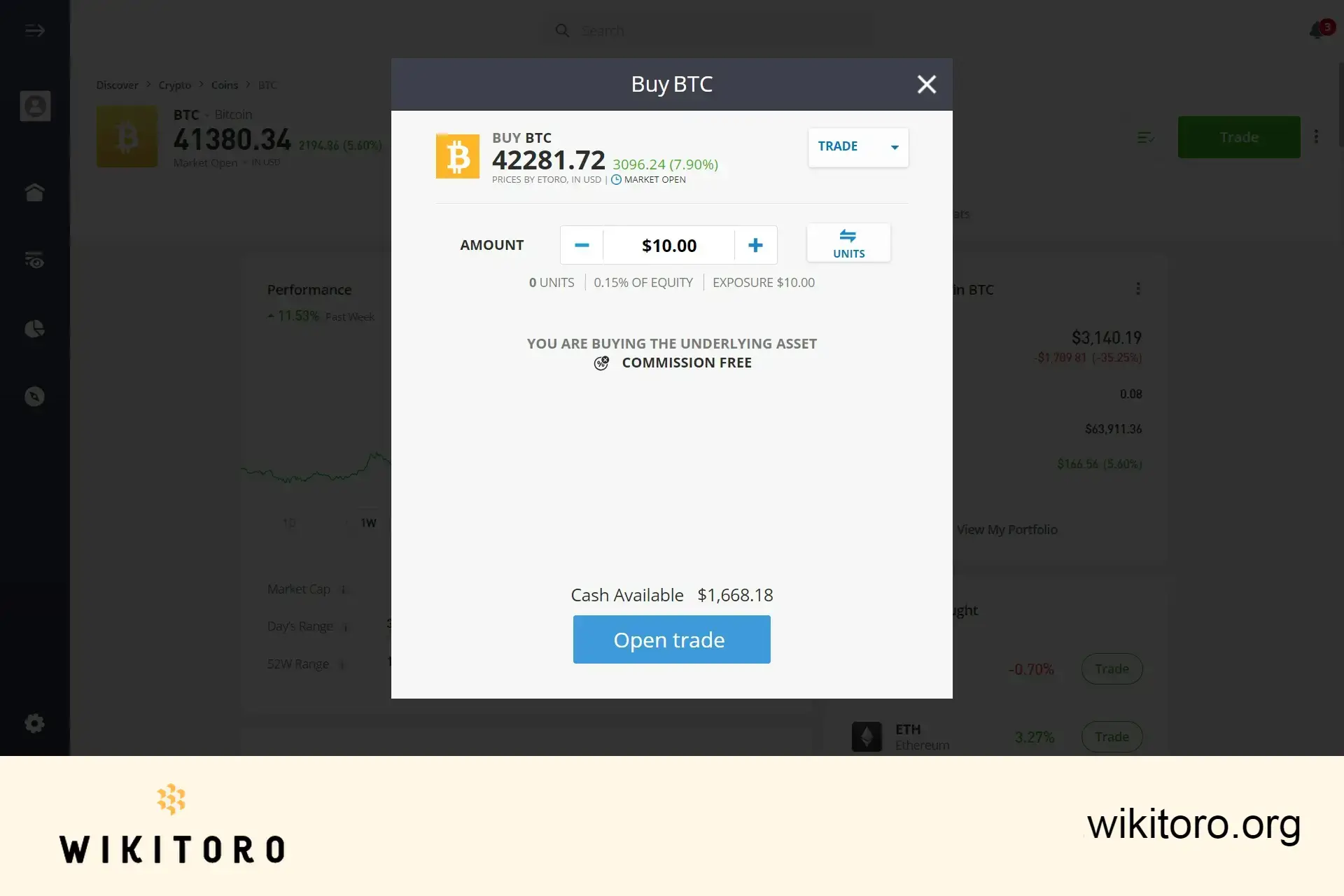

Pokud s Bitcoinem začínáte, rozumné vstupní rozpětí bývá 50 až 500 USD — dost na to, abyste získali expozici, ale zároveň nešli přes čáru. Záleží však čistě na vašem rozpočtu a toleranci k riziku. A ne, nepotřebujete koupit celý BTC. Na eToro můžete nakupovat zlomky, a to již od 10 USD.

Zde je návod, jak zjistit, co vám vyhovuje:

Bitcoin se nehýbe rovně. Vyletí, spadne, pak zase vyletí. Zeptejte se sami sebe: "Kdyby to zítra spadlo o 50 %, litoval/a bych toho?“

Pokud ano, částku zmenšete.

První bitcoinový nákup berte jako testovací jízdu.

Začněte třeba s 20, 50 nebo 100 USD — jen abyste si vyzkoušeli, jak se s kryptem pracuje, aniž byste se stresovali výkyvy.

eToro vám umožní nakoupit BTC už za 10 USD. To stačí na pochopení základů, než se pustíte do vyšších částek.

Většina investorů drží 1–5 % portfolia v kryptu. To udrží riziko v rozumných mezích, ale zároveň vám ponechá prostor pro růst.

Zkušenější investoři mohou jít až k 10 %, ale to už je rozhodnutí, ke kterému se postupně dopracujete — nezačíná se tam.

Snažíte se „trefit dno“? Raději ne. Lepší je pravidelné investování (DCA) — vkládat stejnou částku týdně či měsíčně. Vyhladí to volatilitu a odstraní stres z výběru ideálního okamžiku.

Jdete po dlouhodobém růstu, nebo chcete rychlé zisky? Bitcoin nabízí velký potenciál — ale i větší riziko, hlavně na krátkých časových horizontech.

Investice by měla zapadat do vašeho širšího plánu — spoření, důchod, finanční cíle, cokoliv budujete.

Neexistuje univerzální částka. Nejlepší je začít malou sumou — takovou, kvůli které nebudete mít probdělé noci, ale zároveň vás motivuje sledovat trh.

Za mě je nejdůležitější držet si jasné limity, chápat rizika a přidávat jen tehdy, když se na to opravdu cítíte.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman