eToro’s Bitcoin spread usually starts at 0.75%. That’s the gap between the buy and sell price you see when placing a BTC trade. It’s how the platform makes money. No hidden fees, just this built-in difference. You’ll pay it when you open the position, and it’s already factored into the price you see.

eToro’s shaken up its crypto pricing and this time, it’s simpler, tighter, and far more transparent.

Here’s what’s new:

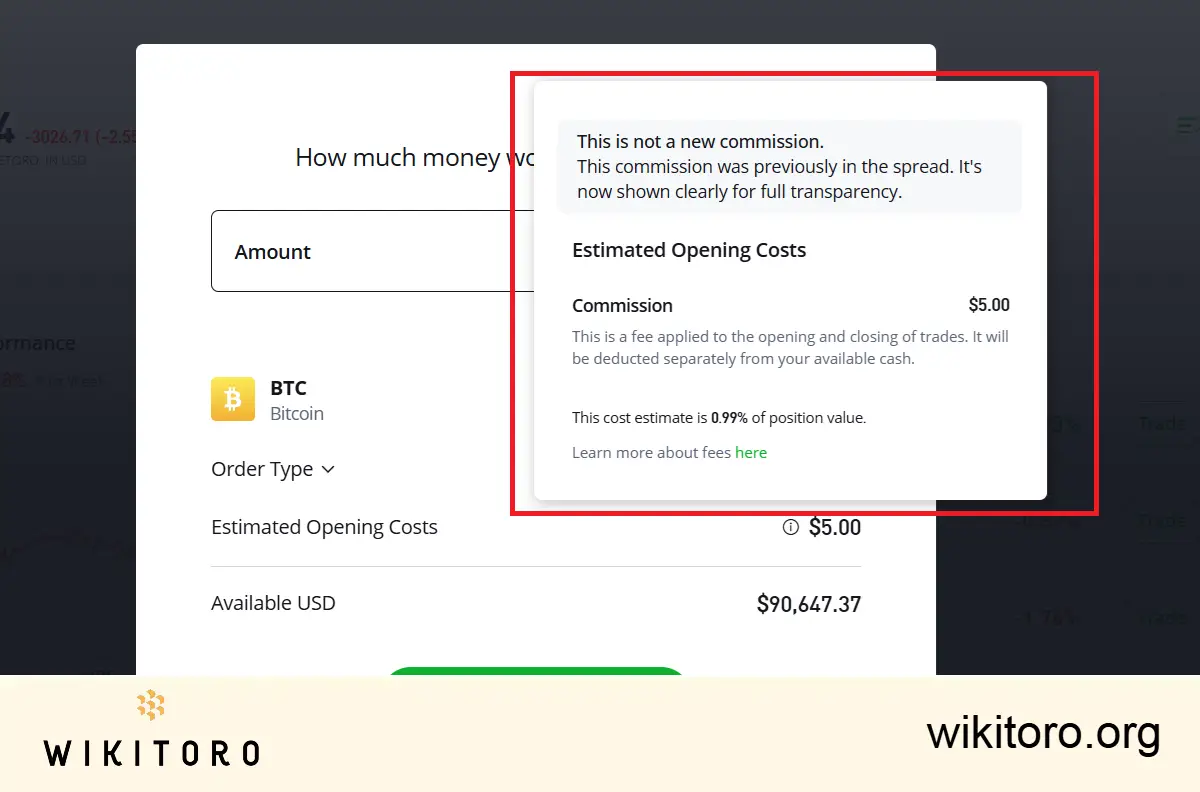

Instead of hiding trading costs inside the spread, you now see a flat 1% commission when buying Bitcoin, and another 1% when you sell. It’s shown clearly on the trade ticket. No more digging through price charts to figure out what you paid.

Spreads? They’ve been trimmed. So your quoted price now sits closer to the actual market rate.

And your P&L? It only reflects market movement. No more fees baked into your gains or losses.

| Cost Component | What It Means |

| Buy commission | 1% of your trade amount, displayed as a separate charge |

| Sell commission | 1% of sale proceeds, shown clearly on exit |

| Market spread | Now narrower; varies based on market conditions |

| P&L reporting | Shows only real price movement, not trading fees |

Let’s say you put $1,000 into Bitcoin.

You’ll see a $10 charge on entry. Then when you sell, another 1% comes out of your final proceeds.

But here’s the kicker: with tighter spreads, you’re buying closer to the market price, and exiting with less slippage.

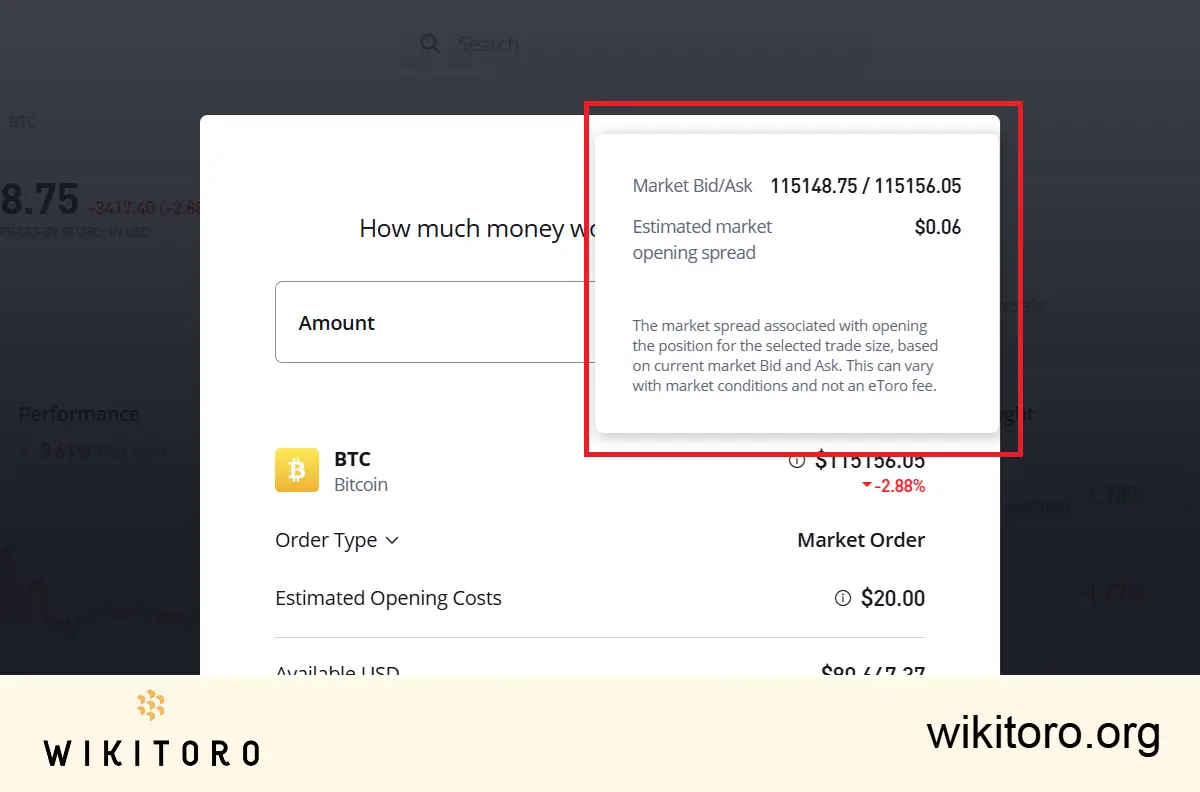

Spreads are just the gap between the buy price and the sell price. That gap shifts depending on liquidity and volatility.

Because eToro uses third-party liquidity providers, spreads can widen when markets get choppy. But now that commissions are listed on their own, you can actually spot the spread cost directly in the quote. And yes, it’s narrower than before.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman