The Nikkei 225, also known as N225 or JPN225, is often compared to the Dow Jones Industrial Average in the United States, serving as a key indicator of Japan's economic health. This index reflects the performance of 225 leading blue-chip companies on the Tokyo Stock Exchange. While it's not possible to invest directly in the Nikkei 225, as it's an index, there are ways to engage with the stocks it represents, such as through Contract for Difference (CFD) trading and Exchange-Traded Funds (ETFs). In this guide, I'll share detailed insights on how to invest in this index using eToro, offering personal experiences and tips to consider in your investment journey.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

It's important to understand that trading the Nikkei 225 on platforms like eToro involves dealing with CFDs, not directly with the stock exchange. The allure of CFD trading lies in its ability to speculate on the movement of indices markets without needing to own the actual assets. CFDs allow traders to profit from price changes by calculating the difference between the opening and closing prices of a contract. This flexibility means that you can achieve a Return on Investment (ROI) in various market conditions, provided your trades are well-planned and executed. Crypto CFDs/ Leverage trading is restricted for users under FCA.

After multiple trading sessions with the Nikkei 225 on eToro, I've identified several benefits worth noting:

Remember, investing in CFDs carries a high level of risk due to leverage and may not be suitable for all investors. It's crucial to understand the risks and seek advice if necessary.

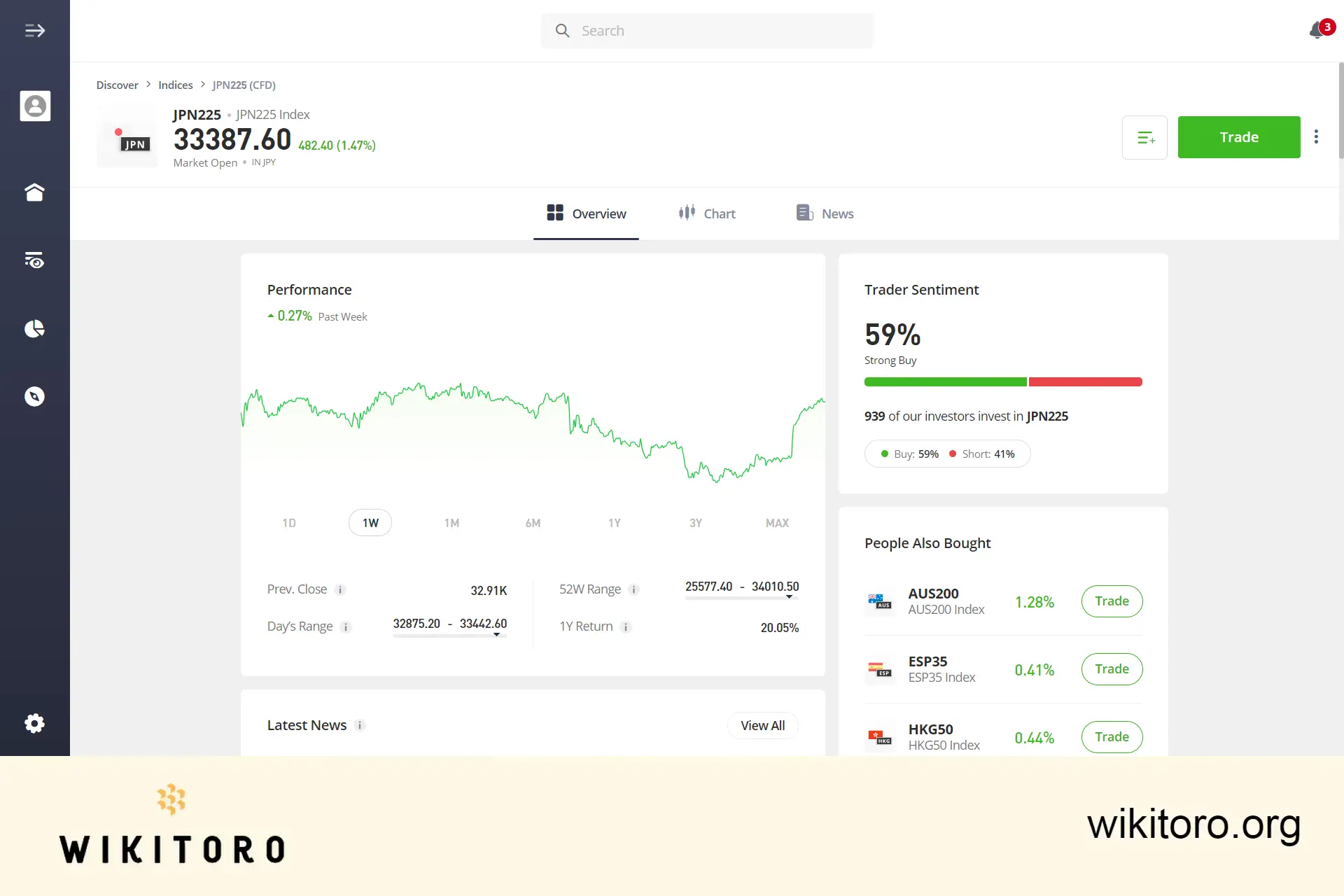

When you access the Nikkei 225 asset page on eToro, you'll start in the Overview section, which is the default landing area. This section includes several key elements:

eToro's platform integrates various tools for a seamless trading experience, eliminating the need to switch between apps or screens. These tools include:

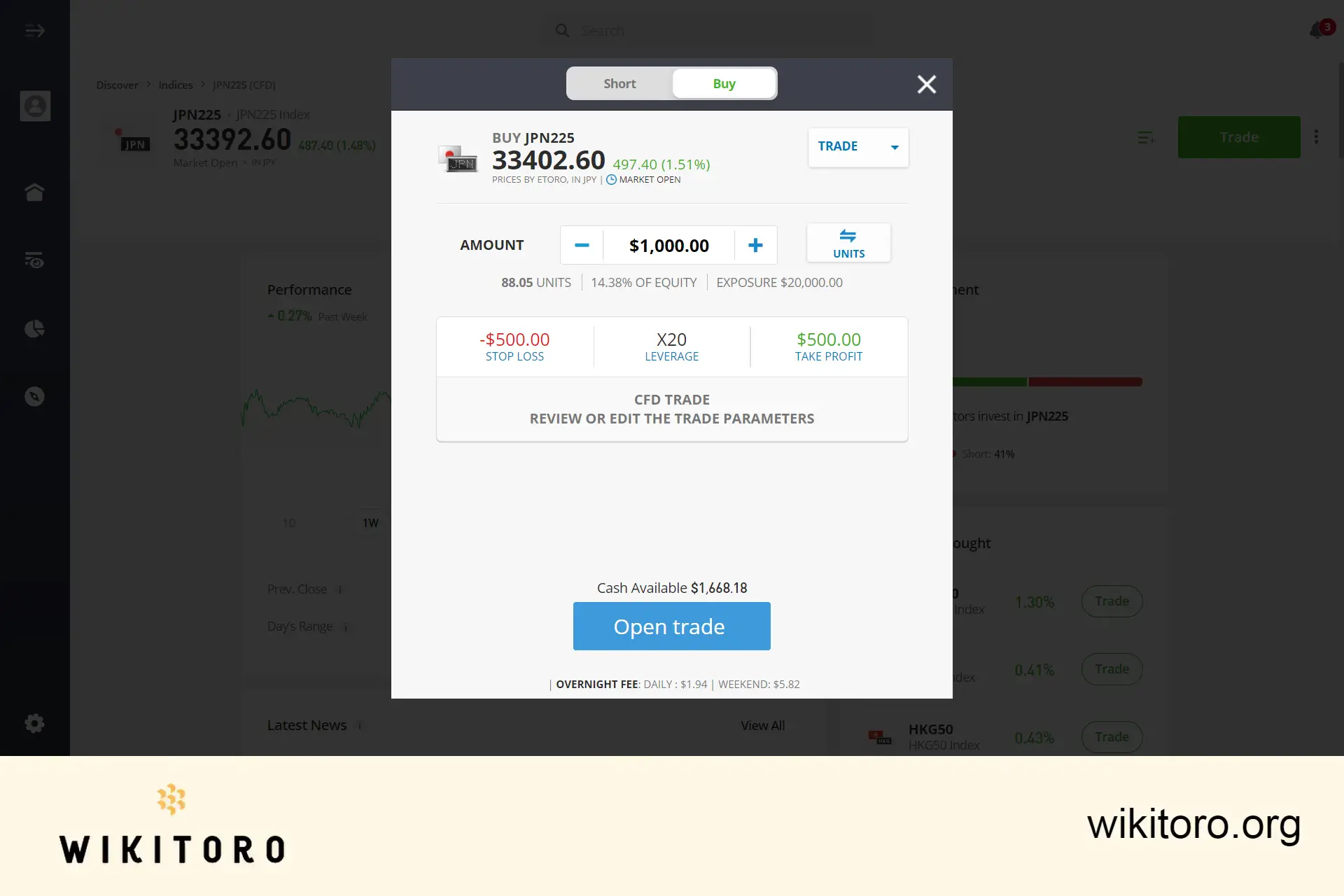

To begin trading the Nikkei 225, search for the asset, select either "BUY" or "SELL," enter your investment amount, set your trade preferences, and then execute the trade.

To summarize, this guide covers everything you need to know for investing in the Nikkei 225 index on eToro. The insights and tips provided are relevant for both the web-based platform and the mobile app. Remember to apply these strategies thoughtfully in your trading endeavors and enjoy your journey on this versatile platform!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman