Dividends play a pivotal role in the world of trading and investing, touching upon various facets such as investment opportunities, payment mechanisms, and optimal trading strategies. In this guide, I aim to offer an in-depth exploration of dividends, tailored to eToro traders who seek a comprehensive understanding. The insights and information presented are drawn from my personal experiences and extensive research.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| 📊 Eligible Assets | Stocks, Indices, ETFs (specific assets only) |

| 🧾 Applicable Tax | 0% - 30% depending on country |

| 💵 Payment Date |

On the ex-dividend date for CFDs On the payment date for real assets |

A dividend is a payment made by a company, like eToro, to its shareholders from its profits or reserves. The amount each shareholder receives is proportional to their shareholding. For instance, if you own 100 shares in Tesla and it declares a dividend of $0.50 per share, you'll receive a $50 dividend.

But you're probably wondering, does eToro pay dividends? Yes, they do but not for all of the available financial instruments on the platform.

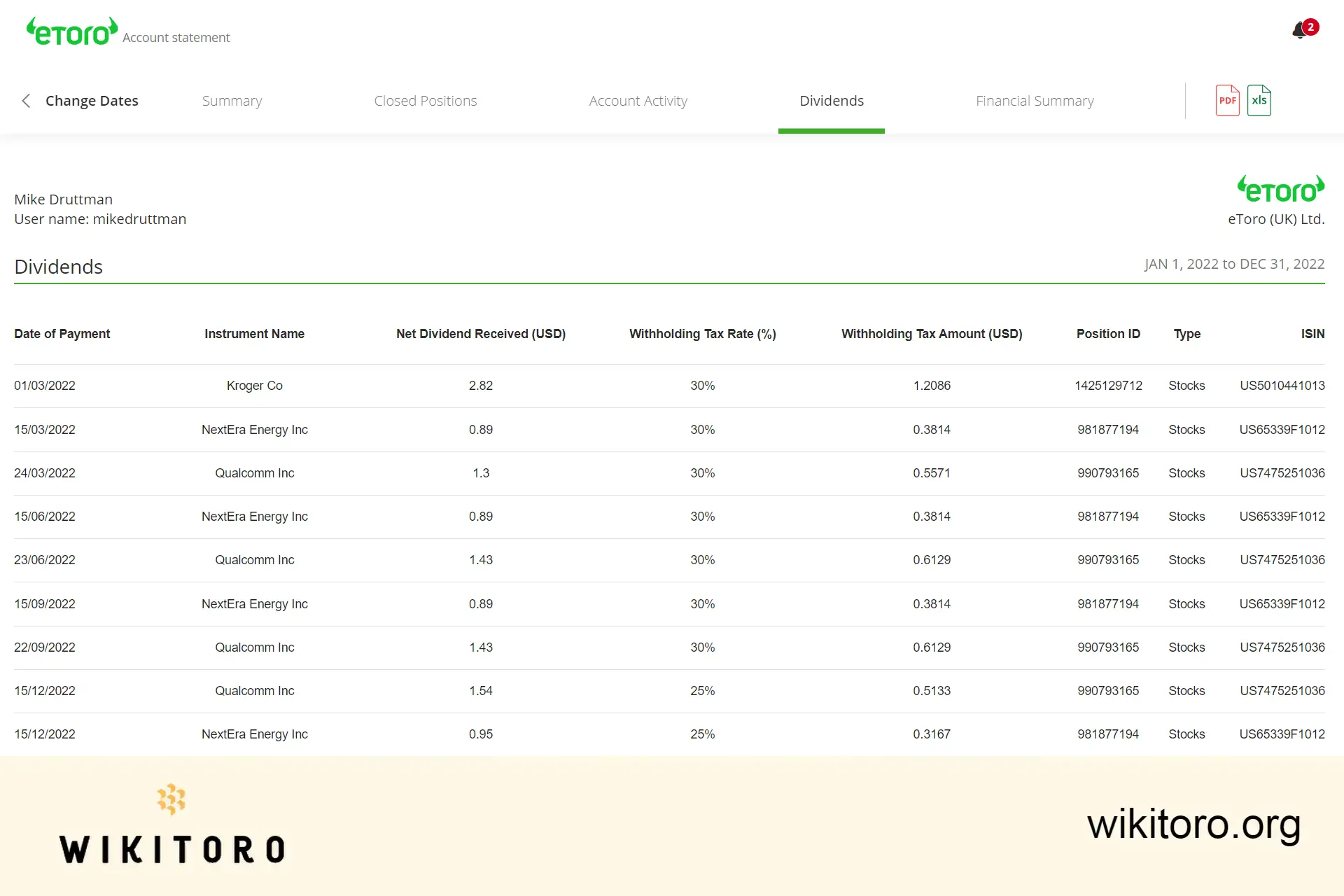

You might ask, where can I see my dividend payments on eToro? This history is accessible via your account statement which has all the information about your eToro funds. This section details all dividends received within your selected period, showing each as a net amount in USD, including withholding tax details and rates.

Curious about which trades on the platform qualify for dividend payments? Here's what you need to know to ensure your positions are eligible for dividends:

The timing of your dividend payment is contingent on the type of asset you hold:

Note: Dividend payments are subject to change due to factors beyond our control, such as adjustments in tax withholding rates or payout amounts. I recommend that you stay updated with upcoming dividend dates by using the Dividend Calendar on the platform.

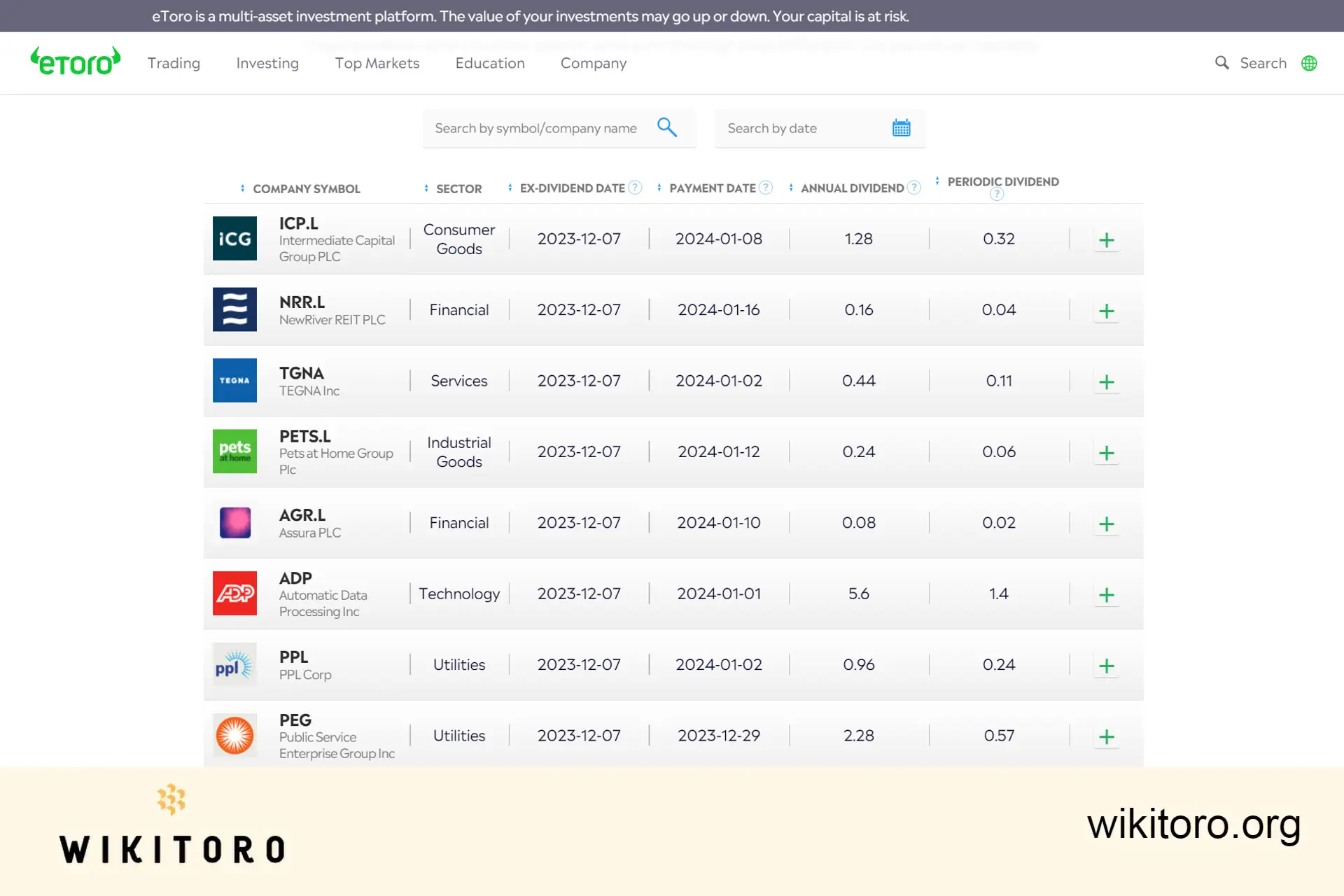

Dividend payments are not a secret; their dates and details are publicly accessible. On eToro, you can conveniently track upcoming ex-dividend dates using the Dividend Calendar feature.

📅 My experience with this tool

I've found this calendar to be extremely useful. It offers detailed insights into upcoming dividends, including crucial dates like ex-dividend and payment dates, as well as the dividend amount per share. Additionally, it lists company names and sectors, ensuring I'm well-informed about potential dividend earnings. This tool has been very helpful in my dividend investment strategy.

The stocks, primarily dividend-paying ones, are organized by market capitalization. You can easily search for specific companies using their name, symbol, or by selecting a particular date.

Dividend payments often trigger tax liabilities, varying based on jurisdiction and the country where the dividend-issuing company is based. The tax withheld is determined by the laws of the company's home country. Additionally, your tax responsibility may vary depending on your country of residence and any relevant tax treaties.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which hasbeen prepared by our partner utilizing publicly available non-entity specific information about eToro.

![]() Related Articles

Related Articles

We've compiled a list of related articles

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.