eToro Islamic Account

- In compliance with Sharia law

- Swap-free trading

- Zero interest (Riba) on open positions

- Minimum deposit requirement of $1000

- No account management fees

61% of retail investor accounts lose money

Looking for a trading platform that respects your religious principles? You’re in the right place.

If you’re checking what eToro offers for traders who follow Islamic finance rules, this page will give you the clarity you need, without the jargon.

I’ve been through the process myself. Opened the account. Tested the features. Reviewed the fine print. And what follows is a no-nonsense summary of how the eToro Islamic Account works, and what makes it different.

Let’s start with the basics.

The eToro Islamic Account is built specifically for traders who follow Sharia law. That means no interest (known as Riba), no hidden swap fees, and no violations of Islamic finance principles.

Unlike standard accounts, where overnight positions might earn or cost interest, this one strips that out completely. You're left with a product that keeps your trades active, without triggering compliance issues.

It’s a tailored setup. One designed to let you trade with peace of mind, knowing the structure aligns with your values.

| ☪️ Islamic Account | Available |

| 💰 Minimum Deposit | $1000 |

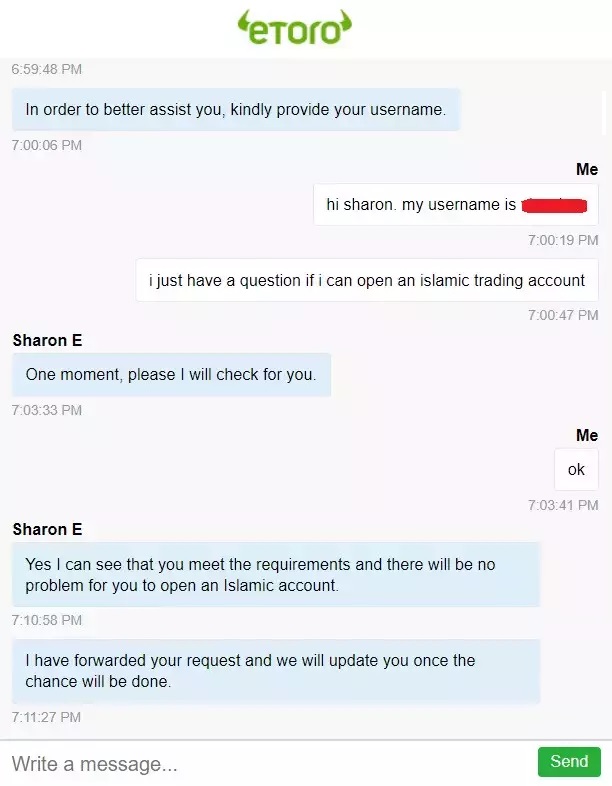

| 🔛 Activation | By contacting customer support |

| 📝 Document Required | Proof of religion |

Why does eToro offer a dedicated Islamic Account for Muslim traders?

Because certain financial activities are strictly off-limits under Sharia Law. And a standard trading account won’t cut it.

Here’s what’s not allowed:

Islamic Accounts on eToro are designed to respect these guidelines. That means no interest fees on trades left open overnight. Instead, a fixed admin fee applies.

Here’s what really matters:

In standard forex accounts, if you leave a trade open past 5:00 pm New York time, it rolls over and racks up interest. This is called “Riba,” and it’s considered Haram under Islamic law.

With an Islamic Account, it works differently.

There are no rollover fees, even if you keep the trade open for days or weeks. No weekend charges either. Hold your position as long as you like because here’s no interest coming your way.

Here’s where it gets important: when money moves between bank accounts (or in the case of forex, when currency is exchanged), religious scholars consider this a physical transfer. It counts as a real exchange under Islamic law.

The main point is that Sharia-compliant trading requires that deals are settled instantly, and that any costs involved are handled at the moment of transaction. That’s not a suggestion. It’s a formal requirement based on fatwas issued by Islamic scholars.

eToro meets this head-on. Their trading platform executes currency trades in real time, with no delays. Which means the timing and structure align with Islamic finance principles.

It’s a question a lot of Muslim traders ask: Is eToro halal?

Here’s the answer.

eToro offers an Islamic account. It’s structured specifically to follow Sharia guidelines: no interest, no overnight fees, and all trading done with immediate settlement.

That makes eToro a viable option for halal trading. If you’re looking to trade while staying aligned with Islamic financial practices, their Islamic account is built for exactly that.

Is eToro Sharia compliant or not? It’s a question that comes up often, especially among Muslim traders looking to stay aligned with their values while investing.

The short answer: yes. eToro offers an Islamic account designed specifically to comply with Sharia principles. That means no interest, no hidden fees, and no compromises when it comes to faith-based financial ethics.

If you're considering whether the Islamic account fits your trading style, here’s a quick breakdown of what it offers:

This setup is tailored for traders who want access to global markets while staying within the framework of Islamic finance. Straightforward, transparent, and built with compliance in mind.

If you're based in the UAE, you're good to go. eToro accounts are open to residents with no special restrictions in place.

While eToro doesn’t currently operate physical offices in Saudi Arabia and isn’t licensed by the Capital Market Authority (CMA), it’s making moves in the UAE. The platform has secured an in-principle approval from the Abu Dhabi Global Market (ADGM) to act as a crypto broker. It’s a primary step toward expanding its footprint across the Middle East.

eToro is available in several countries with large Muslim populations. Here are a few where traders can access the platform without issues:

That said, some countries with significant Muslim populations are currently off-limits due to regulatory hurdles. These include:

| Afghanistan | Iraq | Sudan |

| Burkina Faso | Libya | Syria |

| Cameroon | Mali | Tajikistan |

| Chad | Niger | Tanzania |

| China | Nigeria | Tunisia |

| Congo (DR) | Pakistan | Turkey |

| Ethiopia | Russia | Turkmenistan |

| Guinea | Sierra Leone | Uzbekistan |

| Iran | Somalia | Yemen |

Let’s clear something up, fast.

If you’re wondering how eToro earns revenue from Islamic trading accounts without breaking Sharia rules (no interest, no exceptions), here’s your answer:

Spreads. That’s it.

Spreads refer to the small difference between the buy and sell prices of assets like currency pairs. eToro doesn’t charge overnight fees or interest on Islamic accounts. No hidden fees, no management charges. Only the spread. So the model stays compliant and transparent.

Alright, so you’ve confirmed eToro offers an Islamic account. But what exactly can you trade?

From what I’ve seen, the product lineup is broad. You can access:

Here’s where it gets more complex:

The main takeaway here is that eToro gives you access. But it’s your responsibility to assess whether a trade aligns with Islamic finance principles. When in doubt, I suggest that you talk to a qualified scholar or financial advisor with Islamic finance expertise. Better safe than sorry.

eToro’s Islamic account is designed specifically for Muslim traders, but there’s one thing you need before you can access it: verified proof of religion.

This document should come from an officially recognized Islamic organization in your country or region. It confirms your eligibility and helps eToro align the account with Shariah principles: no swap fees, no interest-based charges, no compromises.

Wondering how to switch your eToro account to Islamic? Here’s the process, step by step:

That’s it. If you’re a Muslim trader looking to stay compliant with religious guidelines, this is the setup you need. I suggest that you keep an eye on eToro’s help center or updates. They sometimes revise requirements or features tied to Islamic accounts, and you’ll want to stay ahead of those changes.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Wikitoro Team

About Wikitoro Team

Related Articles

We've compiled a list of related articles

Wondering if eToro is a halal broker? Delve into eToro's alignment with Islamic financial standards and gain clarity for your trading choices.

Check out this in-depth analysis on whether eToro is Sharia-compliant. Dive into their Islamic account features and how they align with key Islamic finance principles.

Discover eToro's Islamic account benefits: Shariah-compliant features making it a prime choice for Muslim traders pursuing ethical online trading.

Explore Islamic trading on eToro: a firsthand account of Shariah-compliant instruments and a trader's harmonious journey