Made a profit trading Bitcoin on eToro? Then yes, taxes may be waiting for you. While eToro doesn’t send your gains to the local tax office, that doesn’t mean you get a free pass. It’s still your job to report what you earned and handle the tax bill, based on your country’s rules.

Sell Bitcoin for cash? That’s a taxable event. Swap Bitcoin for Ethereum? Same story. Anytime you dispose of crypto by selling, trading, or spending, it may be subject to capital gains tax.

Using crypto to buy service or products, or earning rewards like staking income or airdrops? That's also taxable.

eToro applies the FIFO method: first in, first out. Your oldest assets get sold first.

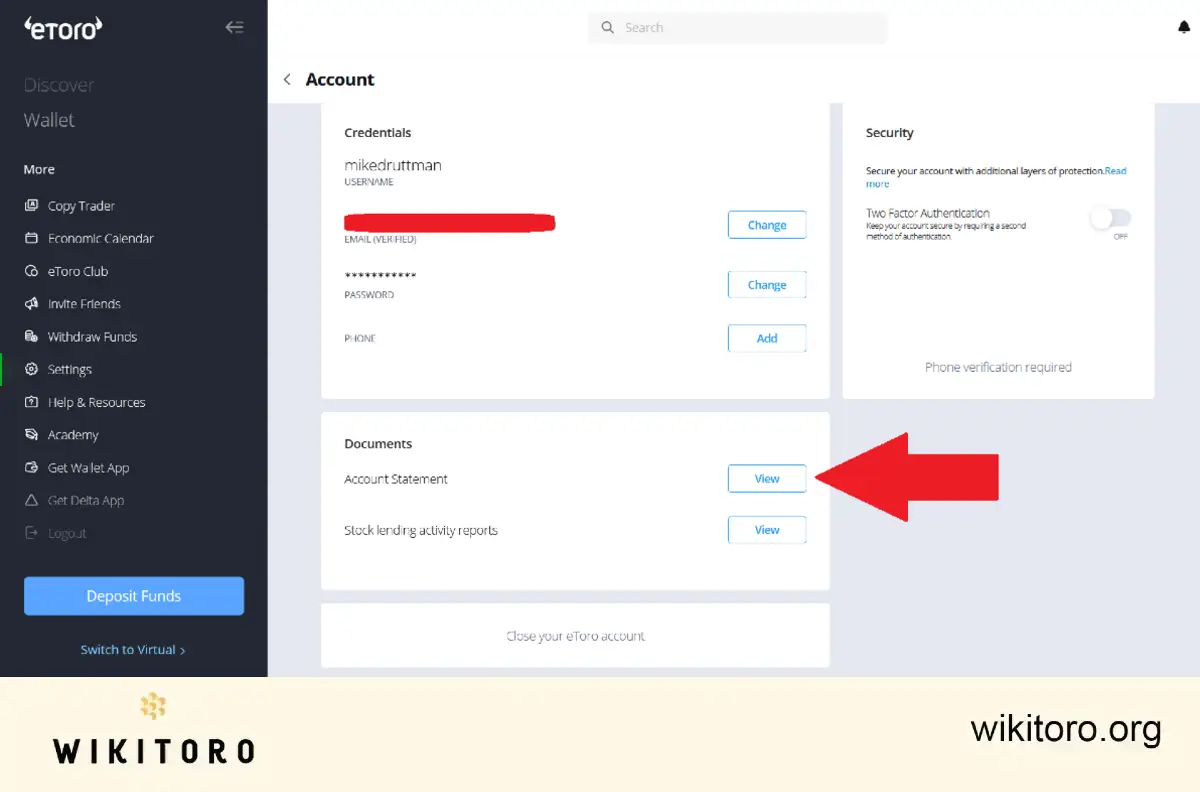

Need to check your numbers? Head to Settings → Account statement to download your trade history. You’ll get the full details: cost basis, sale price, fees, everything.

In the U.S.:

eToro issues tax forms including:

Where to report crypto gains:

💡 Personal tips for tracking and reporting

- Log everything. I take note of every detail like dates, values, fees, cost basis, and proceeds.

- Download and safely store your eToro trade history. This might come in handy if you need to backtrakc.

- Use crypto tax tools like CoinTracking, CoinLedger, Koinly, or Coinpanda to simplify it all

- Have losses? You can use them to reduce your gains and in the U.S., even carry them forward. Just be aware that rules differ by country.

- And if you're still confused, I suggest that you speak with a tax pro. Crypto tax laws are complicated, still changing, and not the same everywhere.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman