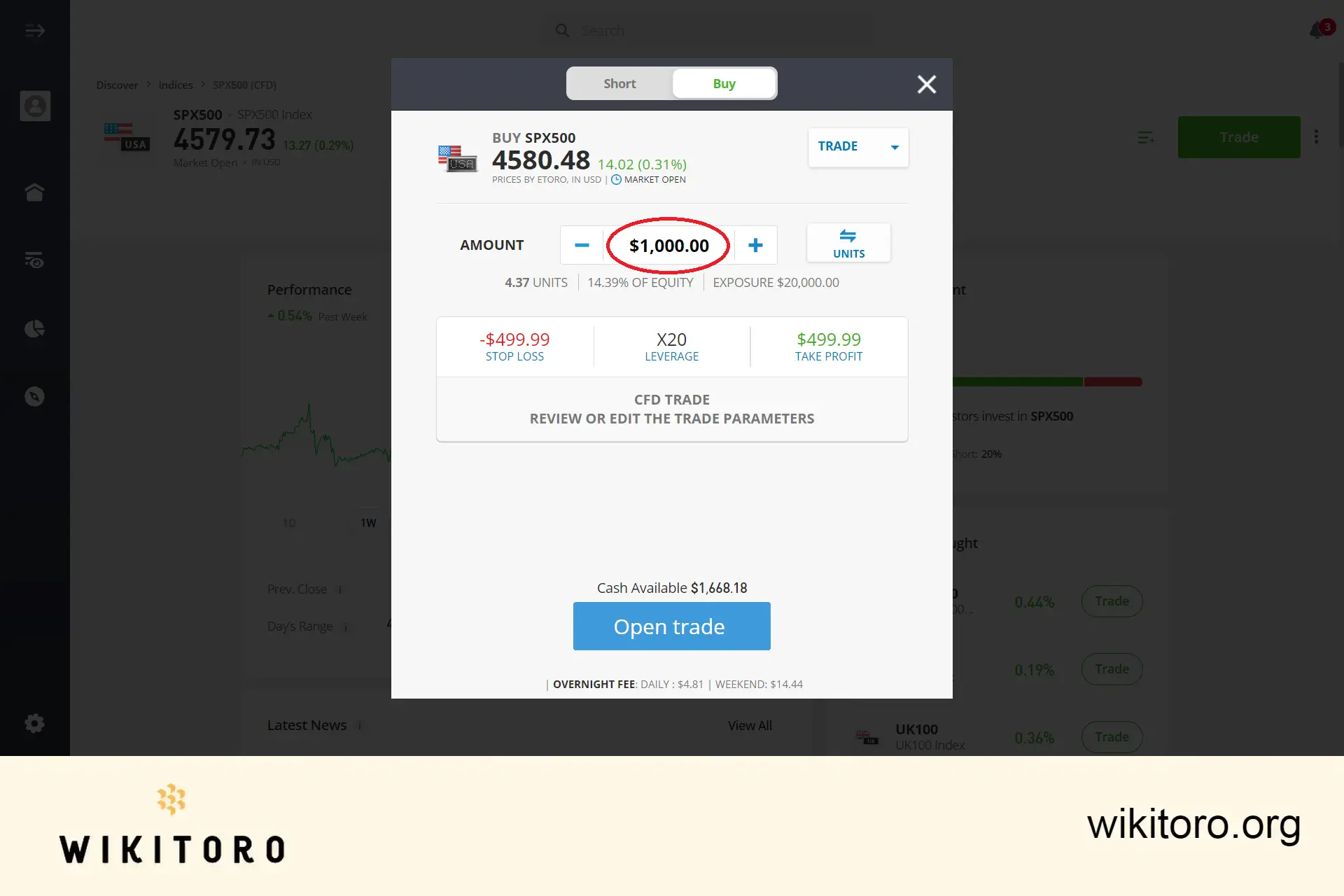

The minimum amount required to invest in the S&P 500 index (SPX500) on eToro is $1,000. It's important to distinguish this from the 'minimum deposit', which refers to the smallest amount you can add to your eToro trading account. This minimum deposit starting from $50, depending on your country of residence.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

In my quest to understand the investment thresholds on eToro, particularly for the S&P 500 index (SPX500), I unearthed some key insights that I believe will be particularly enlightening for those new to the platform.

Firstly, it's crucial to distinguish between 'minimum deposit' and 'minimum investment amount'. The minimum deposit is the least amount you can add to your eToro trading account, which varies based on your country of residence. For instance, the minimum deposit is $50 for UK and $100 for US residents.

Moving beyond the initial deposit, the focus shifts to the minimum investment amount or the minimum trade size for investing in the SPX500 index. Here, the platform sets the bar at $1,000.

This can be a direct $1,000 investment without leverage, or a smaller sum amplified by leverage to reach or exceed the $1,000 mark. In my attempts with smaller amounts like $10, $100, and $500, the platform consistently indicated that the minimum investment threshold wasn't met.

To sum up, understanding these distinctions is pivotal. The minimum deposit caters to your account funding, while the minimum investment amount defines the entry point for specific assets like the SPX500 and in this case, that minimum investment is $1,000.

I hope my experience and the clarity gained from it aid you in your investment journey, particularly if you're considering the eToro S&P 500 index on the platform.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman