To set a Stop Loss on eToro, open the relevant trade in your Portfolio and access the Edit Trade window. Select STOP LOSS and choose Set SL; then, determine your Stop Loss based on a market rate or specify a monetary amount by clicking on AMOUNT. Remember to click Update to save your setting.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Stop Loss, or SL for short, is a tool that helps you manage risks in trading. It tells the platform to close your trade when a certain market price is reached, so you don't lose more money. Want to know how to use eToro stop loss feature? Keep reading this guide I made for you.

For those trading stocks in the US, it's vital to be aware that Stop Loss orders are not available. This limitation restricts the tools traders in the US can use for risk mitigation specifically on eToro stocks.

To establish a Stop Loss on the platform, follow these steps during the process of opening a trade:

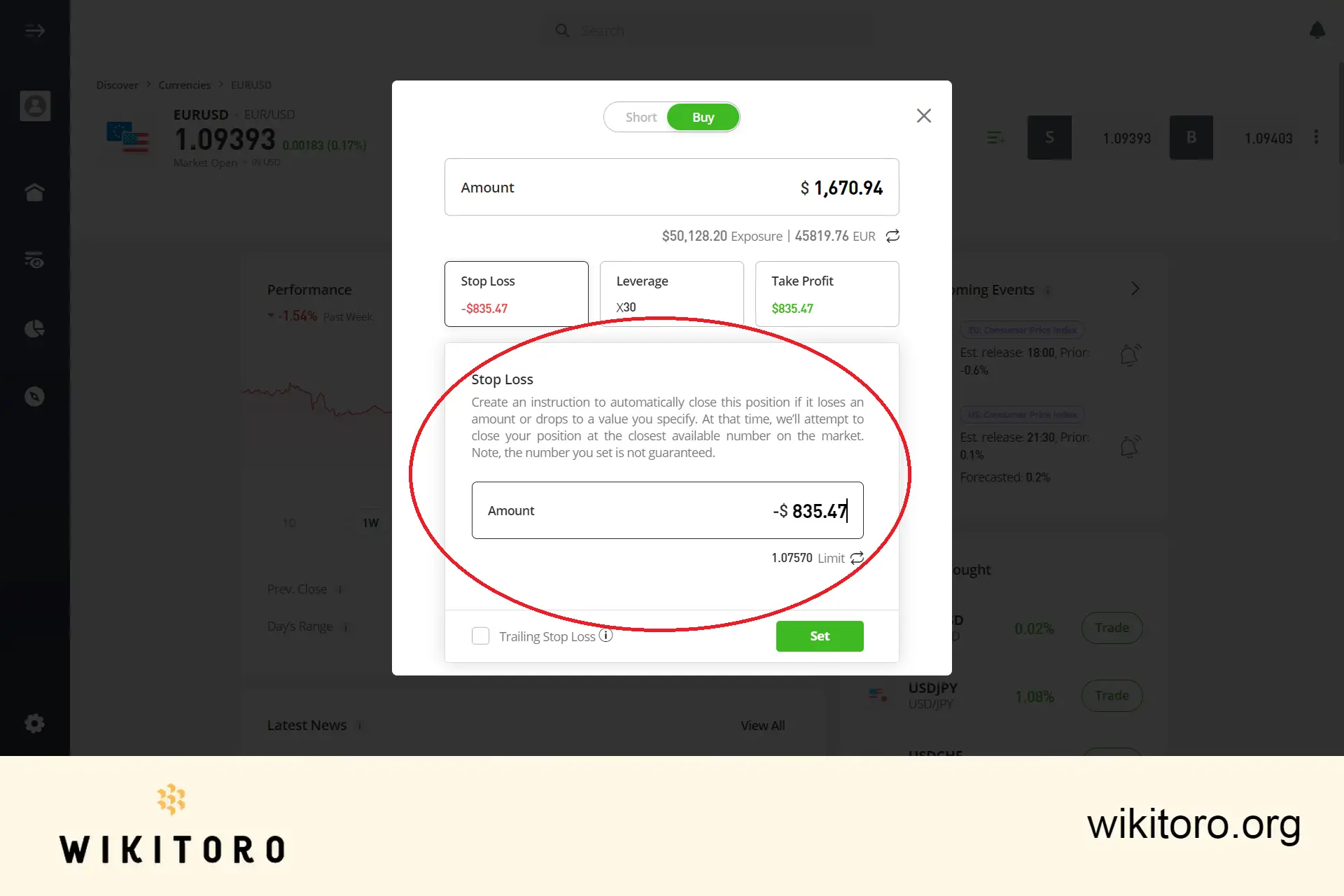

When it comes to initiating an eToro Stop Loss, you're presented with two primary options. First, you can determine a specific rate at which your trade will close. Alternatively, you can set a precise loss amount, meaning your trade will be automatically halted once your losses reach this threshold. This flexibility allows you to customize your risk level based on market understanding and personal preference.

Setting eToro stop loss amount or limit

It's essential to understand that incorporating Stop Loss is entirely up to you. While it offers a safety net, you can very well proceed without it. Whether you're about to open a new trade or mulling over an active one, the choice to set a Stop Loss remains in your hands.

✋Remember: SL is Not Guaranteed

Stop Loss helps protect your trades, but it's not perfect. If the market changes quickly, the Stop Loss might not work at the rate you set. Instead, it could work at the next available rate. I saw this happen when I tried it during big market changes.

In the end, Stop Loss is a powerful tool for traders, especially when the market doesn't go as expected. But using it well matters a lot. So, take the time to learn about it and use it smartly to keep your investments safe and maybe even grow them.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman