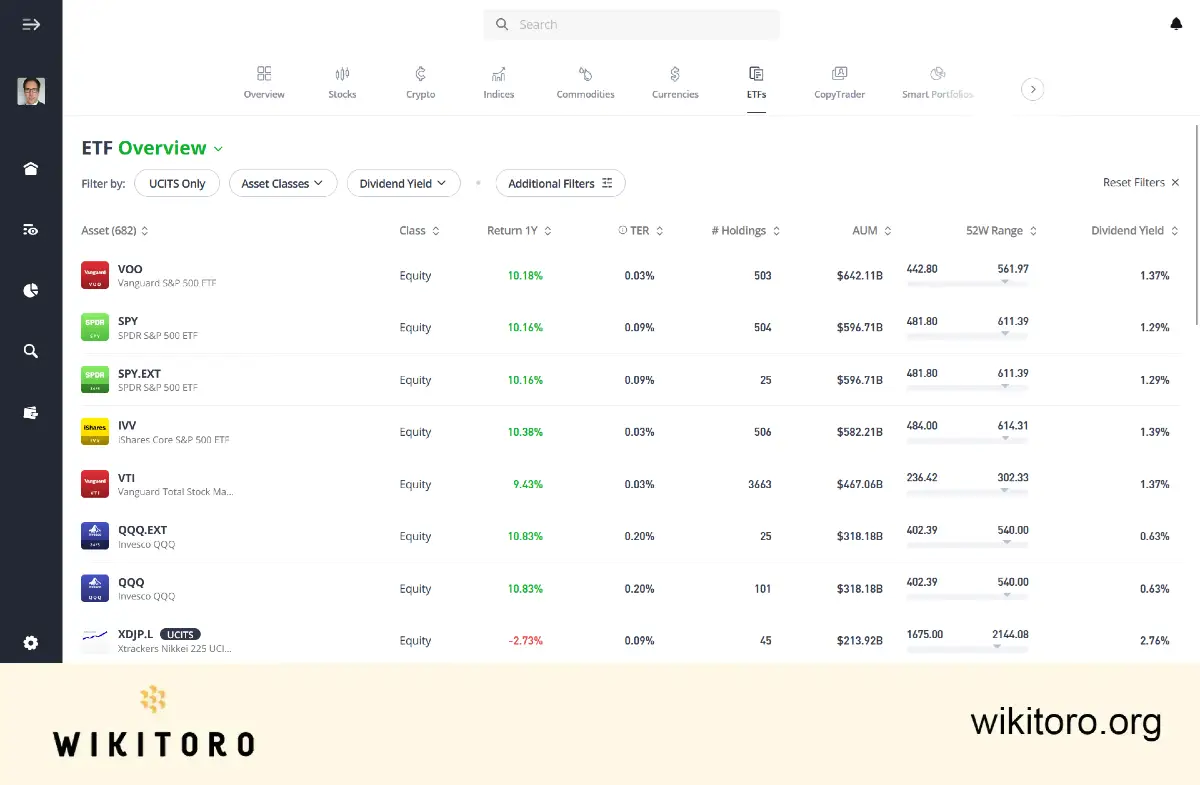

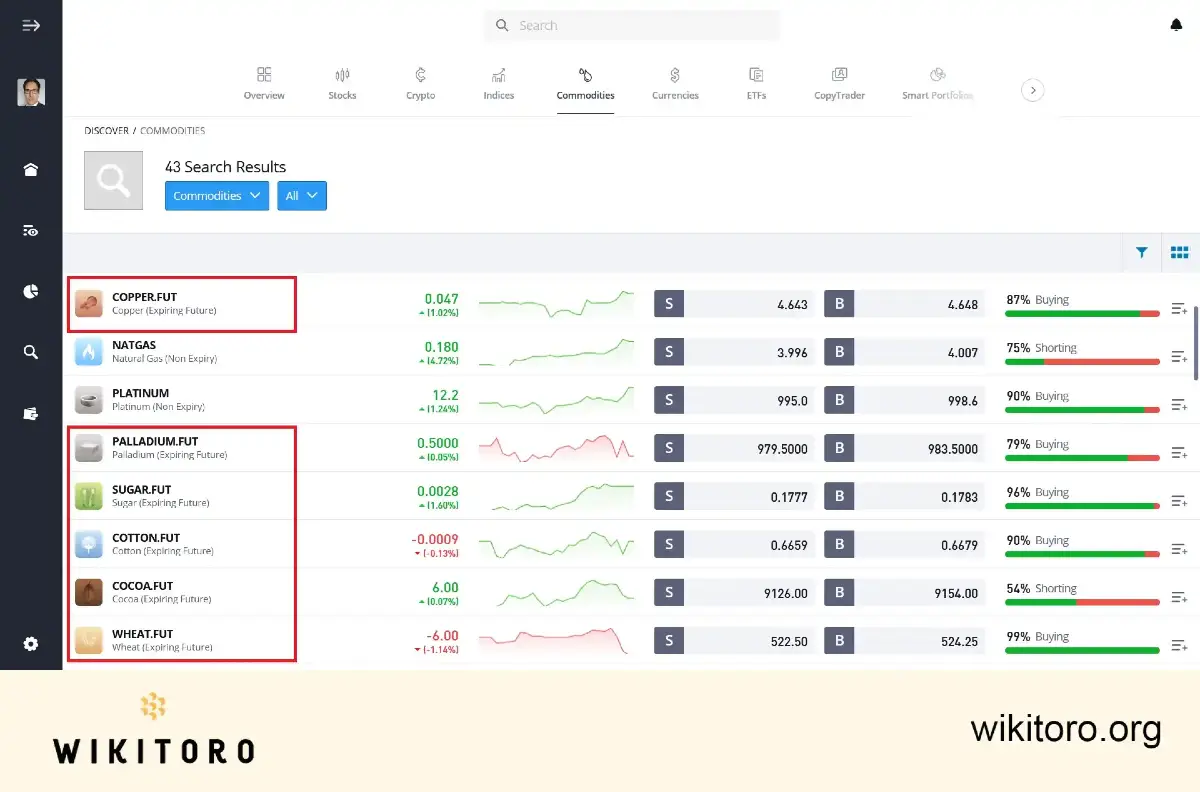

Yes, you can trade futures on eToro. In fact, it offers both exchange-traded futures (ETFs) contracts and CFDs (Contracts for Difference) that reflect futures pricing. That means you can tap into global futures markets (commodities, indices, currencies) without the need to have a trading account with a traditional broker.

These are standardized contracts listed on regulated exchanges like the Chicago Mercantile Exchange (CME). Think Micro E-mini S&P 500 (MES), Micro E-mini Nasdaq 100 (MNQ), and even 1-Ounce Gold futures, all accessible through the platform.

Prefer something a little more flexible? eToro also offers futures-based CFDs. These mimic futures pricing but without the expiry dates or physical delivery headaches. Just pure price speculation, but simplified.

Before you start, here’s a word of advice: futures trading isn’t for everyone. It’s fast-moving, high-stakes, and leveraged, so things can go south just as quickly as they go up. If you're a newbie, I strongly recommend that you use eToro’s demo account first. Get a feel for how futures move before investing real cash.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver