High-profile benchmark indices like the Dow Jones, S&P 500, and NASDAQ 100 rank among the most actively traded in the world, and eToro's platform offers you the opportunity to trade on these indices. Your investment decisions can hinge on whether you predict an increase or decrease in their prices. Adding these indices to your portfolio is a smart way to achieve diversification.

eToro simplifies trading in these indices, enabling you to place Buy or Sell orders with ease. The platform also provides the unique benefit of observing and copying the strategies of experienced traders, all within an easy-to-use interface.

In this guide, I'll offer a detailed overview of the indices available for investment with this broker and demonstrate how to effectively engage in these markets. Drawing from my personal experiences and strategies on the platform, you'll gain insights into the nuances of indices trading and understand why investing in this asset class can be a prudent financial decision.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| 📊 Indices | 20 |

| 📈 Spread | From 0.75 points |

| 🕟 Market Hours | Mondays to Saturdays (different times per index) |

| 📊 Leverage |

Up to x20 for major indices, Up to x10 for non-major equity indices (for eToro (Europe) Ltd, eToro (UK) Ltd, and eToro AUS Capital Limited clients) Up to x100 for major indices, Up to x10 for non-major indices (for eToro (Seychelles) Ltd clients) |

| 💰 Minimum Trade | $1,000 |

When you engage in indices trading on eToro, it's crucial to recognize that you are trading index derivatives, specifically Contracts for Difference (CFDs), rather than the actual indices themselves.

A CFD is an advanced financial instrument enabling you to speculate on the price movements of an underlying asset, such as the S&P 500, Dow Jones, or DAX, without owning the asset. Trading an index on eToro means you're entering into a CFD contract. Your profit or loss is determined by the difference in the price of the CFD at the time you open and close the contract.

One major advantage of CFD trading is the opportunity to benefit from price movements of assets without the complexities and costs associated with direct trading of stock indices. However, it's important to be aware of the risks involved in CFD trading, which can include significant losses, potentially encompassing your entire investment. As such, implementing risk management strategies, such as stop-loss orders, is essential to help mitigate these risks.

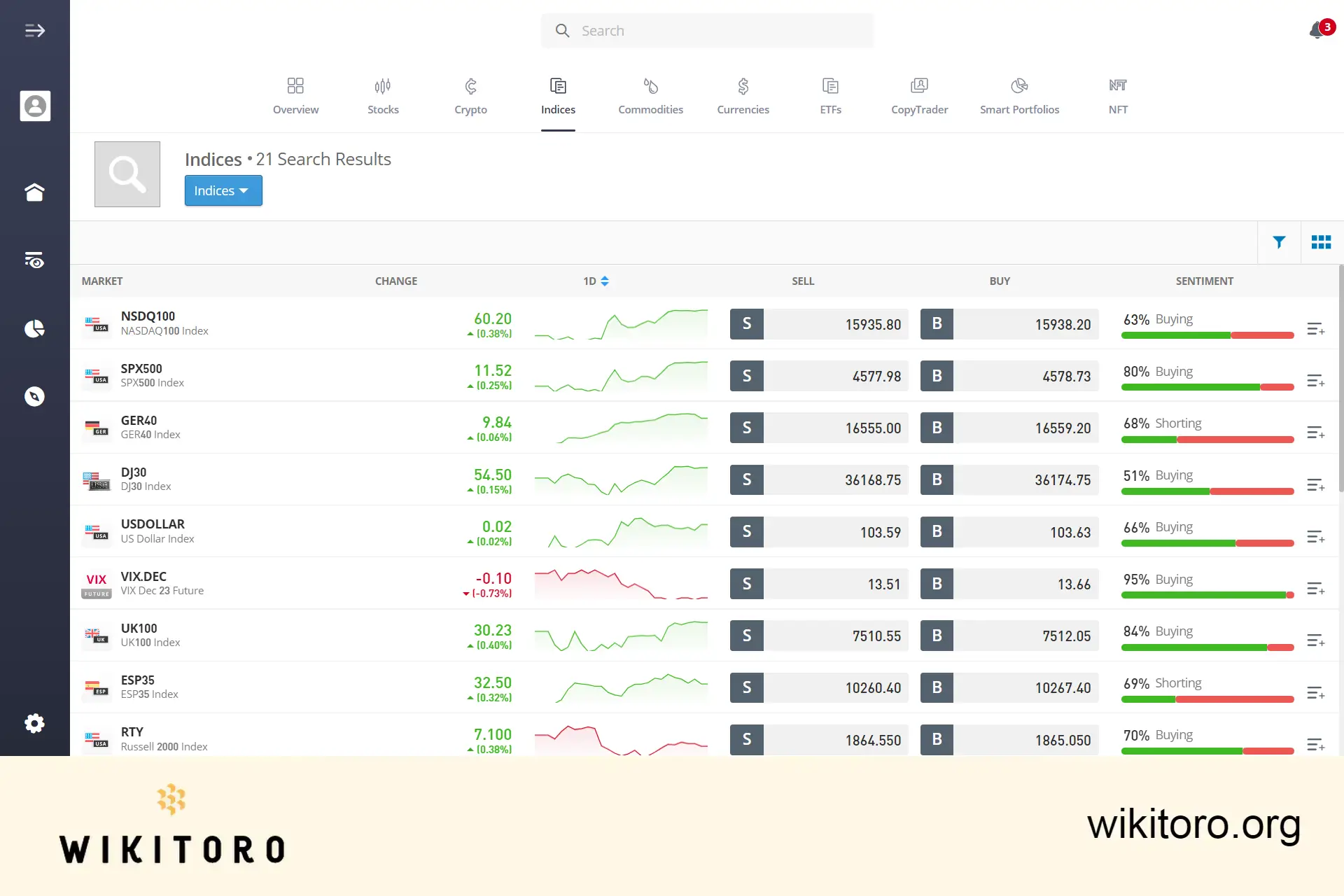

Listed below are the available indicies that you can trade on this investment platform:

| 2-Year Treasury Future (2yUS) | Hang Seng China 50 or China 50 (HKG50) |

| 5-Year Treasury Future (5yUS) | Nikkei 225 (JPN225) |

| 10-Year Treasury Future (10yUS) | Netherlands 25 (NL25) |

| S&P/ASX 200 (AUS200) | NASDAQ 100 (NSDQ100) |

| FTSE China A50 or ChinaA50 (CHINA50) | Russell 2000 (RTY) |

| Dow Jones or US30 (DJ30) | Singapore Index (SGX) |

| IBEX 35 or Spain 35 (ESP35) | S&P 500 or US500 (SPX500) |

| Euro Stoxx 50 Future (EUSTX50) | FTSE 100 (UK100) |

| CAC 40 or France 40 (FRA40) | US Dollar Index (USDOLLAR) |

| Deutscher Aktien Index or DAX (GER40) | VIX Future (VIX) |

My foray into index trading on eToro's platform has yielded several important insights:

Participating in indices trading on eToro is a straightforward and efficient process. To start, use the search bar to locate your desired index (e.g. "DOW", "SP500"). Once you find it, you can enter your investment amount and configure the trade parameters. The final action is to click the "Open Trade" button, which will execute your transaction.

But before you begin, it's important to ensure that your account is verified and has sufficient funds for indices trading. Additionally, be aware that your position in an index will remain open until one of the following occurs:

The trading platform provides real-time data, news updates, and live price charts, which are invaluable tools for traders of all experience levels. These resources are especially useful for analyzing historical and current price movements.

📈 Checking the accuracy of live charts

In my extensive review of the platform's live index rates and charts, I found them to be highly accurate and timely. To confirm this, I compared eToro's data with figures from trusted market data sources like MarketWatch and Wall Street Journal (WSJ). The index prices on eToro's platform were consistently in line with these sources. However, I did notice very slight delays in price updates on some occasions.

For those new to indices trading, I strongly suggest beginning with the demo account. When you register, you'll have access to this account, which comes preloaded with virtual funds. This feature enables you to practice trading various indices, including the Dow Jones, DAX, CAC 40, and others on eToro, in a completely risk-free environment.

This brings us to the end of our journey through indices trading on eToro. Considering the potential for significant returns, it's imperative to make informed decisions and effectively utilize the tools and strategies I've discussed in this guide. I hope that this has enriched your understanding and that my personal experiences have provided useful insights for successfully navigating indices trading with this broker.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman

eToro Tradable Indices

Discover a curated selection of indices ready for trading on eToro today – dive in and elevate your trading experience!

Related Articles

We've compiled a list of related articles

Unlock the potential of index trading on eToro. Our guide provides essential tips and insights to enhance your trading experience.

Learn which major global indices you can trade on eToro, including U.S., European, and international markets. All accessible through one platform.

Wondering if there are fees when trading indices on eToro? Learn about spreads, overnight charges, and commission costs.

Want to trade indices with leverage on eToro? Find out how it works, what fees apply, and what you need to know to trade with confidence.