If you're here, it's likely because you're seeking a trading platform that aligns with your religious beliefs and checking out what eToro has in store for you. As an registered trader who has personally navigated the features of an Islamic account, I've crafted this guide to share my experiences and insights. My aim is to present this information in a straightforward and user-friendly manner, helping you understand how eToro caters to Islamic trading principles.

An Islamic trading account on eToro is distinctively different from standard trading accounts. In adherence to Sharia law, which strictly prohibits the accumulation of interest, or "Riba," this account type ensures that no interest is paid or received in any form. It's essential for the Islamic account to be in complete alignment with the fundamental principles of Islamic law, offering a unique trading experience that respects these religious guidelines.

| ☪️ Islamic Account | Available |

| 💰 Minimum Deposit | $1000 |

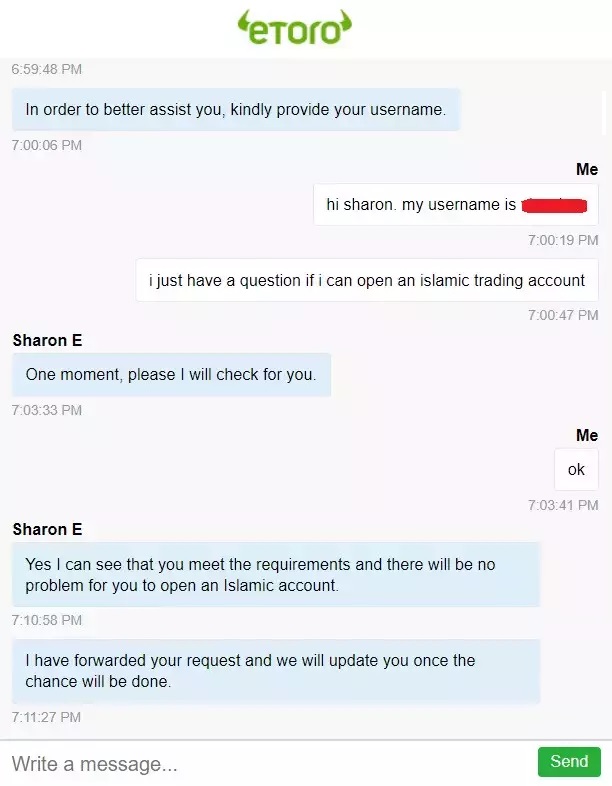

| 🔛 Activation | By contacting customer support |

| 📝 Document Required | Proof of religion |

The creation of a separate Islamic Account for Muslim traders on eToro is necessitated by the specific financial activities that are prohibited and restricted under Sharia Law. These include:

Under this type of eToro account, you are relieved from paying fees on any trades that are left open overnight. Administrative fees apply.

Here's the deal:

Any open trades in the currency market are automatically rolled over if they are not closed by 5:00 pm (New York time) and under a regular trading account, these open trades are bound to be charged with usurious interest which is against the Islamic law and is called "Haram".

But if you are using an Islamic account, there are no rollover or weekend charges if your position has not been closed for over 24 hours. In fact, you can even hold your positions as long as you want and it will not incur any fees.

Here's the thing: Money that is transferred to or from a bank account (something that is similarly done with currency trading) is considered by religious law specialists as delivery or an exchange between hands.

The good news is that "fatwas" or formal rulings have been created with regards to currency trading and among the decrees issued according to the Sharia law is that transactions need to be settled immediately and the costs must also paid during this process. Such ruling of immediate buying and selling of currencies is strictly followed by eToro as trades are executed in real time without any delays.

This is the most common query among Muslim traders: Is etoro halal? The answer lies in eToro's provision of an Islamic account, which is designed to be fully compliant with Sharia law. This makes eToro a halal trading broker, as it offers a specialized account that aligns with the religious principles and financial rules of Islam.

Is eToro Sharia compliant or not? This is another common question of Muslim traders. By offering an Islamic account that strictly follows Islamic finance principles, eToro demonstrates its commitment to Sharia compliance. This ensures that Muslim traders can engage in trading activities without compromising their religious beliefs.

For those curious about what are the benefits of using an eToro Islamic account, here are some key features:

These features are tailored to meet the needs of Muslim traders while ensuring compliance with Islamic financial principles.

eToro UAE residents are welcome to open accounts. Currently, there are no restrictions for users based in these countries.

While eToro doesn't maintain physical offices in Saudi Arabia and isn't regulated by Saudi's Capital Market Authority (CMA), it has made significant strides in the UAE. eToro has obtained an approval in principle from Abu Dhabi Global Market (ADGM) to operate as a cryptocurrency broker in the UAE's capital. This development paves the way for eToro's expansion into the Middle East.

eToro caters to users from a range of Muslim-majority countries. Here's a list of the most populous Muslim countries where eToro's services are available:

However, there are certain countries and territories with significant Muslim populations where eToro's services are currently unavailable due to regulatory changes. These include:

| Afghanistan | Iraq | Sudan |

| Burkina Faso | Libya | Syria |

| Cameroon | Mali | Tajikistan |

| Chad | Niger | Tanzania |

| China | Nigeria | Tunisia |

| Congo (DR) | Pakistan | Turkey |

| Ethiopia | Russia | Turkmenistan |

| Guinea | Sierra Leone | Uzbekistan |

| Iran | Somalia | Yemen |

A common question is how eToro generates income from its Islamic trading accounts, especially since Sharia law prohibits interest rates. The answer is straightforward: eToro's revenue comes primarily from spreads. These are based on the difference between the buy and sell prices of currency pairs. Importantly, Islamic account holders are not charged any fees for account management.

So now you know that this broker offers an account that is specialized for Muslim traders. Good. But what financial instruments are available for Islamic trading on eToro? From my experience, Islamic account users have access to a wide range of instruments, including stocks, commodities, and currencies.

For example:

The bottom line is that most assets are accessible through an Islamic account, and it's up to you to determine whether an investment aligns with Shariah law. For precise guidance, consulting Islamic scholars or experts in Islamic finance is advisable.

To access eToro's Islamic account, exclusive to Muslim clients, proof of religion is necessary. This can be obtained from a recognized religious organization in your area. This step ensures that the account aligns with the specific needs and principles of the Muslim faith.

So how do I open an eToro Islamic account and what are the steps involved? Here's how you do it:

That sums up everything you need to know about eToro's Islamic account. With its features and compliance with Islamic principles, this account offers a peace of mind for Muslim traders. Regularly checking eToro's resources for updates ensures you stay informed about the latest opportunities to trade in alignment with your faith.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which hasbeen prepared by our partner utilizing publicly available non-entity specific information about eToro.

![]() Related Articles

Related Articles

We've compiled a list of related articles

Wondering if eToro is a halal broker? Delve into eToro's alignment with Islamic financial standards and gain clarity for your trading choices.

Check out this in-depth analysis on whether eToro is Sharia-compliant. Dive into their Islamic account features and how they align with key Islamic finance principles.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.