The CAC 40 index, known as the France 40 or FRA40, is a prominent benchmark featuring 40 major companies from the Euronext Paris stock exchange. Its name, Cotation Assistée en Continu, signifies "continuous assisted trading." For those interested in investing in this index, the eToro platform offers a convenient avenue. This guide, enriched with my personal insights, will detail how to leverage eToro for investing in this dynamic asset. So, stay tuned for valuable information that could enhance your investment strategy.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

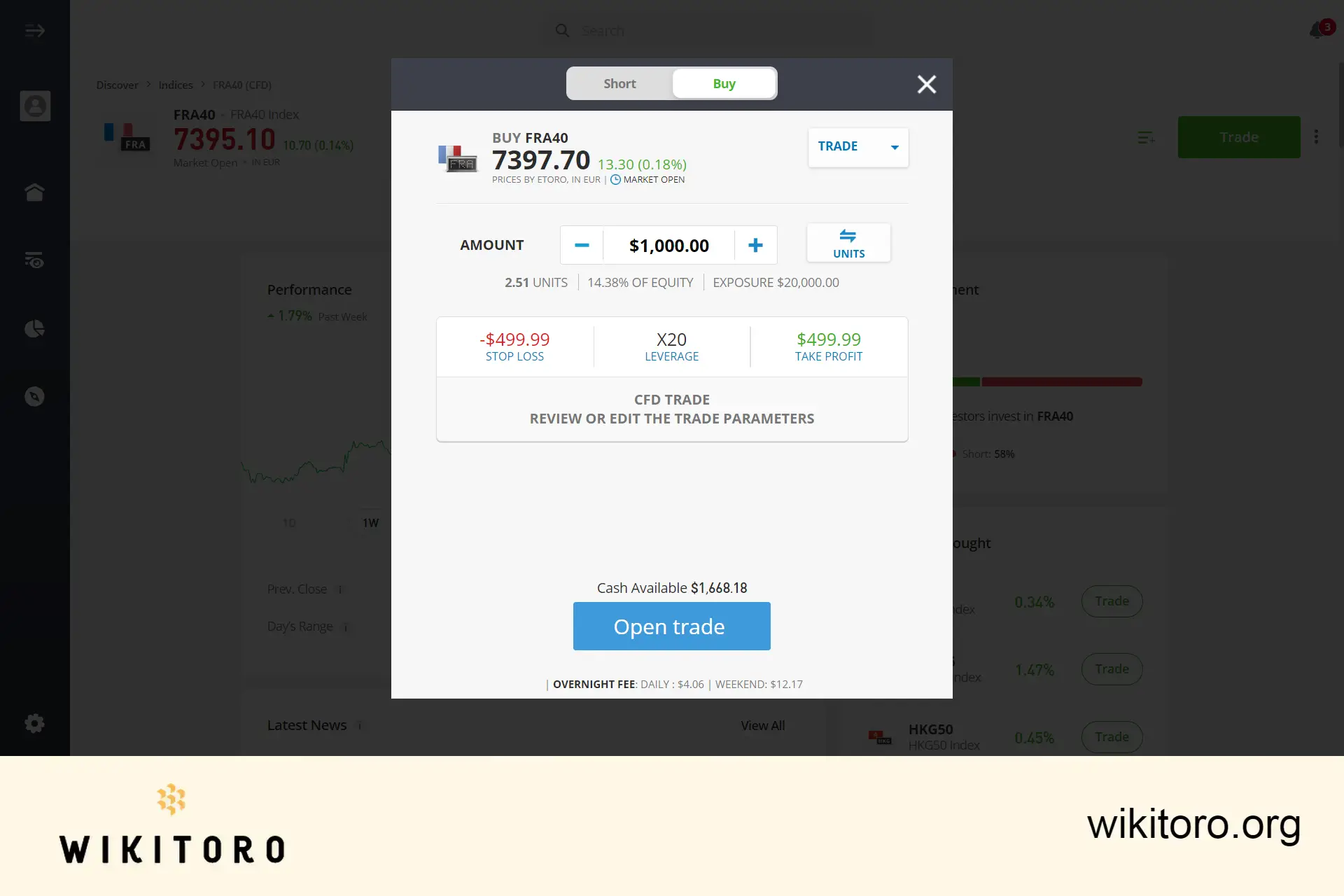

It's crucial to understand that trading the CAC 40 index on eToro involves CFDs (Contracts for Difference), not direct stock exchange transactions. The allure of CFD trading lies in its speculative nature, allowing traders to capitalize on the indices market's movements. CFDs provide the opportunity to profit from price changes without owning the underlying asset. The value of a CFD contract is based on the price difference between when you enter and exit a trade. Skillfully executed, CFDs can yield a Return on Investment (ROI) regardless of market direction. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded this asset on eToro multiple times, I've identified several key benefits:

