Meta (formerly known as Facebook) has seen a significant rise in stock value since its public debut in 2012, with notable spikes in recent years. This growth might pique your interest in trading Meta shares. However, you don't need to invest a large sum or spend extensive time analyzing market trends. Instead, consider using eToro, a platform that enables you to replicate the investment strategies of seasoned traders who have extensively studied the market. This approach allows you to leverage their expertise with less effort.

I've compiled a comprehensive guide that explains this process and includes my personal insights, which could be valuable to you.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Having traded Meta stock on eToro multiple times, I've identified several benefits of using this platform:

When you visit the Meta stock asset page on the platform, you'll initially land on the Overview section. This default area provides a comprehensive view of the asset through various elements:

One of the highlights of this platform is the range of integrated tools that enhance the trading experience, especially for Meta stocks. These include:

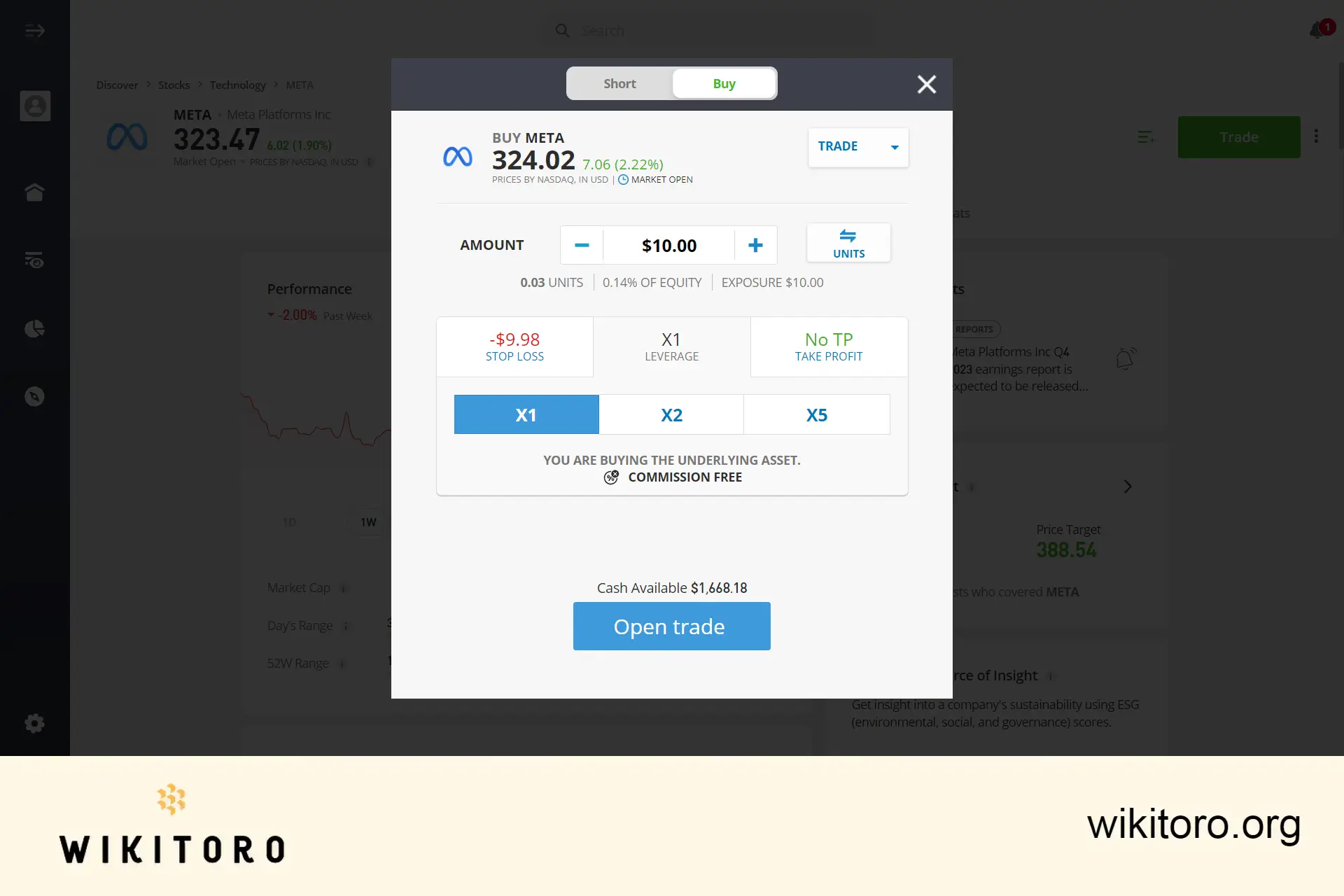

To trade the Meta on the eToro stock invesment platform, begin by searching for the underlying asset. You then have the option to either "Buy" or "Short" based on your market prediction. After deciding on the investment amount, you can set your trading preferences, such as stop loss and take profit levels, before executing the trade. This process is streamlined and user-friendly, accommodating both novice and experienced traders.

Another standout feature is the CopyTrader function. This tool allows you to emulate the trades of seasoned stock investors.

You can refine your search for traders using filters, then decide how much you'd like to invest in their Meta stock trades. By hitting the "Copy" button, your account will automatically replicate their trading positions, simplifying the investment process and potentially reducing risks.

These are the key aspects to consider if you're planning to trade Meta stocks on eToro, whether using the web platform or their mobile app.

Remember to utilize the insights and tools I've discussed to enhance your online stock trading journey. These strategies and features are designed to assist you in making informed decisions and potentially improve your trading outcomes.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which hasbeen prepared by our partner utilizing publicly available non-entity specific information about eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.