The best time to buy Bitcoin is usually in the early morning (before 9:30 AM ET) or on Sundays and Mondays, when prices tend to drop according to market analysts. Long-term buyers also expect market corrections. You can acquire Bitcoin quickly and securely on platforms like eToro.

There is no single answer to when to buy Bitcoin, but there are certain patterns that should be known if you want to make more judicious decisions:

Bitcoin typically shows less movement (and sometimes lower prices) during the early morning, especially between midnight and 6 AM (Eastern Time).

The reason? Low trading volume. Traders in the US are sleeping, Asia is closing its day and Europe has not yet fully started. Some buyers take advantage of this moment to enter at slightly lower prices.

Sundays and Mondays usually come with softer prices. Activity drops over the weekend and that may lead to small drops, especially compared to the mid-week movement.

If you're looking for a slight edge, buying at the beginning of the week isn't a bad idea.

Bitcoin moves in phases. After each halving (approximately every four years), prices usually rise and then enter a cooling stage. Those prolonged declines and early phases of the cycle? That's where many long-term investors decide to come in.

And you don't need to hit the exact floor. It is enough to identify when the enthusiasm has died down and the graph has been in the red for some time.

Trying to hit the lowest point is a risky bet. A safer strategy is Dollar-Cost Averaging (DCA).

It consists of investing a fixed amount periodically, regardless of the price. This takes the pressure off and averages your tackle over time.

The market is sensitive. A major hack, a new regulation or an expert's alarm can cause rapid crashes.

But panic is usually temporary. If your strategy allows it, those declines can be turned into good buying opportunities.

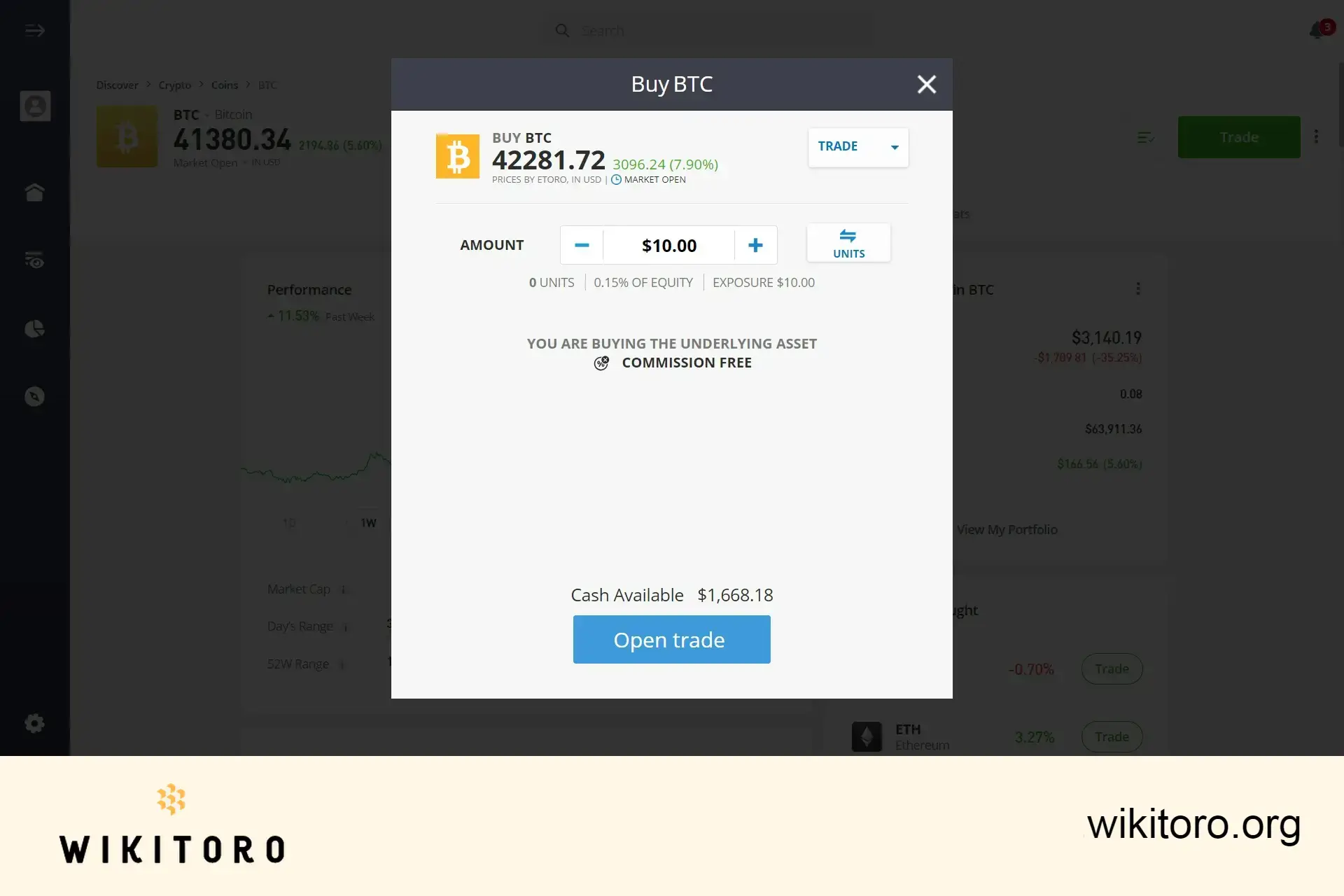

Once you decide how and when to buy, use a reputable exchange. eToro supports Bitcoin (and many other cryptocurrencies) and allows deposits with different payment methods.

In the end, the "best" time depends on your goal. If I look for a one-off entry, I usually look at the small descents in the morning or at the beginning of the week. But if you think about the long term, it's not worth obsessing over the exact moment. Focus on the big moves or apply DCA. Consistency is what makes the difference.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman