eToro's online investment platform includes a crucial trading tool known as the Take Profit feature or TP for short. This tool is especially beneficial for traders as it enables automatic closure of a position once a predetermined profit level is reached.

If you're unfamiliar with this trading command and eager to learn more, this guide will provide a comprehensive overview of how to utilize the TP order on eToro, along with additional personal insights I've shared that could be beneficial for your trading strategy.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| ⚙️ How to Set | By rate, By amount |

| 📈 Maximum Rate | 1,000% of invested amount |

| 🛠️ Adjustable on Open Trades | ✔️ |

The Take Profit (TP) order on eToro is designed to automatically close a trade at a specified price level, allowing you to secure profits for a particular position.

Consider this scenario:

Imagine you've invested in gold at a price of $55. You set a Take Profit order on eToro to close your position if the price reaches $60 or higher. If the price of gold climbs to $60.01 the following day, eToro's platform will automatically close your position, and the profits will be credited to your account.

It's important to note that while the Take Profit order is set to close the trade at your specified price level, execution depends on market liquidity. This feature is particularly useful as it eliminates the need for constant market monitoring and manual position closure at your desired price. However, be aware that in volatile market conditions, Take Profit orders may not execute at the exact specified price level.

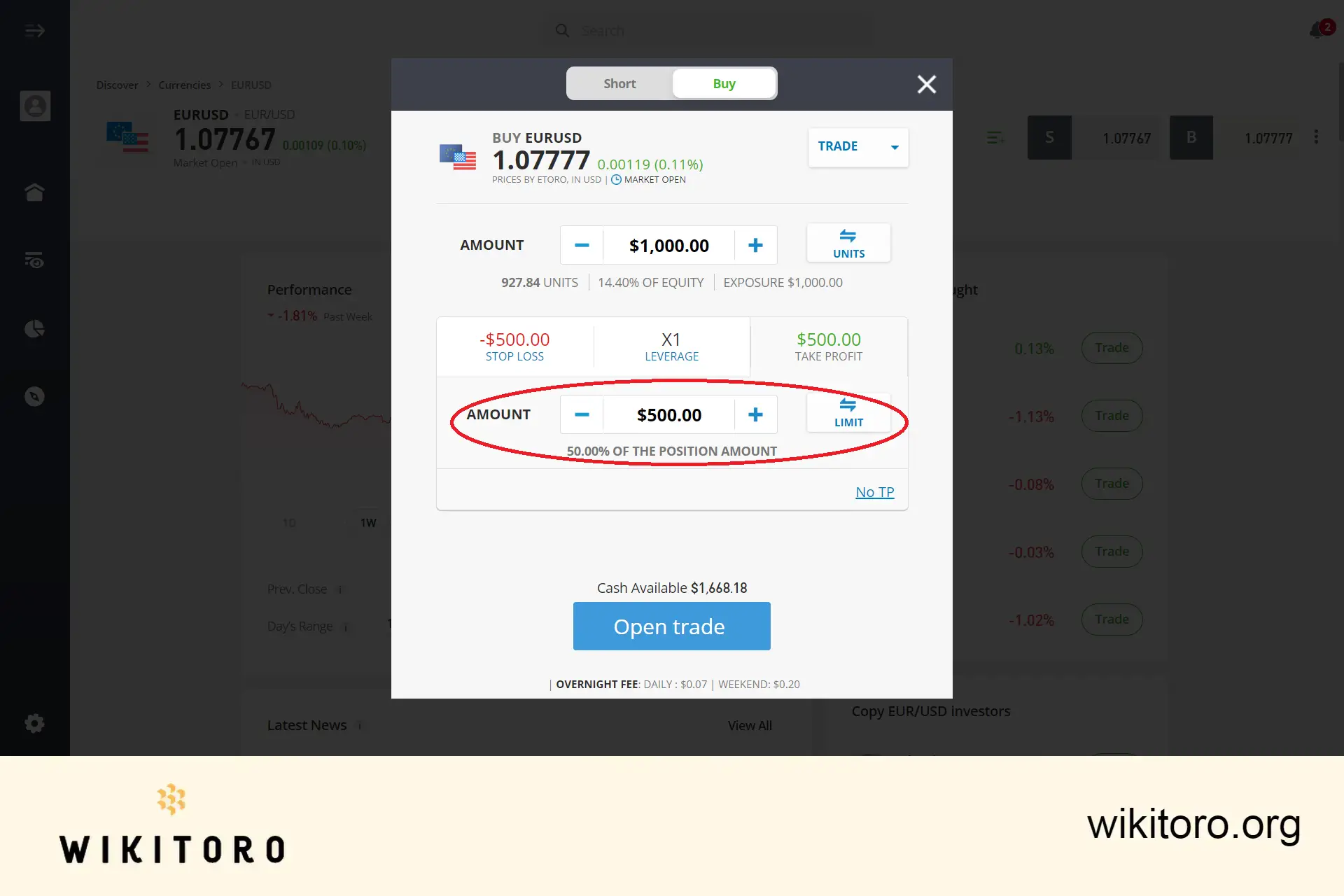

For someone who is new to this feature, I wondered how do I set a take profit order on eToro? To effectively use the TP feature on the platform, it's essential to understand how to set and adjust these levels. Here's a step-by-step guide:

Remember: While setting a TP level is a proactive step, it doesn't guarantee profit due to potential rapid market changes. Regularly monitor and adjust your TP level or manually close the position if needed.

So can you modify the TP level on after already opening a position? The good news is that yes, it's entirely possible to adjust this and here's how you can do it:

Can I set a take profit order on eToro pending trades? I actually though about this, whether it's feasible to apply a TP order to a trade that has not been executed yet. Based on my practical experimentation with the platform, it appears that doing this isn't directly possible, but here's a workaround:

When using this risk management tool on the platform, it's crucial to know what happens if the market price never reaches your set Take Profit (TP) level:

While the platform doesn't impose specific fees for using the TP feature, be mindful of the general fee structure:

Understanding these fees is vital for effective trading. They play a significant role in the overall cost of your trading activities, especially when utilizing features like Take Profit or even Stop Loss.

Take Profit and Stop Loss are essential risk management tools that are available on the platform and each serve a distinct purpose. Stop Loss and Take Profit are not guaranteed and trading with leverage involves high risk.

Below are the notable differences of the TP and SL orders:

| Feature | Take Profit (TP) | Stop Loss (SL) |

| Purpose | To lock in profits by automatically closing a trade when it reaches a specified profit level. | To limit potential losses by automatically closing a trade when it reaches a specified loss level. |

| Function | Closes a position at a predefined price level to secure profits. | Closes a position at a predefined price level to prevent further losses. |

| Use Case | Used when you anticipate that the asset price will reach a certain level and want to ensure profits are realized. | Used to manage risk by setting a maximum loss that you are willing to accept. |

| Setting | Set as a specific price or a percentage above the purchase price. | Set as a specific price or a percentage below the purchase price. |

| Adjustability | Can be adjusted after the position is opened, allowing you to modify your profit targets. | Can be adjusted after the position is opened, allowing you to modify your risk tolerance. |

| Impact on Trading | Helps in securing profits without the need to constantly monitor the market. | Protects your capital by limiting losses in adverse market movements. |

| Market Conditions | Effective in trending markets where reaching a profit target is likely. | Crucial in volatile markets to prevent significant losses. |

| Execution | Executed when the market price reaches the TP level. Execution at the exact level is not guaranteed in volatile markets. | Executed when the market price reaches the SL level. Execution at the exact level is not guaranteed in volatile markets. |

| Fees | No specific fees for using TP, but spreads and overnight fees may apply. | No specific fees for using SL, but spreads and overnight fees may apply. |

| Limitations | Does not guarantee profits as market conditions can change. | Does not prevent all losses, especially in fast-moving or gapping markets. |

It's crucial for traders to understand that while these tools are highly beneficial, they are not foolproof. Market conditions can affect their execution, and traders should regularly review and adjust their strategies as needed.

Yes, eToro's TP feature can be strategically used to secure partial profits. By setting the TP order at a specific price level, you can arrange for only a part of your position to be sold when that price is reached. This approach allows you to realize some gains while keeping the rest of your position active, potentially benefiting from further market movements.

To confirm whether your TP order has been executed, you should:

And that's how it's done! Based on how I've explored the TP order, I could conclude that it is indeed an invaluable tool for automatically closing a position when a certain profit level is achieved.

However, I strongly recommend to exercise diligence and regularly monitor your investments, especially open positions, to effectively utilize this feature. Remember, while TP can help in securing profits, staying informed and adaptive to market changes is key to successful trading.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which hasbeen prepared by our partner utilizing publicly available non-entity specific information about eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.