Forex trading offers an accessible investment path, especially for those with limited capital. It involves trading currency pairs, where you buy one currency while simultaneously selling another, akin to exchanging your home currency for a foreign one at the airport. This process is essentially a transformation of money into different currencies.

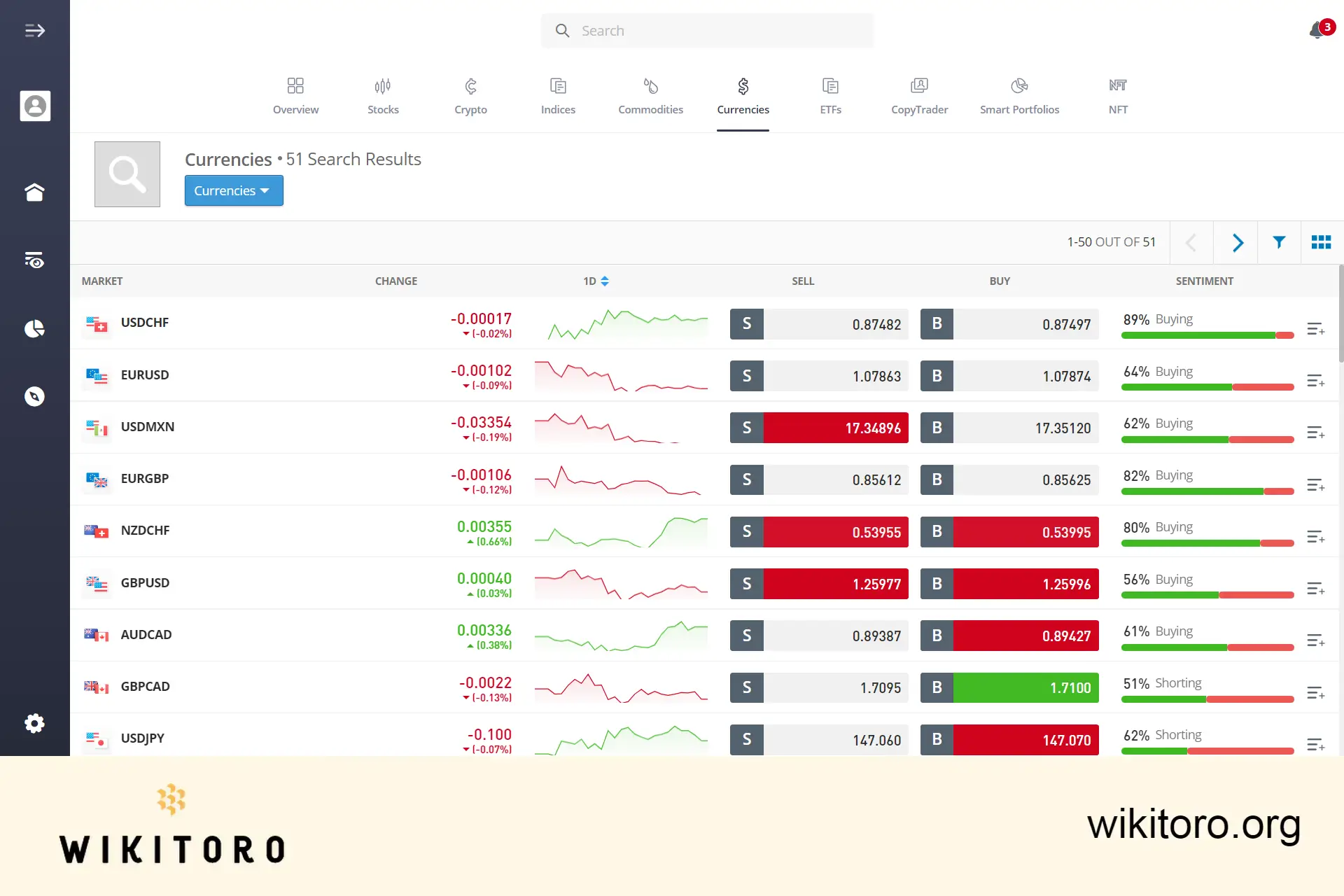

eToro provides a platform for engaging in the world of currency trading. It allows you to place a Buy or Sell order on various currency pairs and follow the strategies of professional traders, all within a single interface.

Before embarking on your currency trading journey, there are a few key concepts to grasp. Firstly, understand that Forex trading can be approached either as an investment or for speculation. Secondly, familiarize yourself with the concept of a currency pair, which comprises a base currency and a counter currency. In this guide, I will delve deeper into forex trading and how to invest in FX pairs using eToro, drawing from my personal experiences and practices on the platform.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| 💱 Currency Pairs | 50+ |

| 📈 Spread | From 1 pip |

| 🕟 Market Hours | 24/7 |

| 📊 Leverage | Up to x30 for major currency pairs |

| 💰 Minimum Trade | $1,000 |

When you engage in forex trading on eToro, you're not dealing with physical currencies. Instead, you're trading in forex derivatives, specifically Contracts for Difference (CFDs). Traditional forex trading involves exchanging one currency for another to capitalize on fluctuating market prices, often used for speculation or hedging rather than long-term investment.

In contrast, a CFD is a financial instrument that lets you speculate on the price movements of an underlying asset, like a currency pair, without owning it. Engaging in a forex trade on eToro means entering a CFD contract. Your profit or loss is determined by the difference between the CFD's opening and closing prices.

CFD trading offers the advantage of benefiting from asset price movements without the complexities and costs associated with handling physical currencies. However, it's crucial to remember that CFD trading carries risks, including the potential loss of your entire investment. Utilizing risk management tools, such as stop-loss orders, is vital to mitigate these risks.

During my exploration of forex trading on eToro, I uncovered several noteworthy aspects:

Want higher leverage? If you would like to use a higher leverage (x50, x100, x200 or x400) then your account needs to be categorized as a Professional. This specific account type has certain conditions, experience and trading knowledge that you need to meet in order to qualify. You can click on the x50 to x400 leverage to trigger the Enable High Leverage Trading pop-up notification and proceed with the Professional Client application.

eToro's platform provides real-time data and news updates, along with live price charts, making it an invaluable resource for both beginners and experienced traders. These tools are crucial for analyzing historical and current price movements.

💱 Forex rate accuracy

My extensive testing of eToro's live Forex rates and charts has shown them to be remarkably accurate and up-to-date. Timeliness in rate and chart updates is critical in forex trading, as even minor delays can result in significant financial losses.

This broker offers a diverse selection of approximately 50 currency pairs, encompassing majors, minors, and exotics.

The platform provides all seven major currency pairs for trading, which include:

You have a choice of over 20 minor pairs or crosses, offering a range of trading opportunities:

| AUDCAD | EURILS |

| AUDCHF | EURJPY |

| AUDJPY | EURNZD |

| AUDNZD | GBPAUD |

| CADCHF | GBPCAD |

| CADJPY | GBPCHF |

| CHFHUF | GBPILS |

| CHFJPY | GBPJPY |

| EURAUD | GBPNZD |

| EURCAD | NZDCAD |

| EURCHF | NZDCHF |

| EURGBP | NZDJPY |

For those interested in more unique trading options, the platform also offers around 20 exotic pairs:

| EURHUF | USDILS |

| EURNOK | USDMXN |

| EURPLN | USDNOK |

| EURSEK | USDPLN |

| GBPHUF | USDRUB |

| NOKSEK | USDSEK |

| USDCNH | USDSGD |

| USDCZK | USDTRY |

| USDHKD | USDZAR |

| USDHUF | ZARJPY |

Trading forex on eToro can be accomplished through a series of straightforward steps. However, before you begin, ensure that your account is verified and adequately funded for trading this asset class.

Be aware that your forex position will remain active until one of the following occurs:

Forex trading on eToro is accompanied by competitive transaction costs, primarily in the form of spreads. A spread is the difference between the buy and sell prices of a currency pair. It represents the broker's fee for each trade and is calculated by subtracting the sell price from the buy price.

Spreads serve as the profit margin for the broker and vary based on the volatility of the currency pair. On eToro, these spreads can range from as low as 1 pip to as high as 50 pips, depending on the specific currency pair you are trading. This structure makes eToro an attractive option for those looking to trade currencies with lower transaction costs.

📟 New to forex? Explore with a demo account!

For forex newbies, eToro offers a practical way to learn through its demo account. Upon signing up, you'll receive access to a demo account equipped with virtual funds. This allows you to practice forex trading, along with other financial instruments available on the platform, in a risk-free environment.

The forex market presents excellent opportunities for traders of varying experience and capital levels, with eToro offering particularly favorable conditions due to its low transaction costs and competitive spreads (the gap between buying and selling prices). With the potential for substantial yields, success in forex trading hinges on making informed decisions and effectively utilizing available tools. I hope this guide has enriched your understanding and that my shared experiences have provided valuable insights into trading forex on this platform.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which hasbeen prepared by our partner utilizing publicly available non-entity specific information about eToro.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.