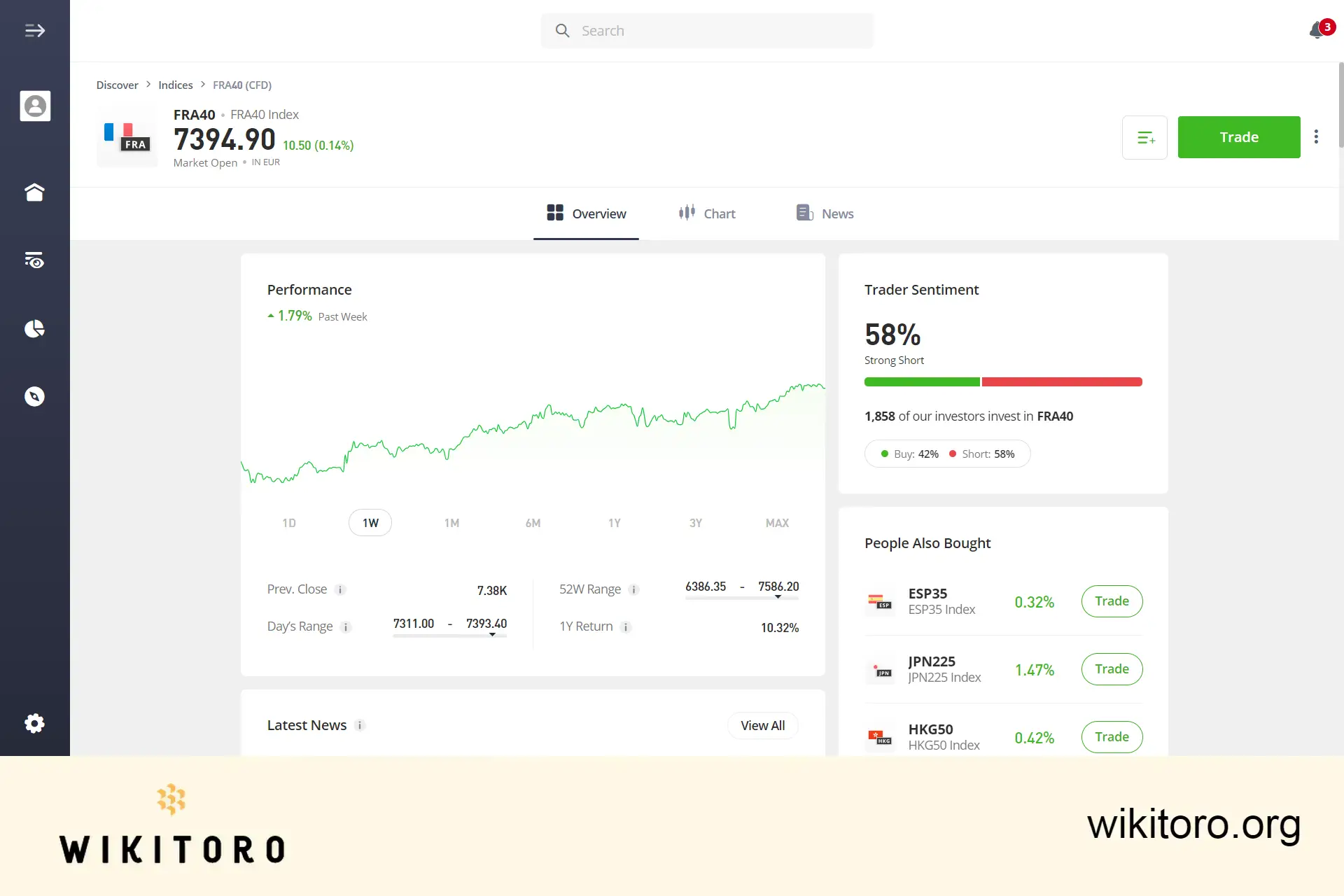

When you access the CAC 40 asset page on eToro, the default Overview section greets you. This section is a hub of critical information, comprising several key elements:

eToro’s platform integrates essential trading tools, providing a seamless experience without the need to switch between different applications. Key tools include:

Trading the CAC 40 index on eToro involves a few simple steps:

To sum up, this guide has covered essential aspects and strategies for investing in the CAC 40 index on eToro. Whether you're using the web platform or mobile app, these insights should prove invaluable. Keep these tips in mind to enhance your trading experience and make the most out of your eToro journey. Happy trading!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver