To start trading Platinum on eToro, sign up for a new account or log into your existing one. Go to the "Discover" section, click on "Commodities", and select "Platinum". Choose either "BUY" or "SELL", input your desired trade amount or units, set your trading preferences, and hit "Open Trade".

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Platinum's value extends beyond its glittering appeal. Its market dynamics fascinated me early on, especially how global events or even a shift in the automotive industry could sway its price.

Having delved into the intricate world of commodities trading for over five years, I've had my share of ups and downs. One platform that has been a constant for me is eToro. Here's my personal take on trading platinum on this platform.

Trading this commodity requires an active and verified account. If you already have one, then you can proceed to the next step. If not, you need to register, complete the verification, and fund it.

Finding this asset on the platform wasn't a problem and I found that there are 2 ways:

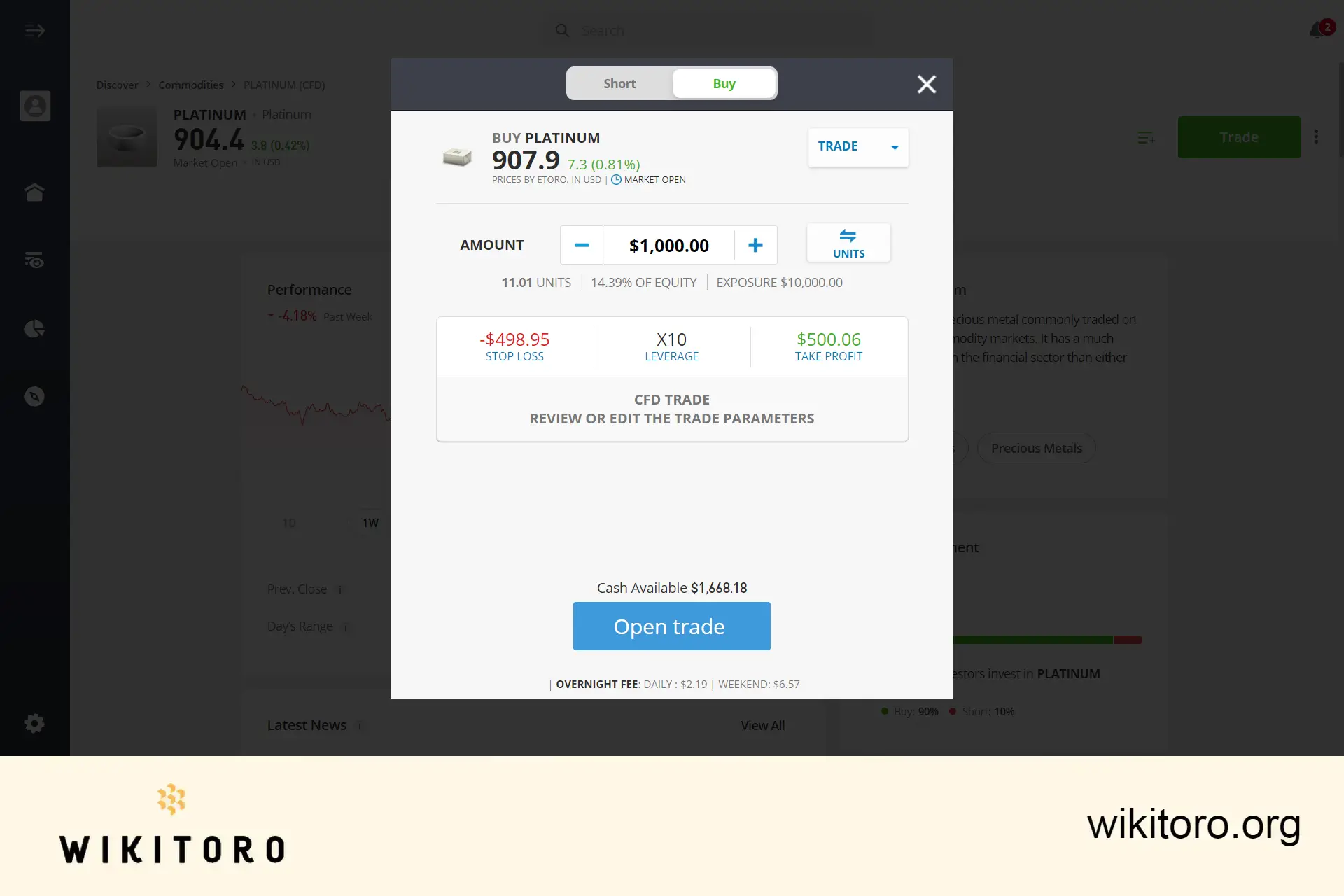

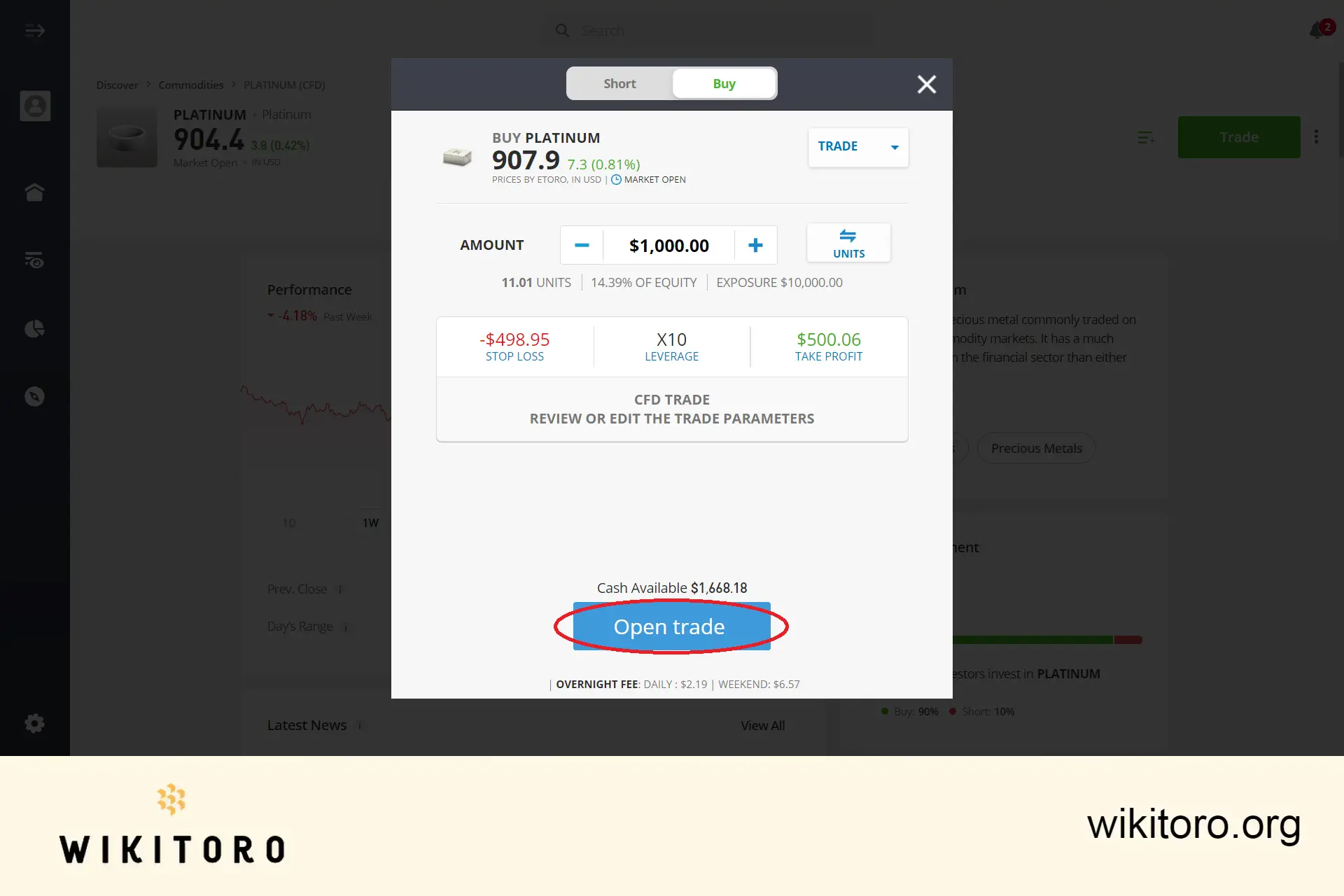

After finding this commodity and accessing its trading page, it's time to set the investment parameters:

The final part is hitting the "Open Trade" button so your eToro Platinum trade gets executed with all your parameters. All you need to do next is to wait, see how the market moves, and find out whether you'll make a profit or a loss.

Trading platinum on eToro has been more than just a financial endeavor for me; it's been a journey of learning, introspection, and growth. For anyone looking to embark on this journey, remember: the market will teach you, but how you respond determines your success.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver