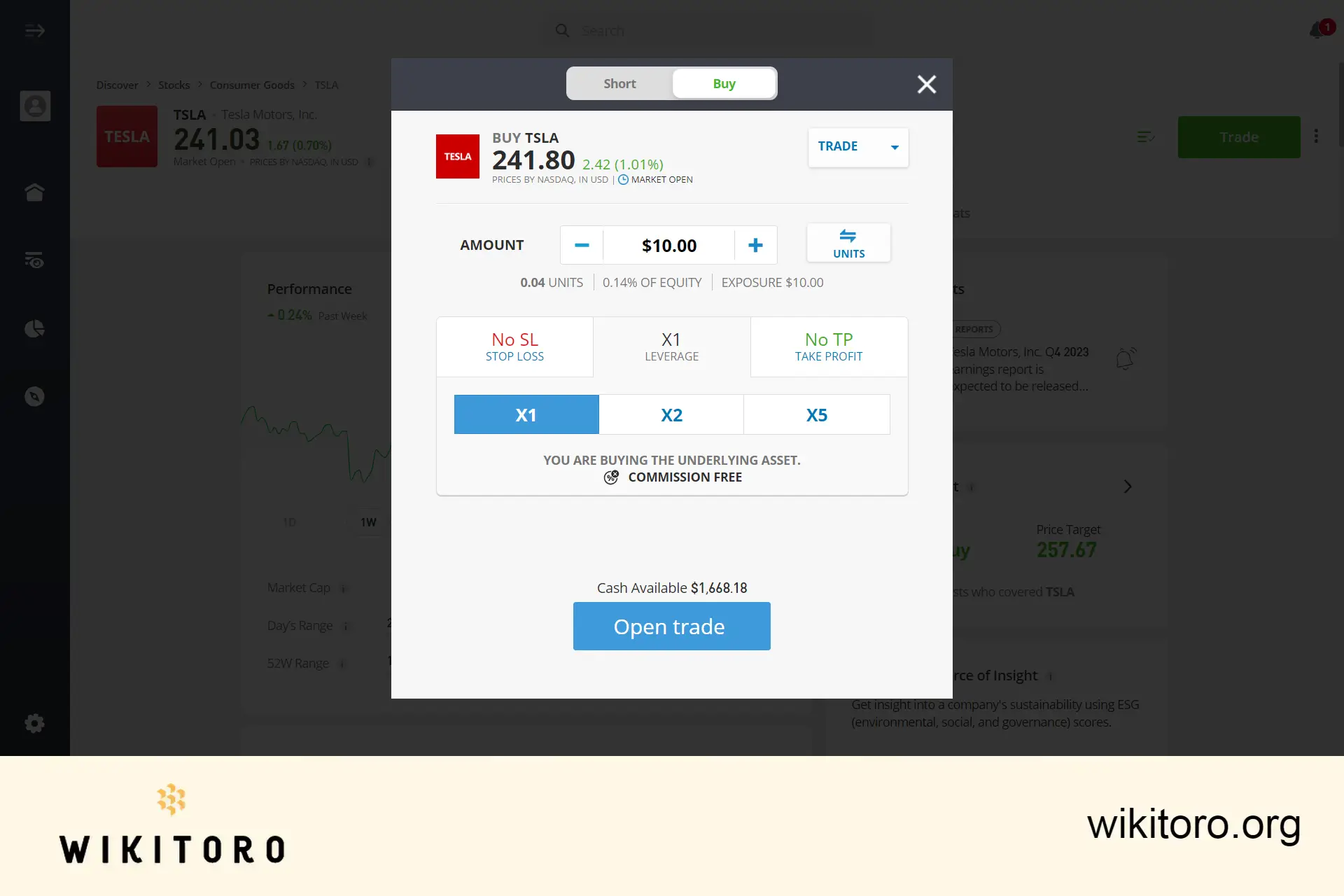

To trade Tesla stocks on eToro, simply search for Tesla as the underlying asset. You have the option to 'Buy' for long positions or 'Short' for short positions. Enter your investment amount, set your trade preferences (such as stop loss, take profit levels), and then execute the trade. This process is straightforward and can be completed quickly, whether you're a novice or an experienced trader.

Their CopyTrader feature uniquely enables me to emulate the trades of seasoned stock investors. By using filters, I can easily find and select traders who specialize in Tesla stocks. After choosing a trader, I decide the amount to invest in their Tesla stock trades. With a simple click on the "Copy" button, I can automatically replicate their trading positions, leveraging their expertise and strategies.

That's everything you need to know about trading Tesla stocks on eToro, accessible both via their web platform and mobile app. Remember to utilize the tips and tools mentioned here to enhance your online stock trading journey. Whether you're new to trading or looking to diversify your portfolio, these insights and features can provide a significant advantage.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman

Related Articles

We've compiled a list of related articles

Ever wondered how to invest in Tesla on eToro? Our article provides a personal journey and step-by-step guide to building and managing a Tesla stock portfolio.

Unlock the power of social trading on eToro. Our step-by-step guide showcases strategies, tips, and firsthand experiences to help you confidently invest in Tesla shares.