Begin trading Silver on eToro by either logging in or registering. Navigate to "Discover", select "Commodities", then "Silver". Choose "BUY" or "SELL", enter your trade amount or number of units, adjust your trade options, and press "Open Trade".

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

I've been trading on various platforms for years now, and eToro quickly became one of my favorites. When I decided to diversify into commodities, silver was one of my first picks.

Growing up, my grandmother always said, "If not gold, then silver." That wisdom, combined with my research into its historical significance and industrial demand, convinced me of silver's potential. Let me share with you my experience in trading this commodity using their app. The same method actually applies for those who prefer the web-based platform.

The initial part requires you to have a verified and funded account. When I first joined this platform, the signup process was smooth. My advice? Use a strong password and enable two-factor authentication – it gave me peace of mind.

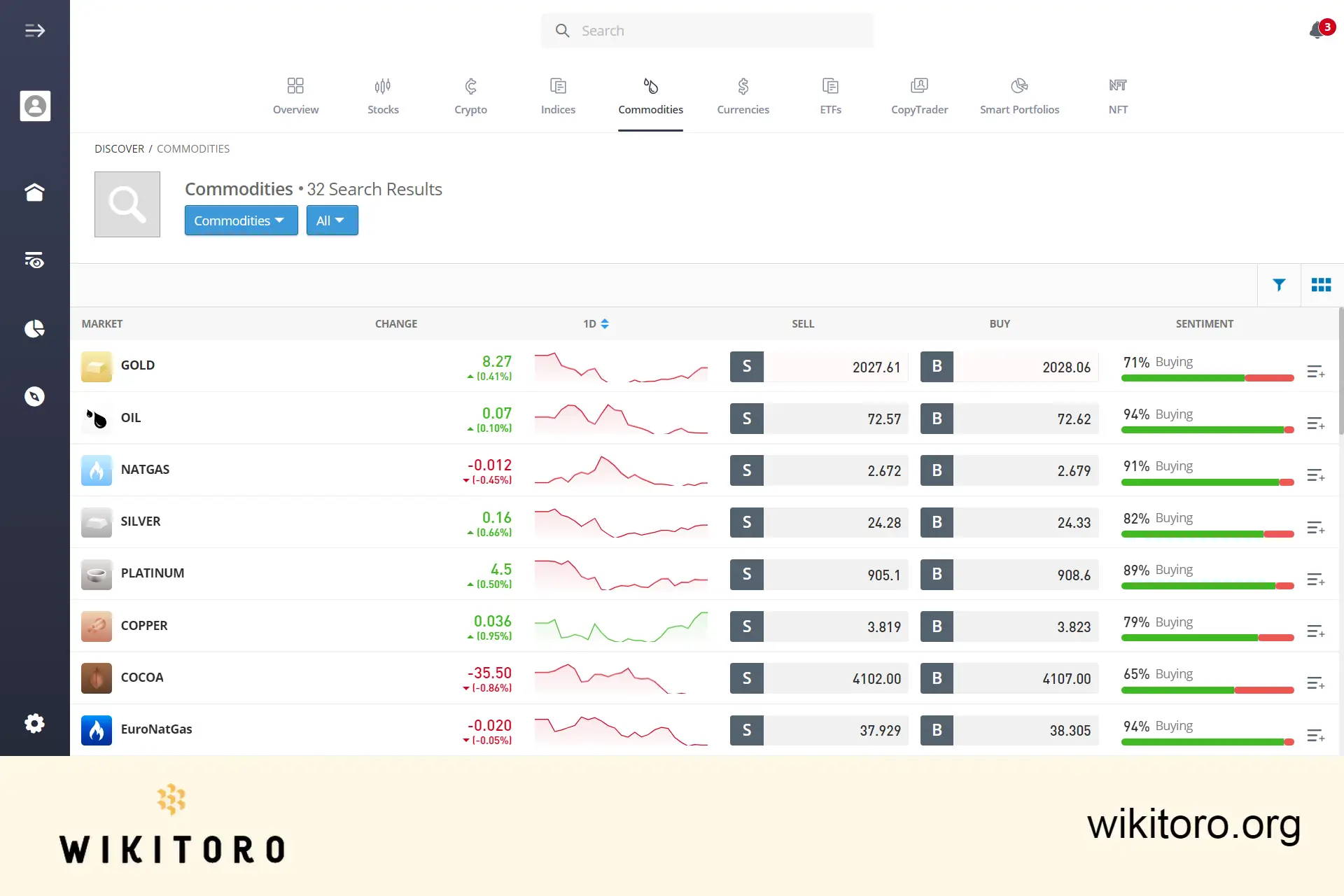

The first time I searched for silver, I was amazed at the options available. From ETFs to silver mining stocks, this broker's diverse offerings were impressive. Remember, each type of investment comes with its nuances, so take time to understand them. In this scenario, let's choose 'Silver'.

I vividly remember making my first silver purchase on the platform. The 'Buy' button was tempting, but I also familiarized myself with the 'Sell' option, anticipating future market shifts.

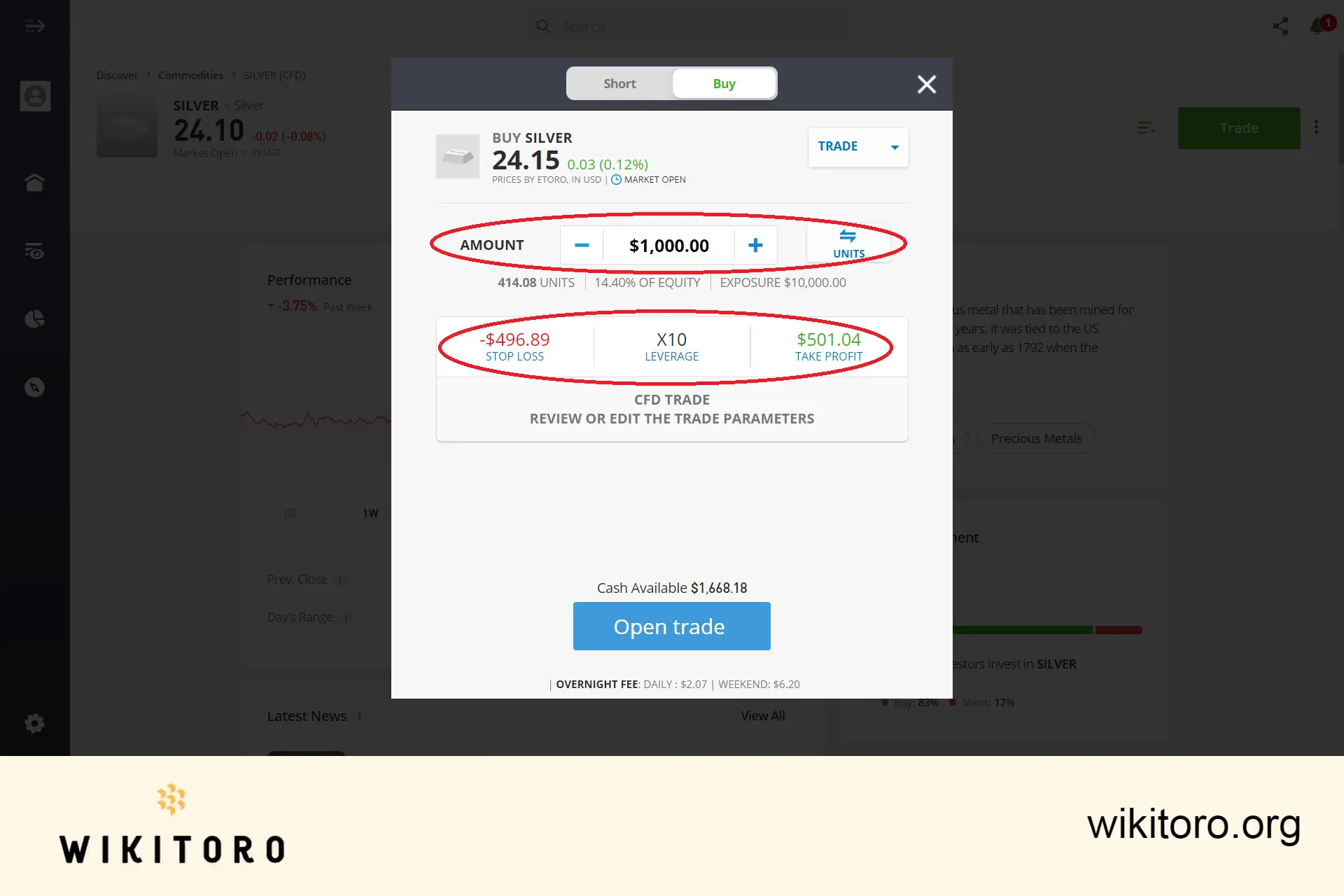

The minimum investment for commodities, including silver is $1,000. You can use leverage to increase your market exposure but this can be tricky. I learned the hard way when I over-leveraged a different asset early in my trading career. If you're new, start with low leverage and remember that while potential profits increase, so do potential losses. It might also be wise to set the Stop Loss and Take Profit as these are very useful risk management features.

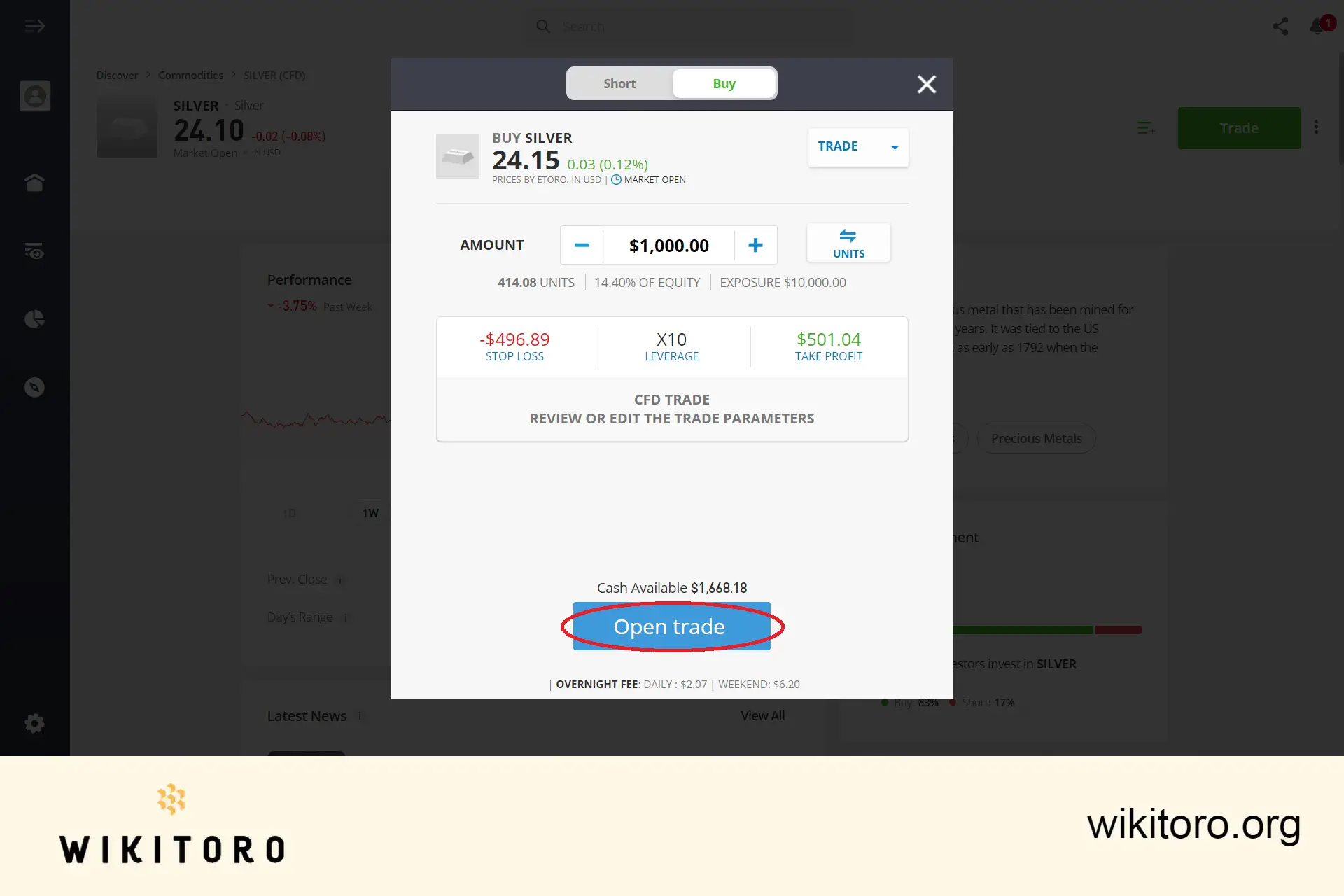

Once all these trading parameters are set, the last step to take is pressing the "Open Trade" button to begin executing your eToro Silver trade order. Once that is done, monitor your position, watch as the market moves, and you'll know later on if you make a profit or a loss.

My journey with investing in silver on eToro has been interesting, exciting, and at times, nerve-wracking. But it's a decision I'll never regret. If you decide to embark on a similar journey, arm yourself with knowledge, stay updated, and trust in the process.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman