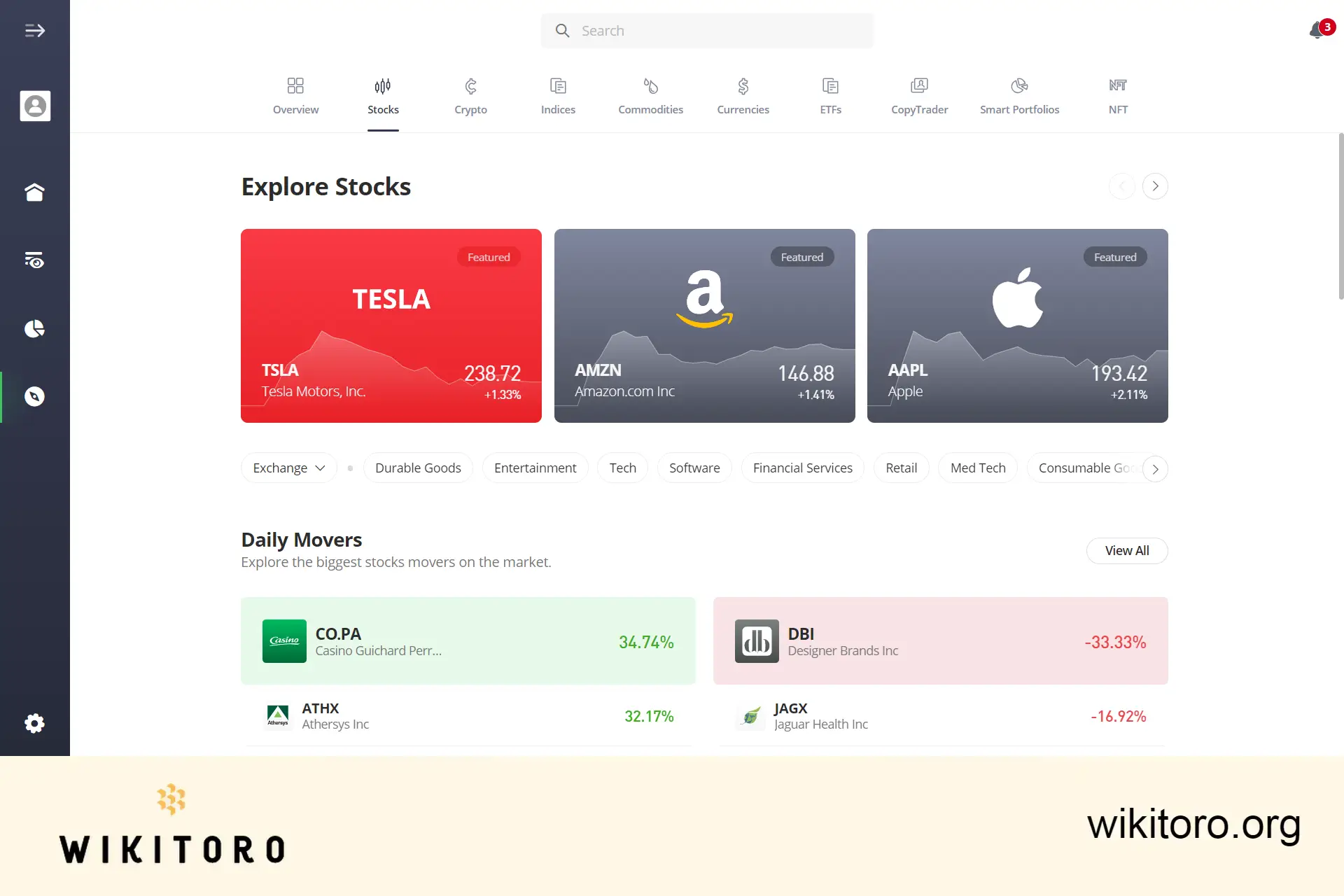

Did you know that eToro's platform offers access to over 3000 stocks? Through its online interface and app, you can trade shares from not only popular companies but also emerging markets. Additionally, the platform enables you to analyze market trends and engage in discussions with fellow stock traders.

If you're new to this or looking to enhance your stock trading knowledge on eToro, this comprehensive guide is for you. I'll share my personal experiences and provide tips on selecting the right stocks, managing your portfolio, and making informed investment decisions.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| 📊 Stocks | 3,000+ |

| 📈 Spread |

0% for real stocks 0.15% for stock CFDs |

| 🕟 Market Hours | Varies (depends on exchange) |

| 📊 Leverage |

Up to x5 for stock CFDs (for eToro (Europe) Ltd, eToro (UK) Ltd, and eToro AUS Capital Limited clients) Up to x10 for stock CFDs (for eToro (Seychelles) Ltd clients) |

| 💰 Minimum Trade | $10 |

Wondering how many stocks are on eToro? This broker currently boasts a selection of over 3,000 stocks, encompassing both well-known companies and those in emerging markets.

From my experience, the platform offers stocks from approximately 20 different industries, including technology, healthcare, manufacturing, transportation, energy, and many others.

Deciding on what is the best stock to buy on eToro can be challenging with the plethora of options available. Selecting the right asset to invest in should align with your trading preferences, available capital, and risk tolerance.

Having invested with this broker for a considerable period, I've discovered various methods to obtain stock recommendations using features from the platform:

So, can you buy stocks with eToro or is it limited to CFDs only? Fortunately, they offer the option to purchase real shares. In fact, you can even invest in a fraction of a stock, starting as low as $10.

It's important to note that to buy real company shares, the underlying asset must be purchased without leverage. This means keeping the "Leverage" setting at its default value, which is X1.

My experience with stock trading on eToro has offered me a wealth of valuable insights:

Engaging in stock trading on eToro is streamlined and user-friendly. To begin:

Before starting, ensure your account is verified and funded. Be aware that your stock position will remain open until you close it manually, it's closed by a stop-loss or take-profit order, or the contract expires.

eToro's trading platform offers real-time data, news updates, and live price charts, essential for traders at every level. These tools are particularly beneficial for analyzing both historical and current stock price trends.

📈 Verifying the Accuracy of Live Charts

My thorough examination of eToro's live stock rates and charts revealed their high accuracy and promptness. To validate their reliability, I compared eToro's data with trusted market sources such as Yahoo Finance and Bloomberg. While minor delays in price updates were occasionally observed, the stock prices on the platform generally aligned well with these external sources.

For newcomers to stock trading, I recommend starting with this broker's demo account. Upon registration, you'll gain access to this account, equipped with virtual funds. It allows you to practice trading a variety of stocks, like Tesla, Apple, and Meta, in a completely risk-free setting.

And that leads us to this question: Is eToro good for investing in stocks?

Determining whether eToro is a good platform for investing in stocks depends on various factors, including your investment goals, experience level, and specific needs. Here's my unbiased assessment based on the features I have explored:

We've now covered all aspects of stock trading on eToro. Given the potential for substantial returns, informed decision-making and effective use of the discussed tools and strategies are crucial. I hope this guide has enhanced your understanding and that my personal experiences have provided valuable insights for your successful stock trading journey.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver

Related Articles

We've compiled a list of related articles

Unlock the potential of trading CFD stocks on eToro with our expert guide, tailored to help you make informed and strategic trading decisions.

Is eToro the right choice for your stock investments? Read our balanced analysis of its pros and cons.

Find out how to purchase stocks on eToro with our easy-to-follow article. Tips on real stock trading and leveraging CFDs.

Find out which stocks are best to buy on eToro. Our article offers insights and strategies for smart stock selection.

Discover eToro's ever-growing stock portfolio, featuring more than 3,000 diverse companies across various industries.

Is eToro a stock broker or something else? Discover how it works, what it lets you trade, and how it compares to standard brokerage platforms.

Find out if you can trade US stocks on eToro. Learn how the platform gives access to US shares and how to start investing today.

Buy fractional shares on eToro with just $10. Get into big-name stocks and learn how to diversify without a large upfront cost.

Find out why eToro may have sold your stock: stop-loss triggers, contract expiry, policy changes, or CopyTrader actions could be the reason.

Find out if eToro’s zero-commission stock trading, fractional shares, and copy trading features are enough for it to be the right platform for your goals.

Get details on eToro’s stock options for U.S. traders, including platform features, supported contracts, and who can qualify.

Understand how stock purchases are handled on eToro, including key details about custody, shareholder rights, dividends, and your portfolio’s structure.