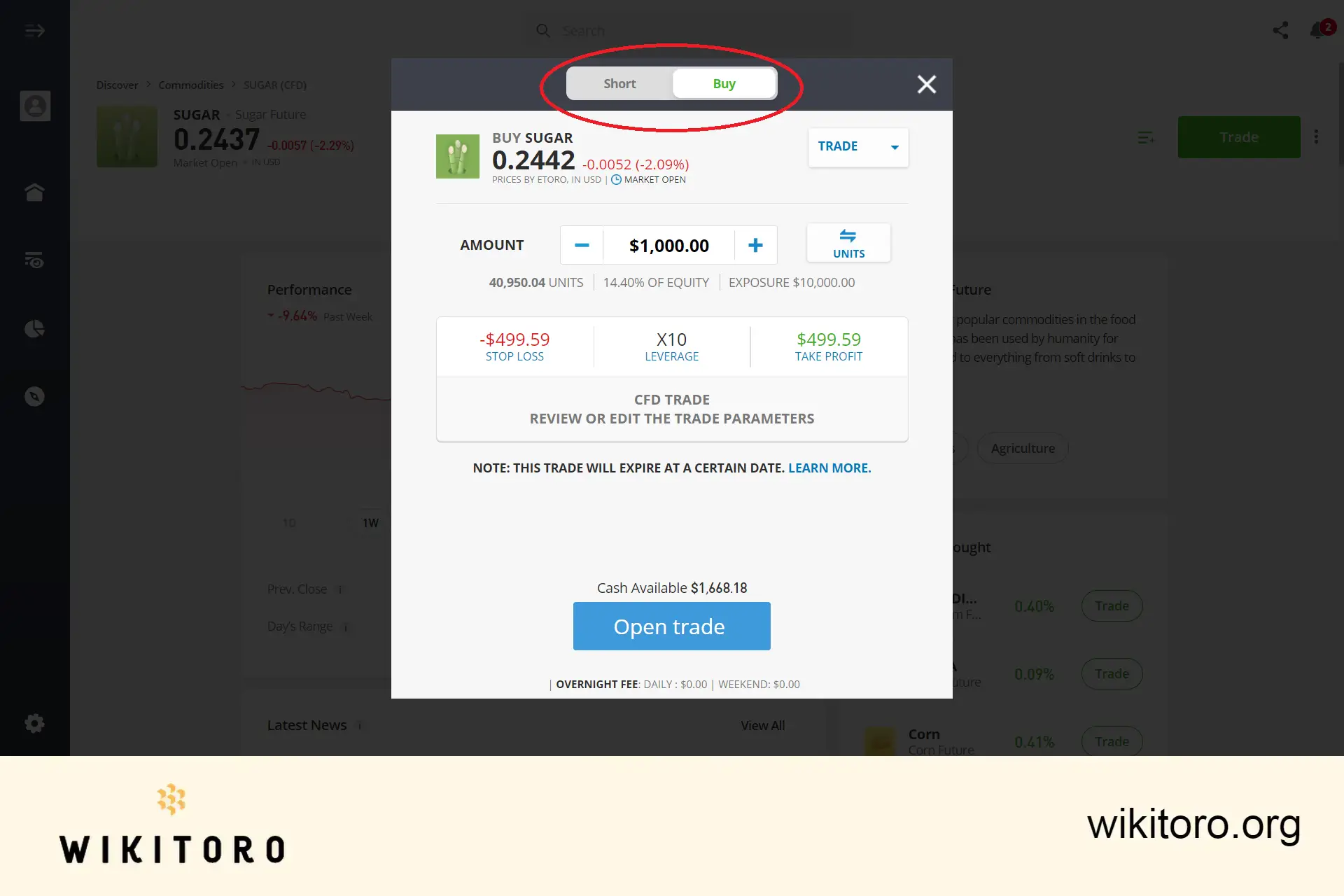

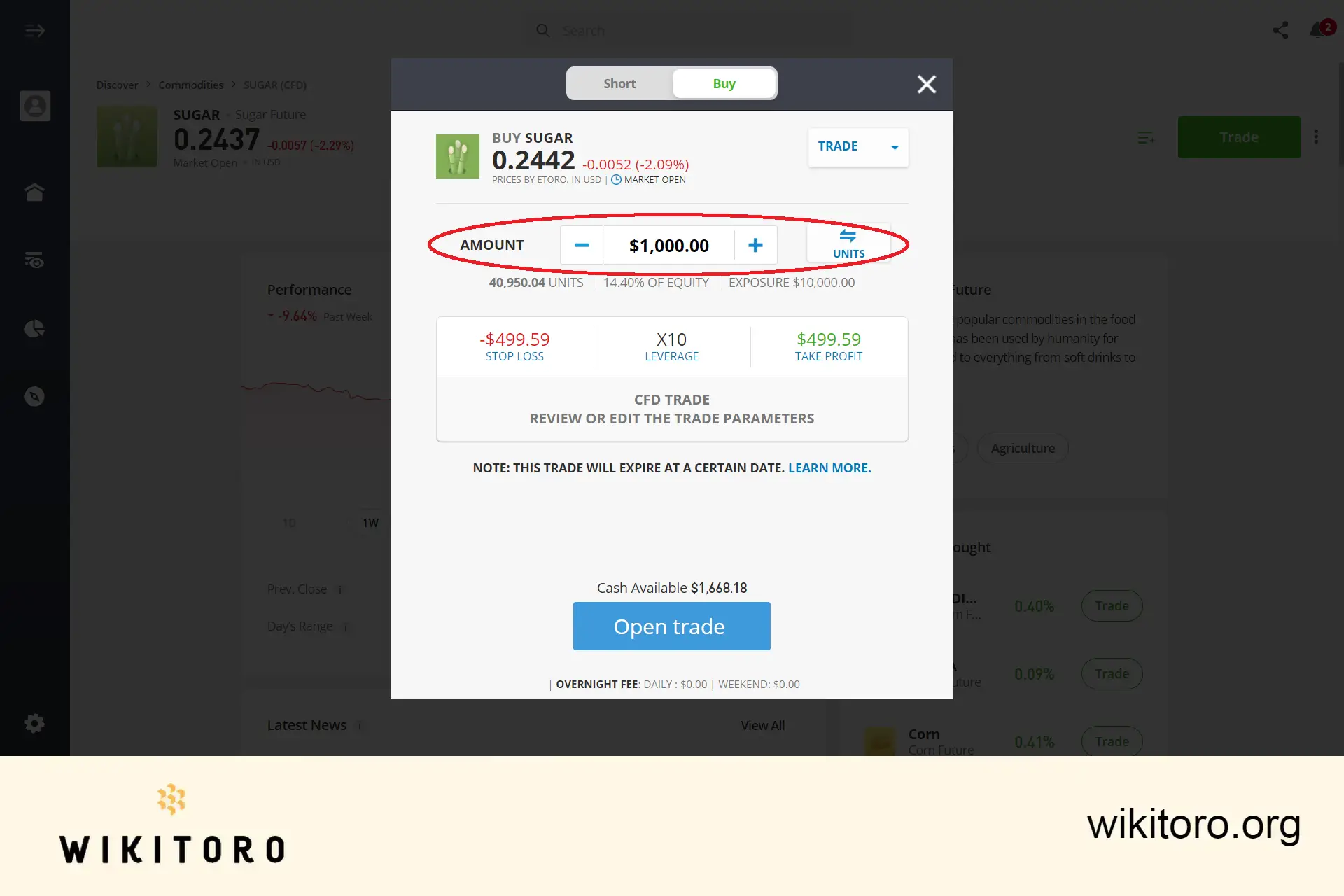

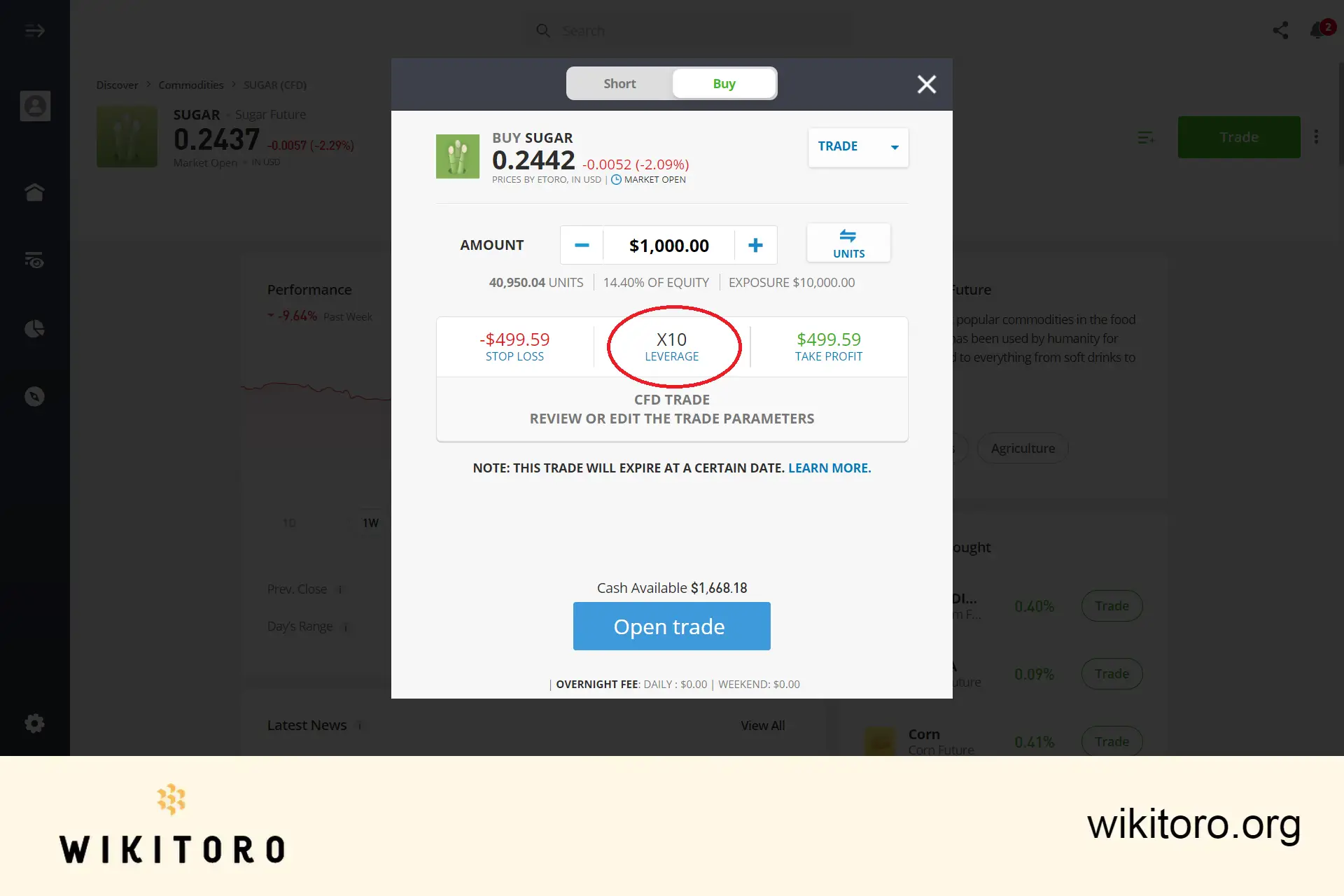

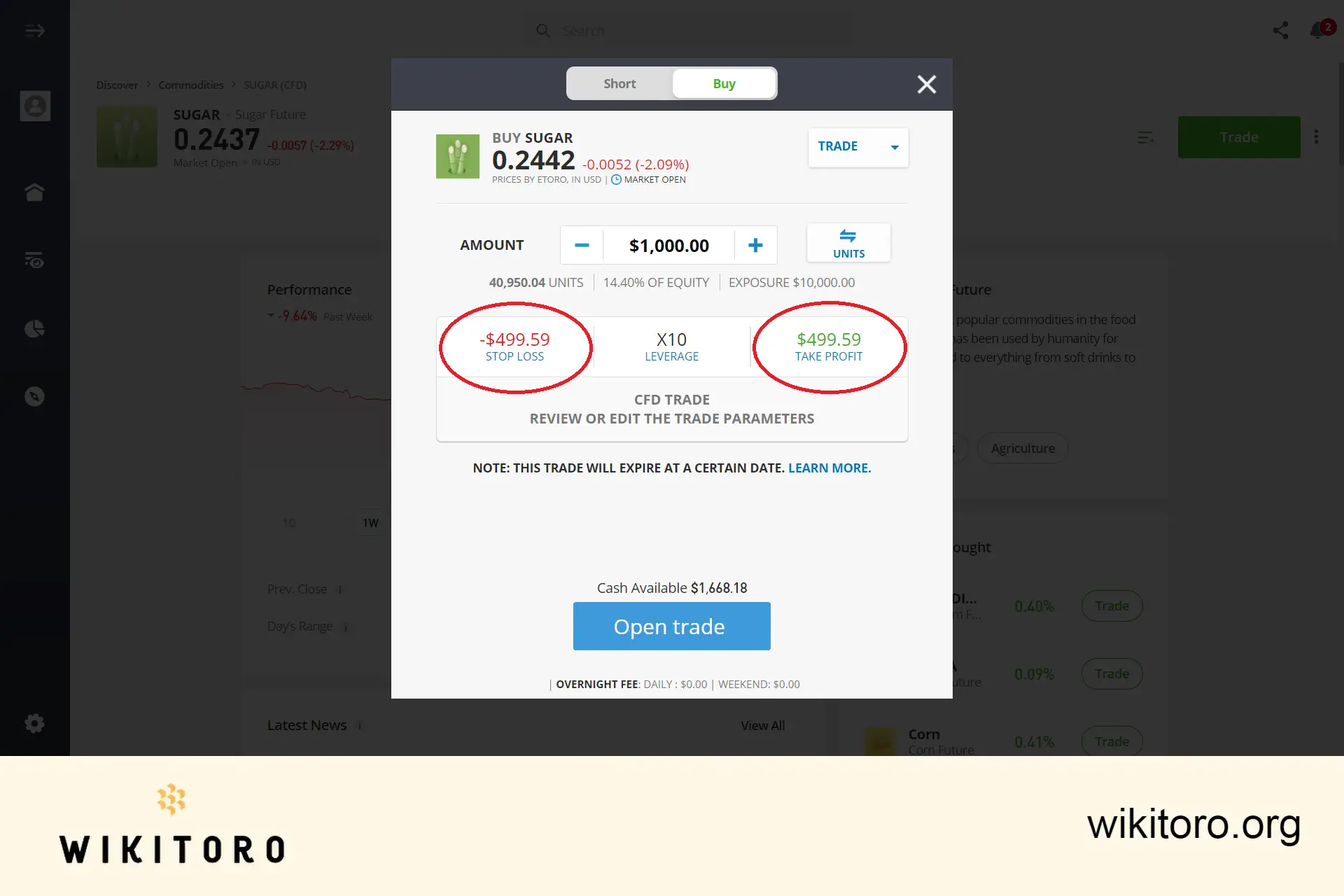

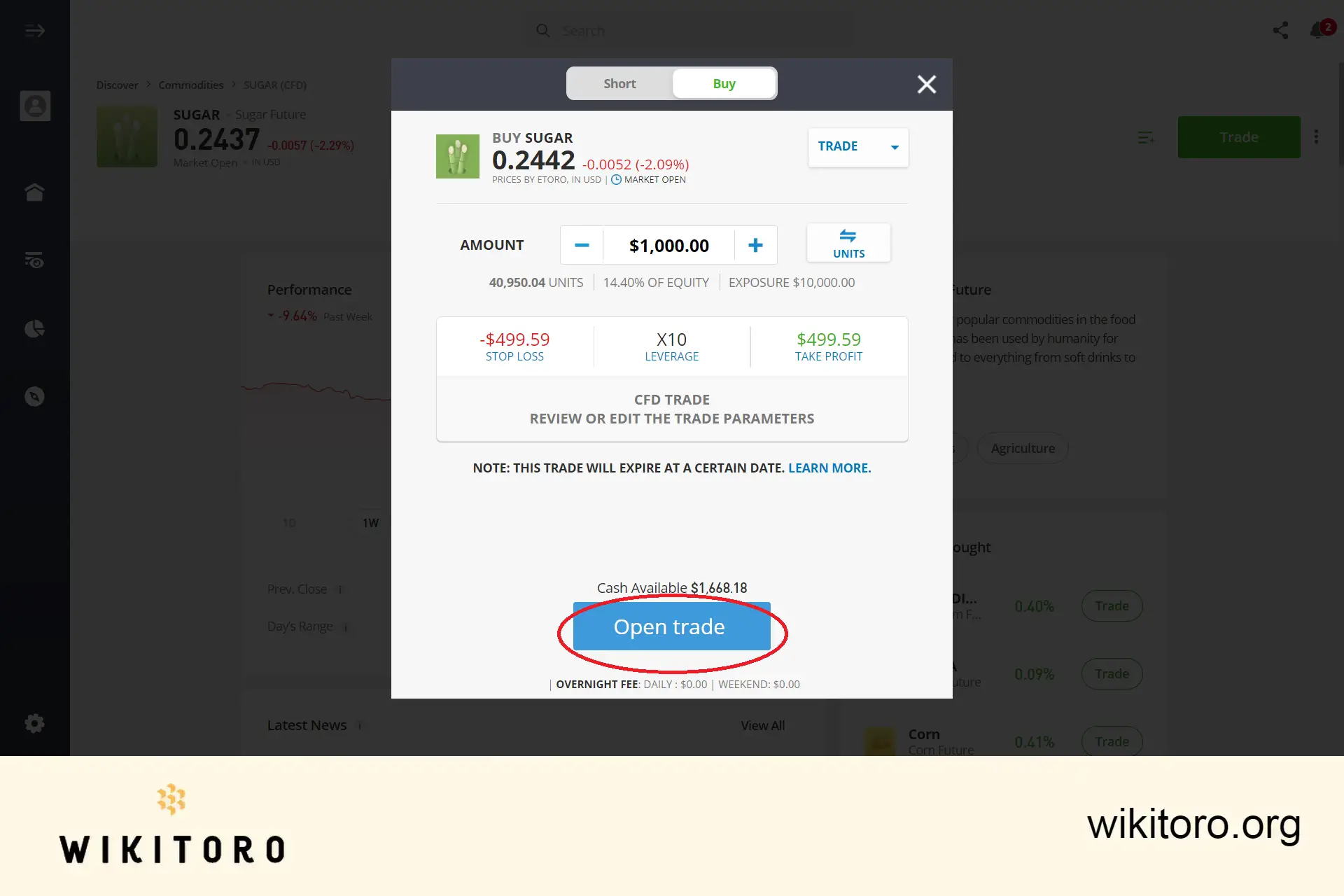

To trade Sugar on eToro, first log in to your account or sign up for a new one. Once you're logged in, use the platform's search bar to search for "Sugar"; it should be prominently displayed in the search results. Decide whether you want to place a "Buy" or "Sell" position. Then, enter the amount or the number of units you wish to trade. Adjust your trade settings as necessary. Finally, click "Open Trade" to complete your transaction.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Commodities trading on eToro has always piqued my interest, particularly in the vast and high-demand market of agricultural products like sugar. Many might wonder, "Why sugar?" For me, tracking the shifts caused by monsoon rains in India or Brazil's production policies turned this agricultural product trading into an engaging strategy game. It's a dance of global events and economic decisions.

And with that, I'd like to share my experience and some personal tips on trading this sweet commodity on the platform.

To trade this commodity, just follow these four simple steps:

This experience with sugar trading on eToro has been a somehow a roller coaster, filled with ups, downs, and invaluable lessons. As platforms and markets evolve, so does my strategy. But the core remains – informed, responsible trading with a touch of adaptability.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Nadav Zelver

About Nadav Zelver