Yes, investing in Cotton on eToro is possible. Begin by signing into your existing account or creating a new one. After logging in, use the search bar on the platform to find "Cotton," which typically appears at the top of the search results. Next, choose whether to place a "Buy" or "Sell" order. Specify the trade amount or the number of units you intend to trade. Adjust your trade settings according to your preferences. To complete the process, click "Open Trade" to execute your order.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

My fascination with commodities trading on eToro, especially in the dynamic and high-demand sector of agricultural products, has led me to explore cotton trading. I recall reading an article about the booming textile industry, which piqued my interest in this particular asset as an investment.

I'm excited to share my journey and some personal insights on trading this particular commodity on the platform.

Wondering how to start trading cotton on eToro? Just follow these straightforward steps:

To engage in cotton trading, an active and verified eToro account is essential. Existing users can directly proceed to the next step. New users will need to register, complete the verification process, and fund their account.

Finding cotton on the web platform or app is a hassle-free process. You can:

Once you've chosen your method, you'll be directed to the cotton trading page. Here, click on the "Trade" button to proceed.

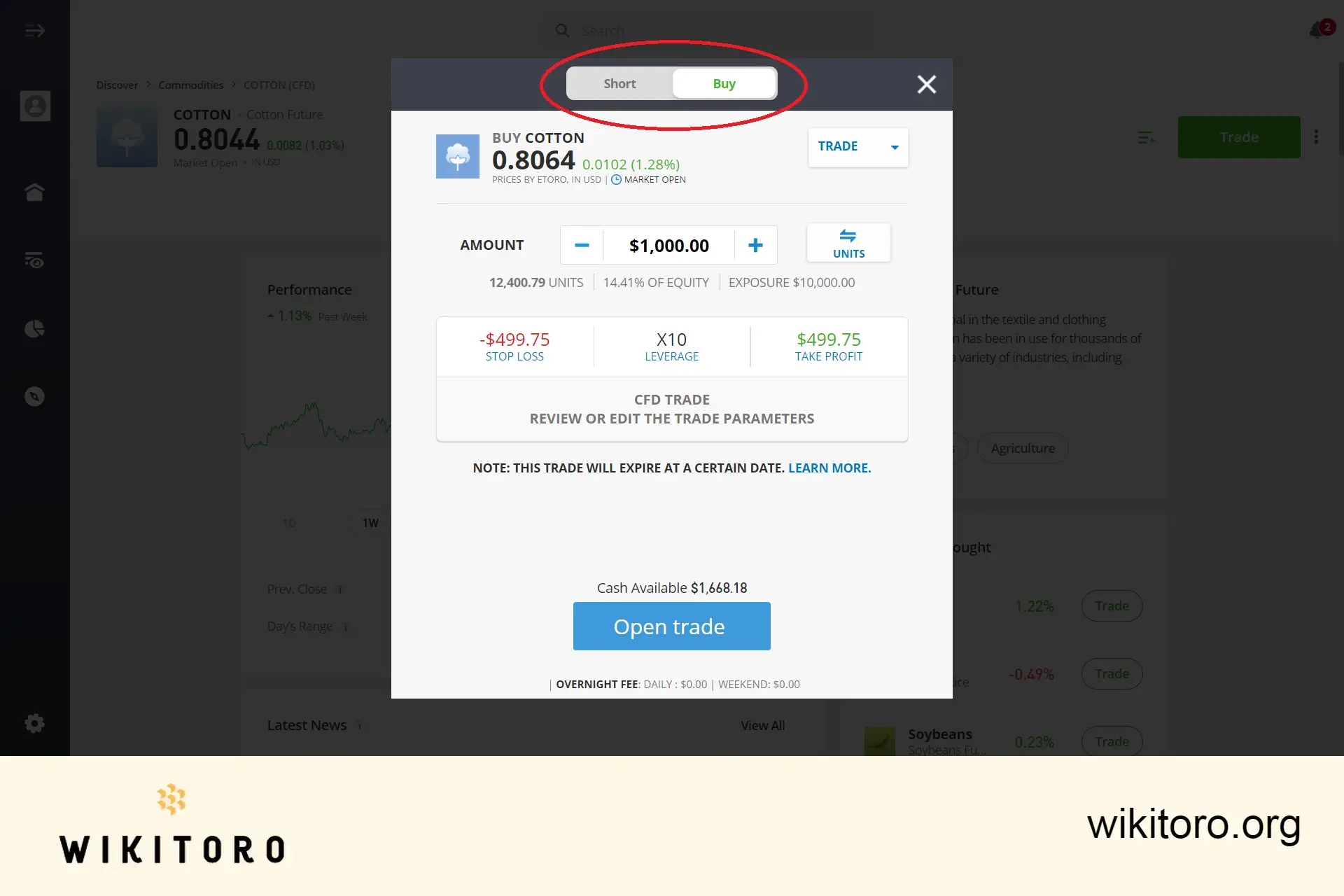

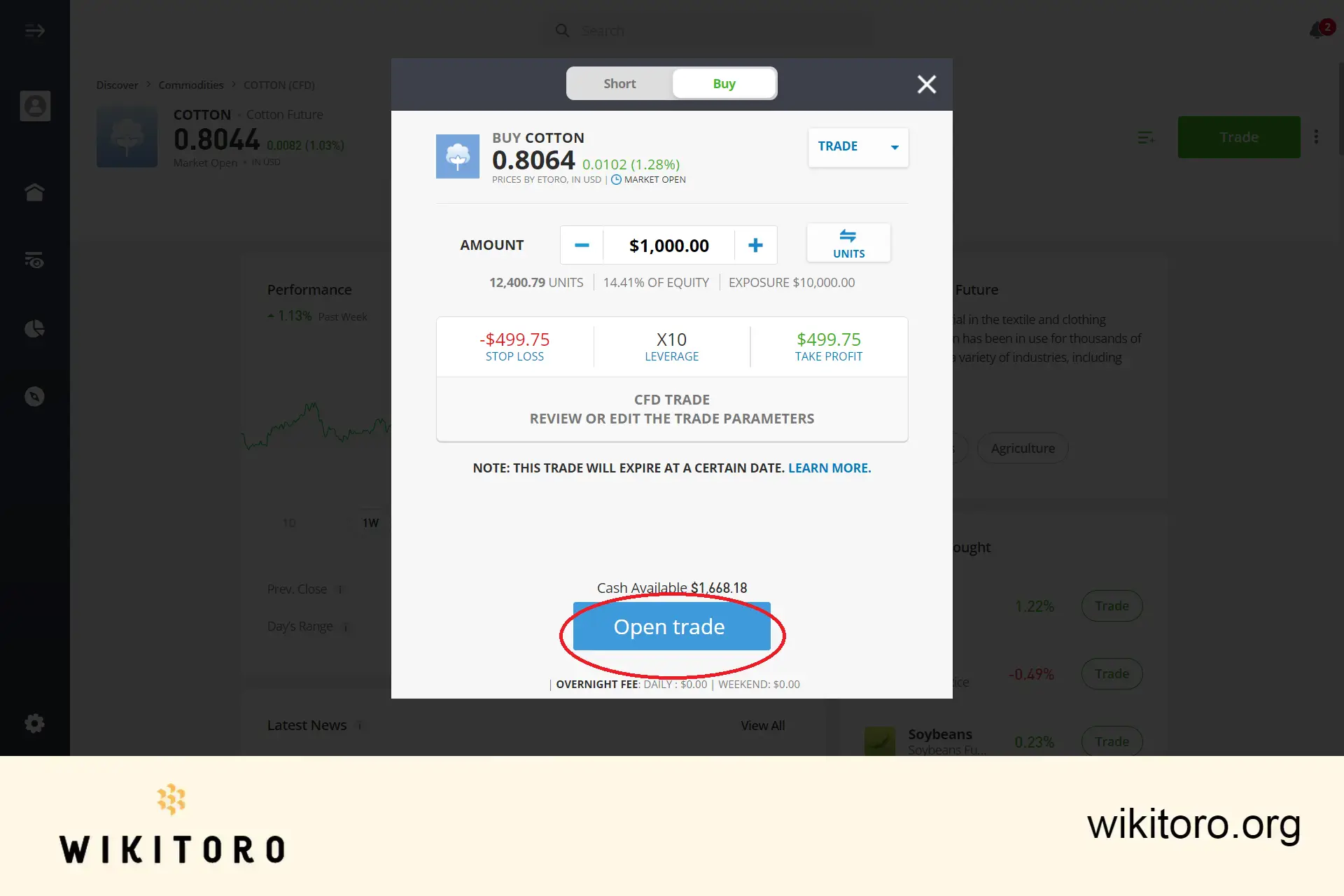

Based on your market analysis and personal assessment, decide whether to Buy or Sell.

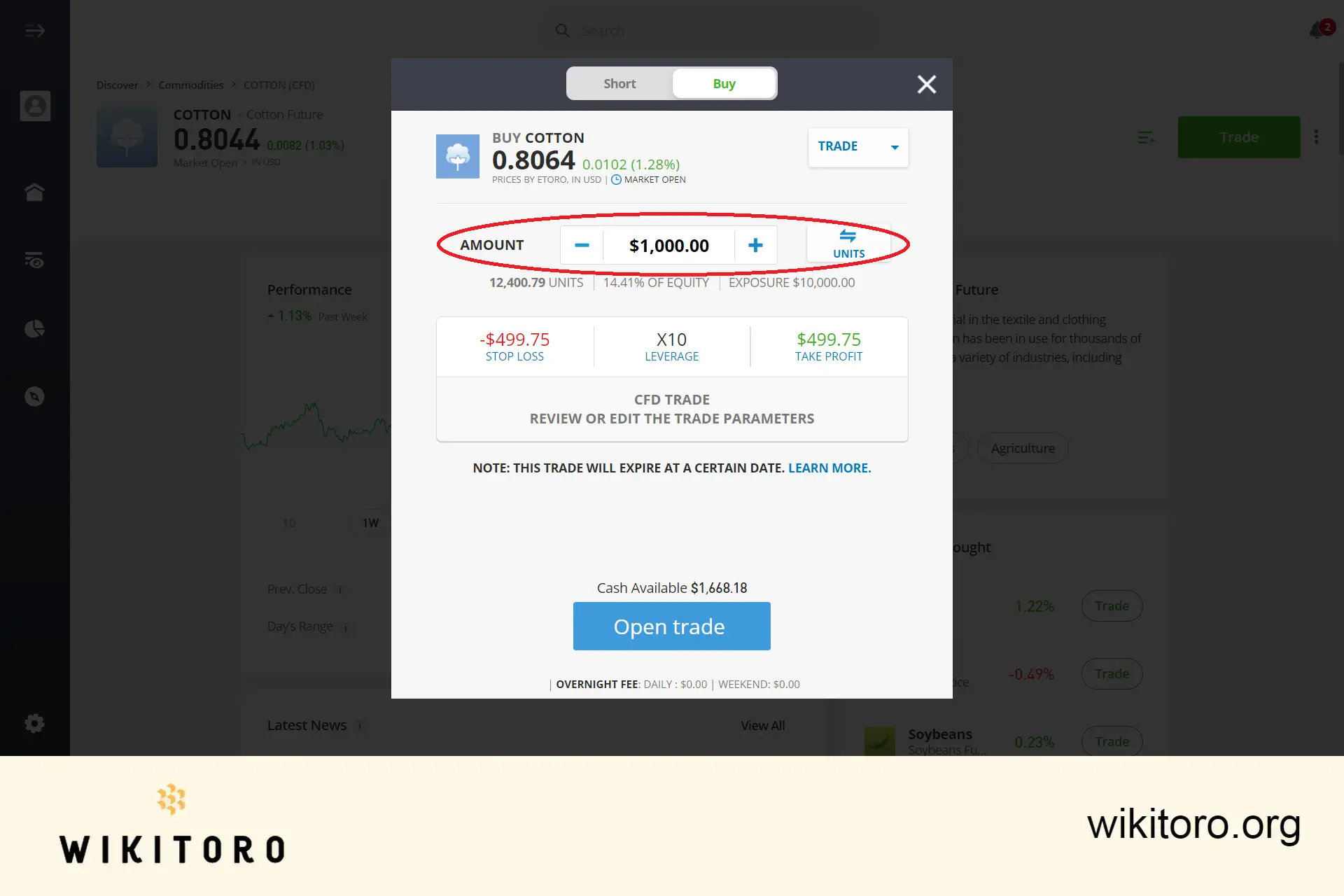

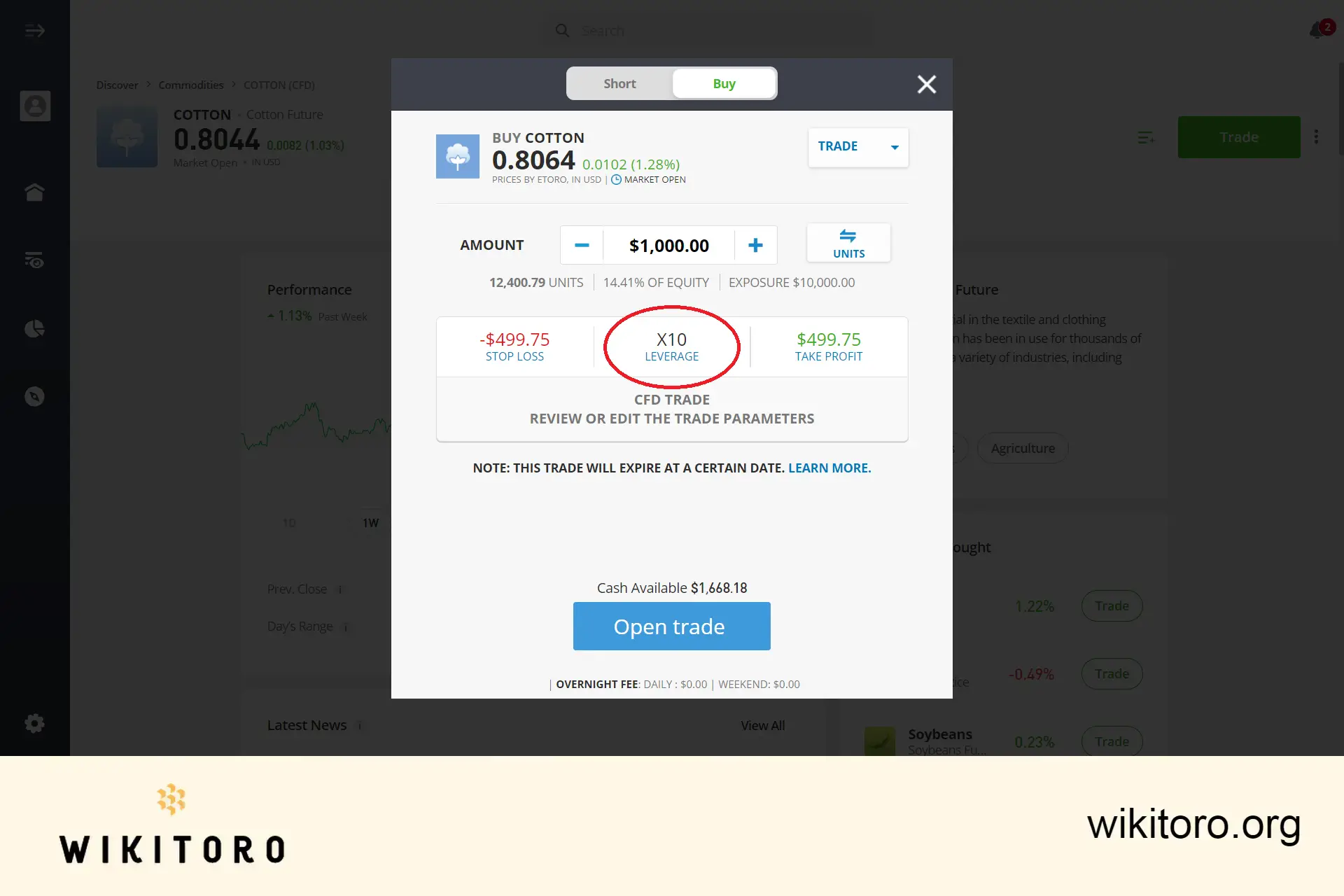

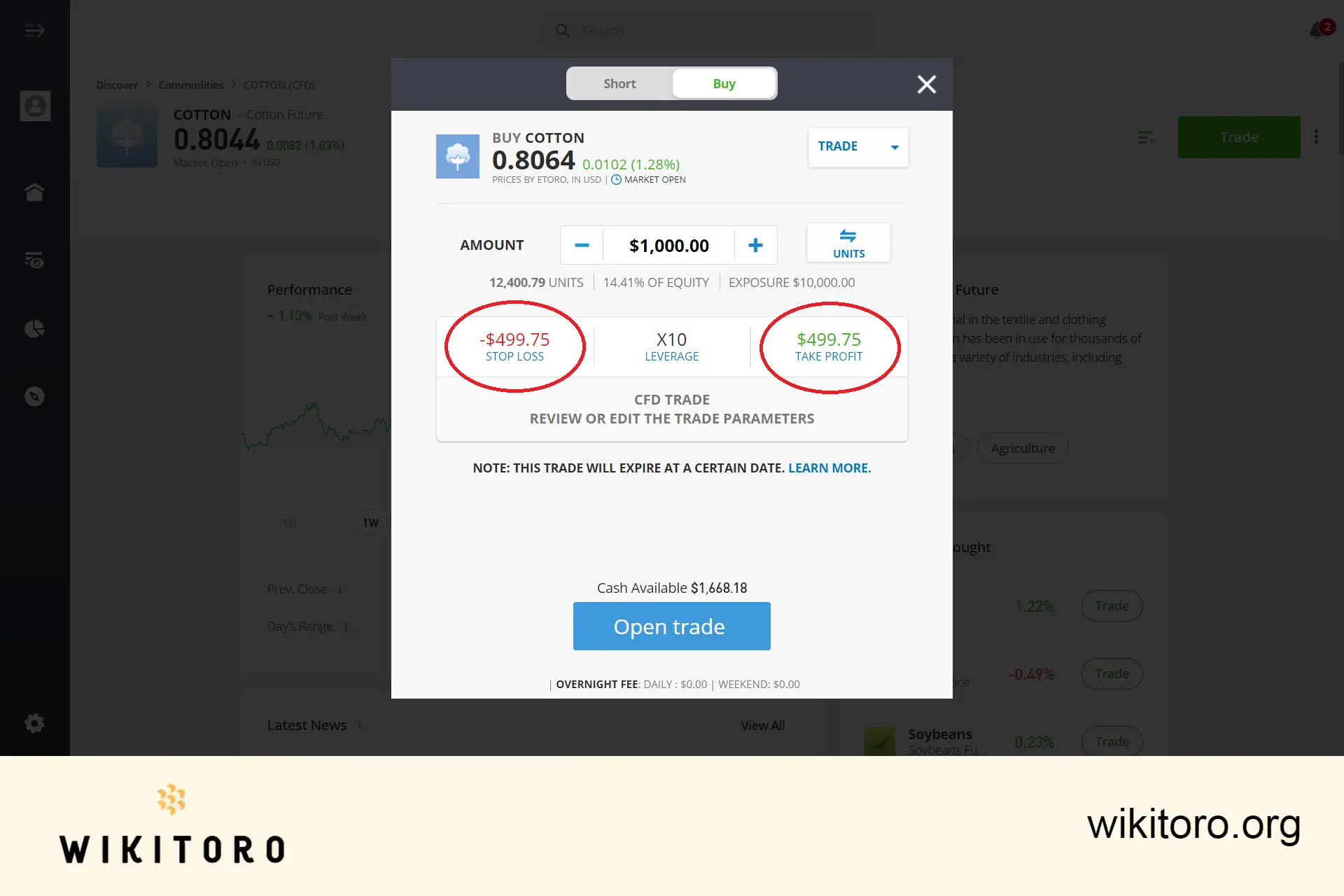

Now, determine the size of your investment. Remember, the minimum investment for commodities like cotton typically starts at $1,000.

Lastly, hit the blue "Open Trade" button to initiate your eToro cotton trade with the selected parameters. It's crucial to keep an eye on the market to evaluate the performance of your trade and to see whether it results in a profit or a loss.

Is investing in cotton on eToro worth it? Based on my experience, it's a journey of highs and lows, much like any other commodity. If you're armed with research, use the platform’s tools wisely, and engage with the community, it can be a rewarding endeavor. Just remember, every trader's journey is unique – as was mine with cotton.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman