Alibaba, established in 1999, stands as China's premier online retailer. It operates a diverse range of online marketplaces, including Tmall and Taobao, offering a platform for consumers and merchants to buy and sell products. Beyond its online marketplaces, Alibaba encompasses traditional stores, cross-border and international marketplaces, and its Cainiao logistics division. The company's e-commerce segment is the primary source of its revenue and profits.

Did you know?

Investing in Alibaba shares can be efficiently managed through eToro's online trading platform. To assist you in this venture, I have prepared a detailed guide complete with personal insights. This guide will provide clarity on investment options and demonstrate how to effectively utilize the tools available for trading this stock.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

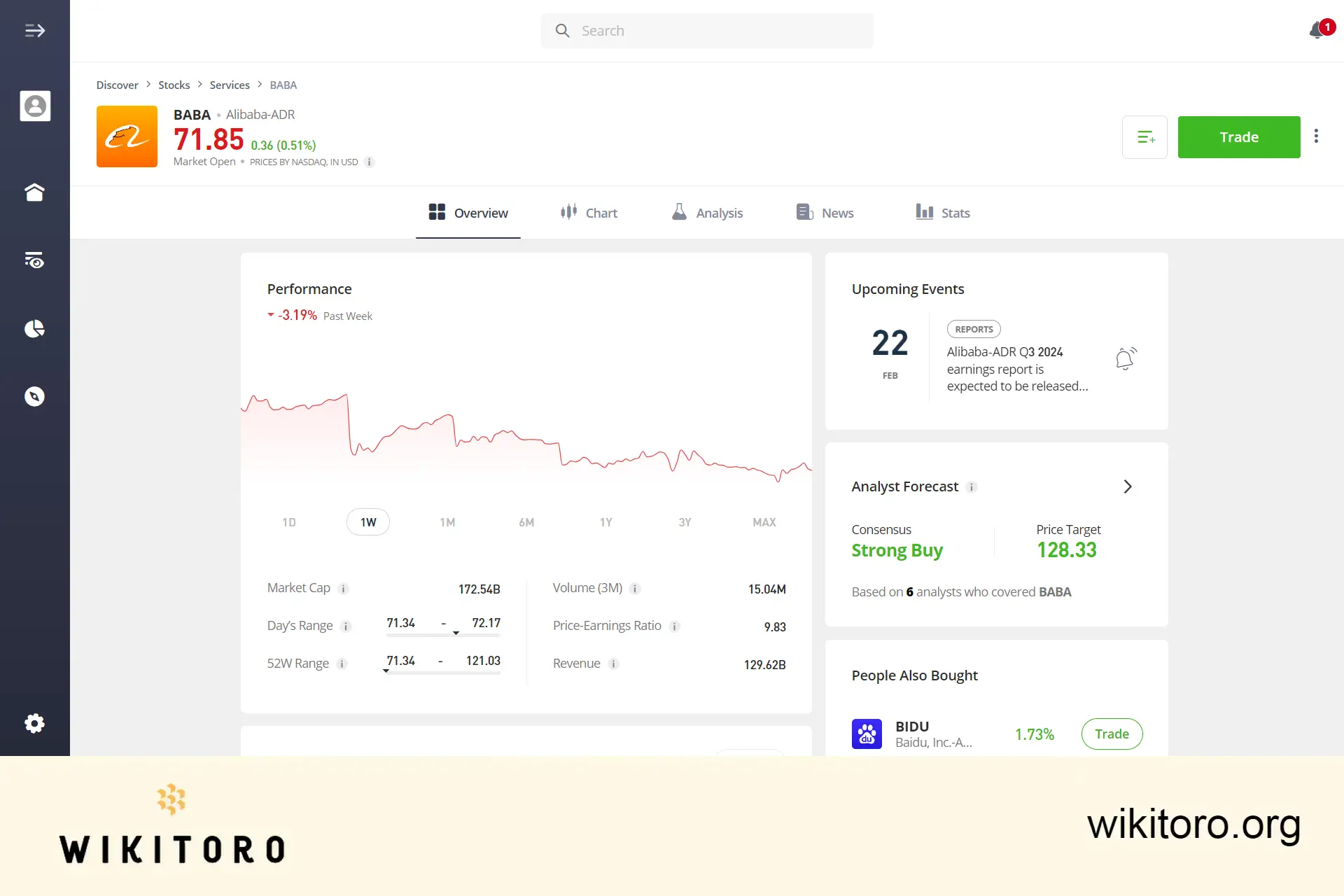

On navigating to the Alibaba stock asset page on eToro, you'll be presented with the Overview section. This default area displays several key elements that provide a comprehensive snapshot of Alibaba's stock. Here's what you'll find in order:

The integrated eToro stocks trading tools have significantly enhanced my investing experience with this asset. Here's an overview of the tools I found particularly useful:

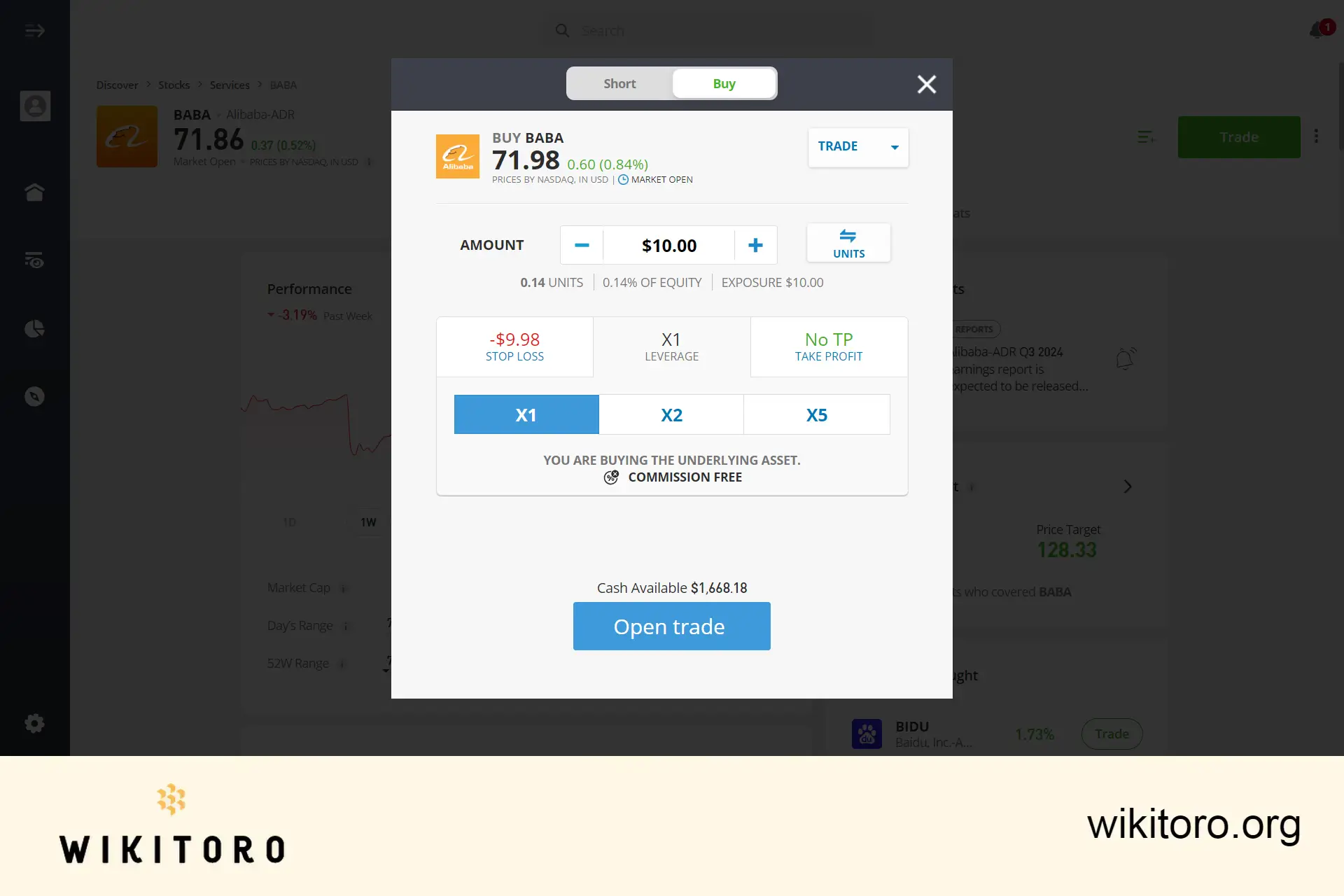

To trade Alibaba stock on eToro, first search for the underlying asset. You can choose to either "Buy" or "Short" the stock based on your market assessment. After deciding on the investment amount, set your trading parameters, like stop loss and take profit levels, and then execute the trade. This process is streamlined and user-friendly, accommodating traders of all experience levels.

A unique feature I appreciate on eToro is the CopyTrader function. It allows you to emulate the trades of experienced Alibaba stock investors. By using the filter tool, I refined my search for suitable traders. Once I chose a trader, I simply determined the amount I wanted to invest in their Alibaba trades and clicked the "Copy" button to begin automatically replicating their trading positions.

Given that I've invested in Alibaba (BABA) stock several times already on this platform, I have identified several advantages:

And that's how it's done!

These are the key aspects to keep in mind if you're considering trading Alibaba stocks on eToro, through either the web platform or the mobile app. Remember to utilize the tips and tools mentioned in this guide to enhance your online trading journey. They're designed to help you make more informed and effective investment decisions.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman