To trade ETFs on eToro, you first need to create and log into your trading account. Then, search for the specific ETF you wish to trade using the search bar. Once you've found the ETF, click on it to open its page, where you can view details and execute trades by selecting "Trade" and entering the amount you wish to invest.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

To start trading ETFs on eToro, create an account on the eToro platform and deposit funds. Then, navigate to the ETF section or use the search bar to find the ETF you want to invest in. Finally, click on the chosen ETF to open its trading page, where you can set your investment amount and place your trade.

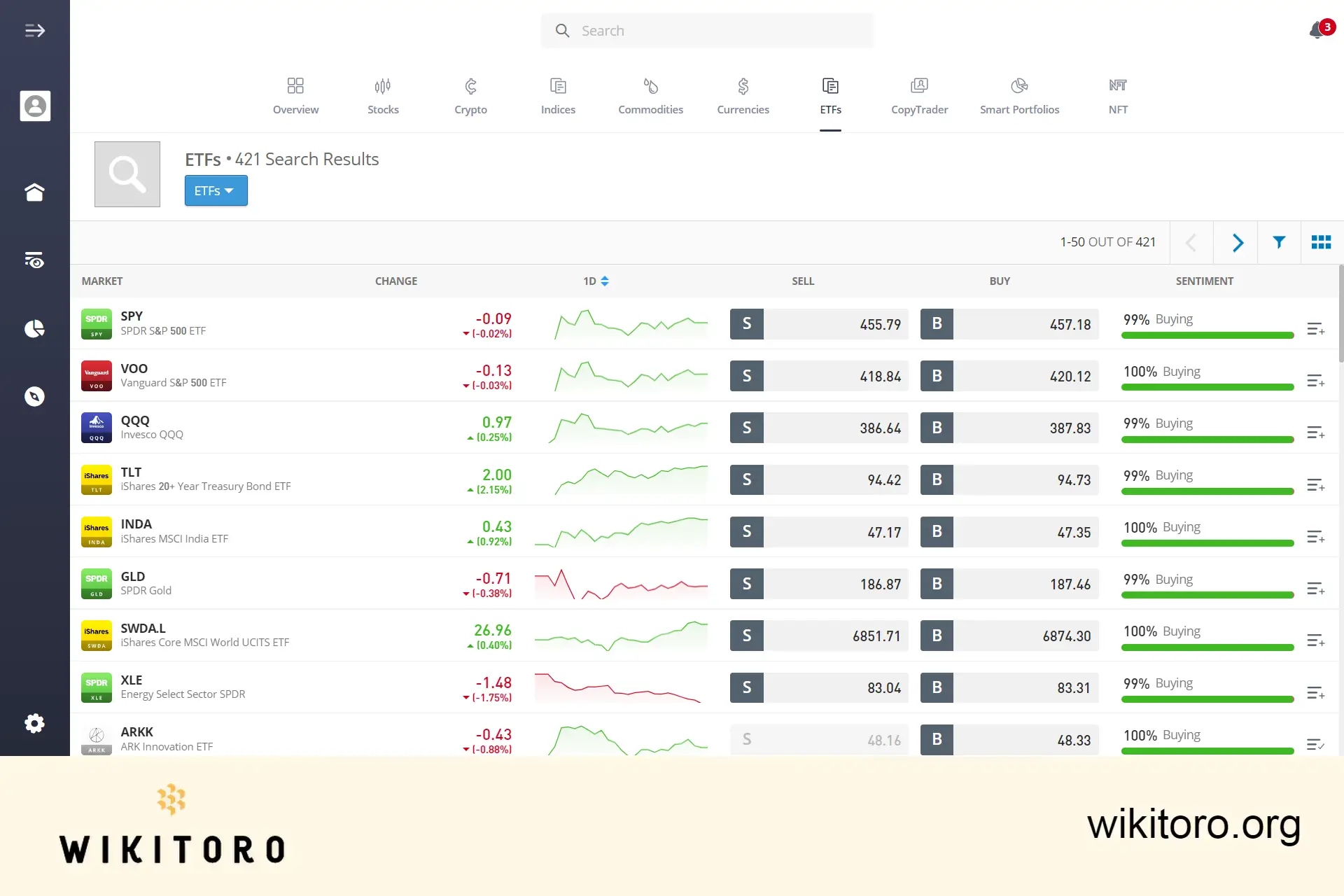

Trading ETFs (Exchange-Traded Funds) on eToro is a straightforward process, suitable for both beginners and experienced investors. ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and typically track an index. On eToro, you have the option to invest in a wide range of ETFs, allowing you to diversify your portfolio across various sectors and regions. The platform offers tools and resources to help you understand each ETF’s performance history, underlying assets, and risk profile. To start trading ETFs on eToro, you first need to set up an account. This involves providing some personal information and completing a verification process. Once your account is set up and funded, you can browse through the available ETFs on eToro. The platform offers an intuitive interface where you can use the search function to find specific ETFs or explore different categories. Each ETF on eToro has its own page displaying detailed information, including past performance, management fees, and the composition of the fund. This information is crucial for making informed investment decisions. Placing a trade on eToro is a simple process. Once you’ve selected an ETF, you’ll need to decide on the amount you wish to invest. eToro offers flexibility in investment amounts, making it accessible for various budget levels. After entering the amount, you can execute the trade instantly at the current market price. eToro also provides features like setting stop losses and taking profits, which are useful for risk management. It’s important to remember that trading ETFs involves risk, and it’s advisable to do thorough research or consult with a financial advisor if you’re new to investing.

Before trading ETFs on eToro, follow these short and direct guidelines:

Remember, all trading involves risk, and it's important to only invest what you can afford to lose.

To trade ETFs on eToro, follow these short and direct steps:

In conclusion, trading ETFs on eToro is a user-friendly and accessible way for investors to diversify their portfolios. By following simple steps such as creating and verifying an account, funding it, researching various ETFs, and executing trades, investors can leverage the flexibility and variety of ETFs offered on the platform. eToro’s intuitive interface and comprehensive tools make it easier for both beginners and experienced traders to monitor and manage their investments effectively. However, it’s important to approach ETF trading with a clear strategy and an understanding of the risks involved, ensuring that any investment decisions align with your financial goals and risk tolerance.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver