As an avid investor on eToro, I've navigated the diverse world of Exchange Traded Funds (ETFs) offered by this platform. If you're considering venturing into ETFs and are curious about how this broker facilitates this, you've come to the right place.

In this guide, I'll share my personal journey and insights into trading ETFs via their platform. Drawing from my hands-on experience, I aim to provide you with a comprehensive understanding of the intricacies and strategies for efficient and ETF trading. So, let's dive into the world of exchange-traded funds and unlock the potential of this exciting investment avenue.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| 📊 ETFs | 260+ |

| 📈 Spread | 0% for real ETFs 0.15% for ETF CFDs |

| 🕟 Market Hours | Varies (depends on exchange) |

| 📊 Leverage | Up to x5 for ETF CFDs (for eToro (Europe) Ltd, eToro (UK) Ltd, and eToro AUS Capital Limited clients) Up to x10 for ETF CFDs (for eToro (Seychelles) Ltd clients) |

| 💰 Minimum Trade | $10 |

To start trading ETFs on eToro, create an account on the eToro platform and deposit funds. Then, navigate to the ETF section or use the search bar to find the ETF you want to invest in. Finally, click on the chosen ETF to open its trading page, where you can set your investment amount and place your trade.

Trading ETFs (Exchange-Traded Funds) with this broker is a straightforward process, suitable for both beginners and experienced investors. ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and typically track an index.

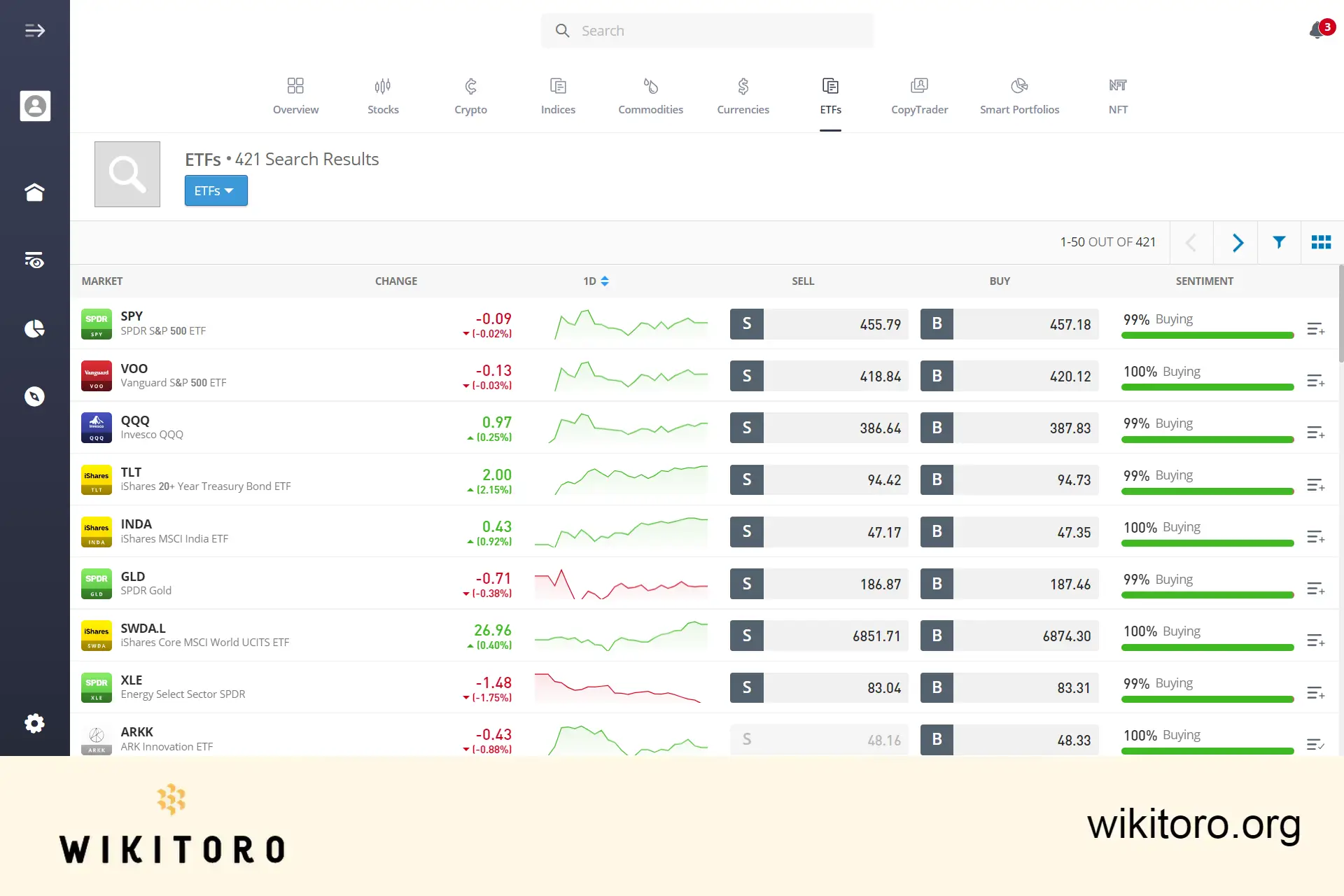

Via the app or the web interface, you have the option to invest in a wide range of ETFs, allowing you to diversify your portfolio across various sectors and regions. The platform offers tools and resources to help you understand each ETF’s performance history, underlying assets, and risk profile.

To start trading ETFs, you first need to set up an account. This involves providing some personal information and completing a verification process. Once your account is set up and funded, you can browse through the available ETFs on the platformm which offers an intuitive interface.

You can use the search function to find specific ETFs or explore different categories. Each ETF has its own asset page displaying detailed information, including past performance, management fees, and the composition of the fund. This information is crucial for making informed investment decisions.

eToro offers flexibility in investment amounts, making it accessible for various budget levels. It also provides features like setting stop losses and taking profits, which are useful for risk management. It’s important to remember that trading ETFs involves risk, and it’s advisable to do thorough research or consult with a financial advisor if you’re new to investing.

eToro offers a convenient way to invest in ETFs through CFD (Contract for Difference) trading. This method allows you to speculate on the price movements of an ETF without owning the underlying asset.

For instance, if you anticipate a decline in the FTSE 100 index, you could open a SELL position on the iShares FTSE 100 UCITS ETF (ISF.L) as a CFD. Should the index's value decrease, your short position could yield a profit. Conversely, if the index appreciates, your position would incur a loss.

Remember, CFD trading involves significant risk, so it's crucial to understand the mechanics and risks involved.

ETFs (Exchange-Traded Funds) offer a straightforward and efficient way for investors to engage in the market. Here's how it works:

Profit from market movements: If you predict an upward trend in an index tracked by an ETF, you can capitalize on this by opening a BUY position, commonly known as "going long". If the index value rises, your investment in the ETF appreciates, leading to potential profits when you close the trade. Conversely, if the index value decreases, the ETF's value and your investment may decline, resulting in a loss.

When trading ETFs, it's important to be aware of the associated fees:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which hasbeen prepared by our partner utilizing publicly available non-entity specific information about eToro.

eToro Tradable ETF

eToro Tradable ETF

Discover a curated selection of etf ready for trading on eToro today – dive in and elevate your trading experience!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.