As an avid trader, I was intrigued by eToro's platform and its demo account feature so I decided to dive in, curious to see how it could bolster my trading skills. This account, I found, is a goldmine for both rookies and seasoned traders, offering a hands-on experience in a risk-free environment that perfectly mimics real-market conditions.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Here are some simple yet important points from my experience with the eToro demo account:

An eToro demo account is a simulated online trading account that will allow you to apply and practice your trading strategies and techniques without any risk of losing real money. This is a great tool particularly if you are a new user who wants to get a feel for the platform and test out your trading skills before trading with real money.

So how do I open a demo account on eToro and what are the steps involved? This can be done via the regular registration process so you are basically signing up for an eToro account.

That means you need to open your web browser and go to www.etoro.com. Then you just need to click on "Join Now", complete the registration procees, and voilà, you're done. At this point, the demo account will also be activated.

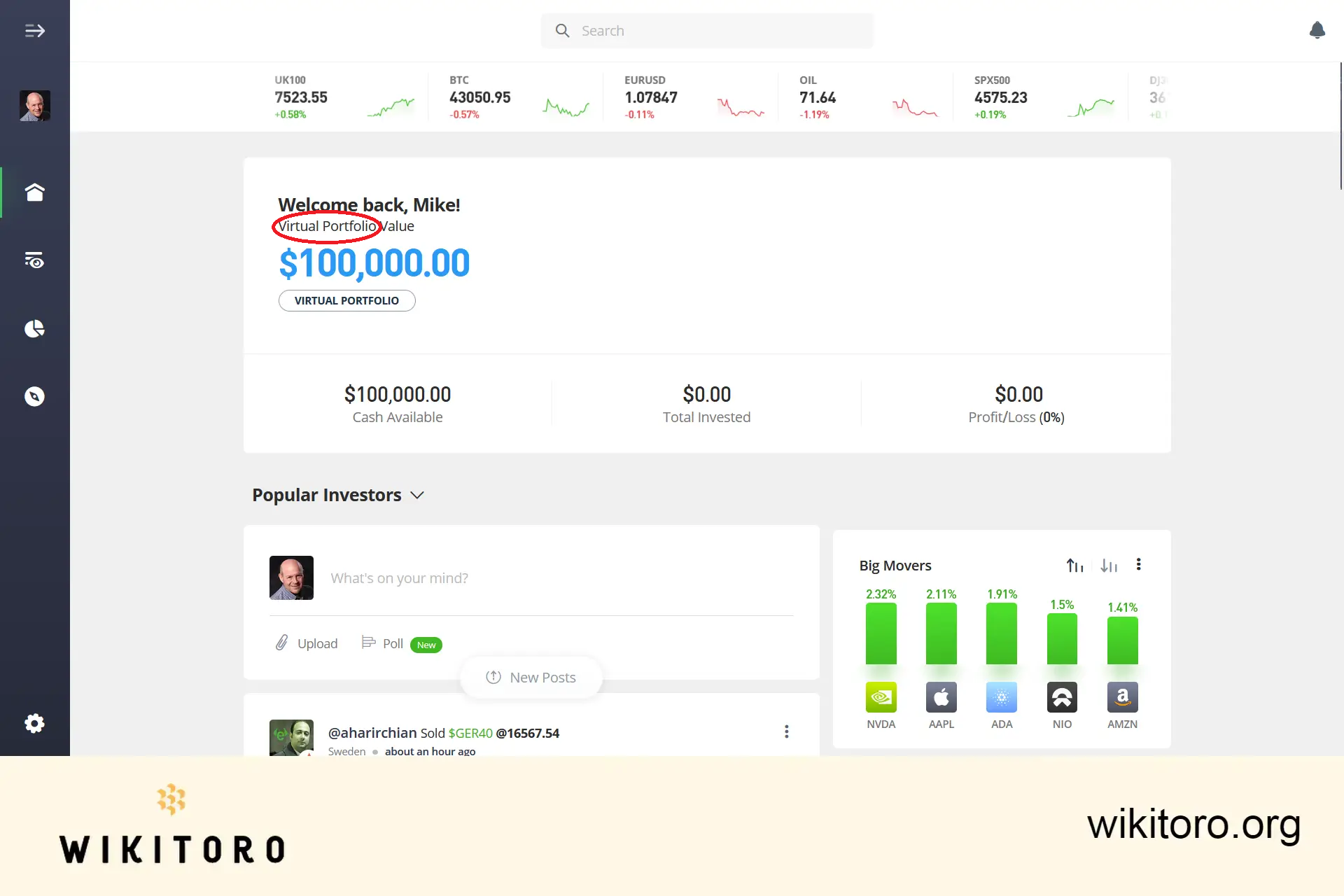

Wondering if real money is involved in a demo trading account? The answer is a clear NO. This is a virtual portfolio, equipped with a separate virtual currency, and it arrives pre-loaded with a generous $100,000 in virtual credit.

💰 How does this work for you?You can utilize these virtual funds to explore the platform or engage in practice trading, all without the risk of losing actual money or capital. Additionally, if you wish to simulate a more modest trading environment, you have the option to reduce the virtual balance to as low as $2,000.

One of the key questions I had before starting was, 'Is there a time limit on eToro's demo account, or is it unlimited?' The good news is that it doesn't expire.

Given its indefinite availability, you have the flexibility to use it for an extended period. Nonetheless, it's advisable to treat the demo account primarily as a means for learning and honing your trading skills, rather than as a perpetual trading platform.

💸 It's also important to be aware: The $100,000 virtual fund in your demo account are finite. Consequently, should these funds deplete, you'll need to replenish them to maintain your practice trading activities.

One common inquiry among beginners is what are the limitations of an eToro demo account when it comes to experiencing actual market volatility.

Although this virtual portfolio offers a comprehensive preview of the live platform and gives you acces to real market prices, it is important to note that it has certain limitations. These include the absence of real-world financial consequences and constraints on specific features and updates.

You might be wondering what is the difference between the eToro demo and real account. Here are some key points:

You're probably wondering, how do I use the eToro demo account to get started without risking real money?

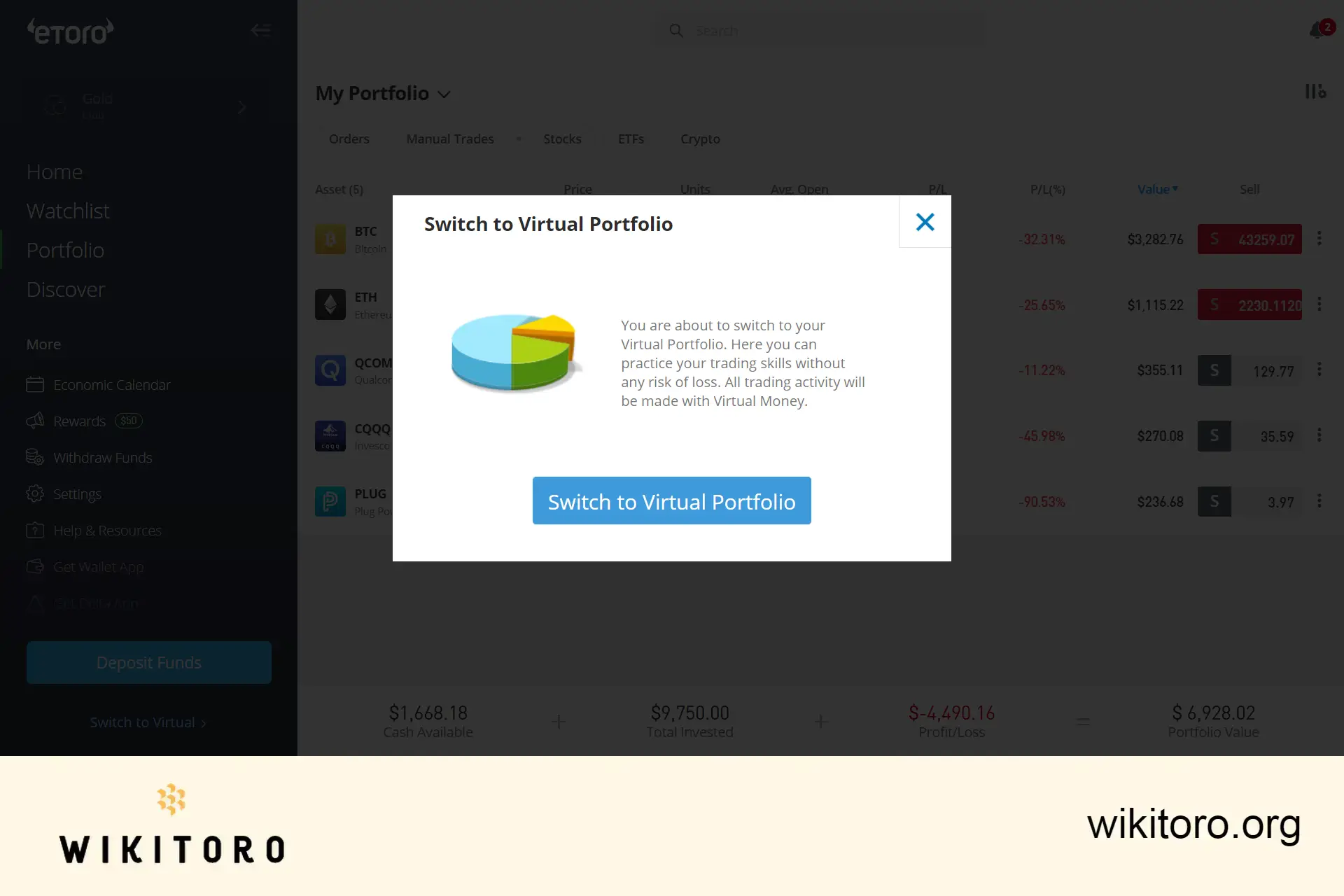

To begin, you first need to create an account with eToro, as access to the practice account is tied to your registration on the platform. Once you've registered and can access the platform or app, simply select the "Virtual Portfolio" option. This will take you directly to the demo environment.

At this stage, you'll have the opportunity to engage in practice trading using the provided virtual funds, allowing you to experiment and learn without any financial risk. This is an excellent way to familiarize yourself with the trading world in a safe and controlled setting.

Once you successfully register with eToro, you automatically receive access to a demo account. That means there's no need for you to request activation of this feature, as it becomes available automatically when your real account is opened.

I find accessing this broker's demo account to be very straightforward, as it uses the same login credentials as the real account. You can access it via the following:

This virtual account is set to use US Dollars by default. However, they offer the flexibility to choose from other supported currencies. Since I am more accustomed to Pound Sterling, I opted to use this currency while operating in the demo mode on the platform.

| Europe | Asia-Pacific | Americas | Middle East & Africa |

| Euro | NZ Dollar | US Dollar | South African Rand |

| Pound Sterling | Japanese Yen | Canadian Dollar | |

| Swiss Franc | Australian Dollar | Mexican Peso | |

| Norwegian Krone | Hong Kong Dollar | ||

| Swedish Krona | Russian Ruble | ||

| Turkish Lira | Chinese Yuan | ||

| Hungarian Forint | Singapore Dollar | ||

| Polish Zloty | |||

| Czech Koruna |

💱 Important Consideration for Currency Selection:

Please be aware that if you select a currency other than US Dollars for your eToro demo account, the $100,000 virtual fund will be converted into your chosen currency. The value of this virtual fund is subject to fluctuation, as it adjusts in real-time according to the prevailing exchange rates. For instance, when I chose Pound Sterling, the $100,000 demo fund was converted to approximately £81,382.90, based on the exchange rate at the time of writing this article.

What if your virtual equity drops to $0? In such a case, you'll need to reach out to thecustomer support team to request a top-up of your virtual funds. This can be done by submitting a ticket through eToro's Customer Service Center page, specifying the amount you wish to add to your virtual portfolio. You can request up to an additional $100,000 in virtual money for your demo account. While top-ups are generally permitted, they are subject to approval.

If you prefer to work with a smaller amount, you can also request to decrease the funds in your virtual account. This is done by sending a ticket to the customer support team, indicating the specific amount of virtual funds you wish to retain. Remember, the minimum amount you can reduce your demo funds to is $2,000.

As for resetting your demo account, including trading history and stats, it's important to note that this is not an option. The broker does not allow for the virtual portfolio to be restarted as it is directly linked to your real portfolio.

Here's a tip: If you're looking for a fresh start with no trading history and stats, and the initial $100,000 virtual equity, the only alternative is to open a new eToro account with a different username and email address. This will create a new virtual portfolio.

If you're curious about whether eToro offers a basic demo or sample interface for non-registered users, the answer to that is there's none. After exploring eToro's website and app, I was able to conclude that the standard demo account, also known as the "virtual portfolio," is the sole demo feature available. And in order to utilize this, registration with eToro is necessary, and you must be logged into the platform to access the feature.

Copying a trade while using the demo account follows similar steps to the live account, with just a few minor differences. Here's how you can copy trade in practice mode:

In my quest to discover if there's a specialized method for UK-based eToro traders to access the demo account, I learned that the process is uniform for all eToro clients, regardless of their country. UK traders, like their counterparts from other nations, can easily log in to their virtual portfolio using the web platform or mobile apps.

Now what about traders from other countries? The same principle applies. eToro traders from various countries, including Australia, Austria, Bahrain, Denmark, Finland, France, Germany, Saudi Arabia, Spain, Switzerland, the United Arab Emirates, and others supported by eToro, all follow the same procedure to access their demo accounts. There are no country-specific instructions, ensuring a consistent experience for all users worldwide.

As we reach the end of this guide, I hope the information provided has been both insightful and practical for your journey with eToro's demo account. Whether your aim is to sharpen your trading skills or to simply get a feel of the platform in virtual mode, this guide is designed to assist you in making the most of this valuable feature. So be sure to utilize this account to its fullest potential, and may it serve as a stepping stone towards your trading proficiency.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which hasbeen prepared by our partner utilizing publicly available non-entity specific information about eToro.

![]() Related Articles

Related Articles

We've compiled a list of related articles

Unveil the secrets of eToro demo account's longevity. From personal trials to expert advice, learn how long you can benefit from risk-free trading.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.