First, make sure your eToro account is verified and funded. No funds, no trades. Next, head to CopyTrader, find a trader specializing in Ethereum, and set your investment amount. Once you’re in, keep an eye on performance. If your copied trades are paying off, ride the wave. If not? Adjust or exit before losses pile up. Consistent monitoring is important. Your money, your call.

eToro’s CopyTrader lets you mirror the trades of seasoned investors. This takes the guesswork out of crypto investing. Think of it as having a professional trader working for you, without the hefty fees.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Here’s how to set it up and make the most of your Ethereum investments:

Before you can start copying trades, you’ll need a verified eToro account.

Once that’s done, you’re ready to tap into the expertise of top Ethereum traders.

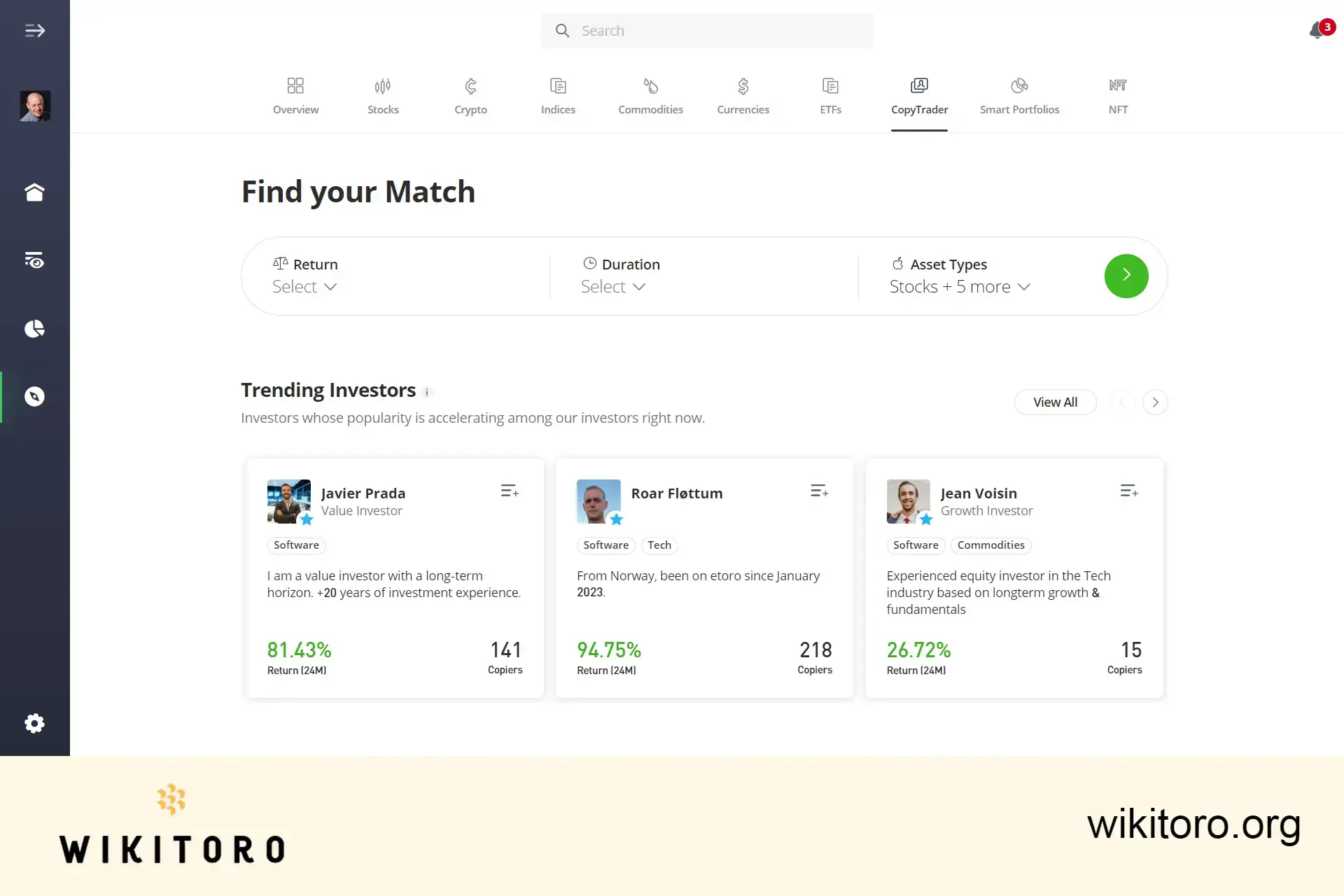

Now that your account is live, it’s time to find traders worth copying.

Click on the “Discover” tab, then select “Copy People.” This will take you to eToro’s list of available traders.

Not all ETH traders are equal so look for:

You can review a trader’s portfolio, trading strategy, risk score, and performance history before making a decision.

Once you’ve found a trader that fits your style, click “Copy” on their profile. Enter the amount you want to allocate (take note that the minimum is $200).

Put a check on "Copy Open Trades" if you want to mirror their existing Ethereum positions. This means you’ll replicate both their current and future trades so you get instant exposure to their strategy.

CopyTrading isn’t set-and-forget. Stay on top of:

You’re in control. If things don’t look right, you can stop copying anytime.

Seeing solid returns? Great! You’ve got two choices:

Either way, you’re in the driver’s seat.

What I liked about eToro’s CopyTrader is that makes Ethereum investing simple. Instead of constantly watching the market, you can capitalize on top traders’ expertise while keeping full control over your funds.

But here’s a must: Don’t just copy blindly.

It's important to choose traders wisely, set risk management parameters, and stay informed about Ethereum’s price movements

With the right strategy, CopyTrader can be a powerful tool for growing your Ethereum portfolio.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman