Holding a CFD (Contract for Difference) position overnight on eToro incurs an overnight fee (also called a swap or rollover). It’s basically the cost of keeping a leveraged trade open after normal trading hours.

When Are Overnight Fees Charged?

Fees kick in at 21:00 GMT (or 22:00 during Daylight Saving Time) from Monday to Friday. If your CFD is still open when the clock strikes, the fee is automatically deducted from your balance.

Then there’s the weekend fee, a charge that’s three times the standard overnight rate to cover the longer gap between Friday and Monday. That triple fee depends on the asset:

| Asset |

Charged on |

| Forex and Commodities |

Wednesdays |

| Stocks, ETFs, Indices, Oil, Natural Gas |

Fridays |

Now that you know the charging days, plan accordingly.

How Are Overnight Fees Calculated?

There’s no flat fee here. It varies depending on:

- The asset class

- The size of your position

- Market factors at play

Fees for currencies, indices, and commodities are usually calculated per unit. Also note: fees differ between long (buy) and short (sell) positions. eToro has a dedicated CFD Overnight Fees page that has all these details.

Effect on Different Asset Types

- Stocks and ETFs: Buying without leverage? You’re in the clear because these won't incur overnight fees. But if you short or use leverage, the trade becomes a CFD and yes, you’ll pay the fee.

- Cryptos: No loopholes here. All crypto CFD positions (even non-leveraged buys) carry overnight fees. This is charged daily and calculated per unit.

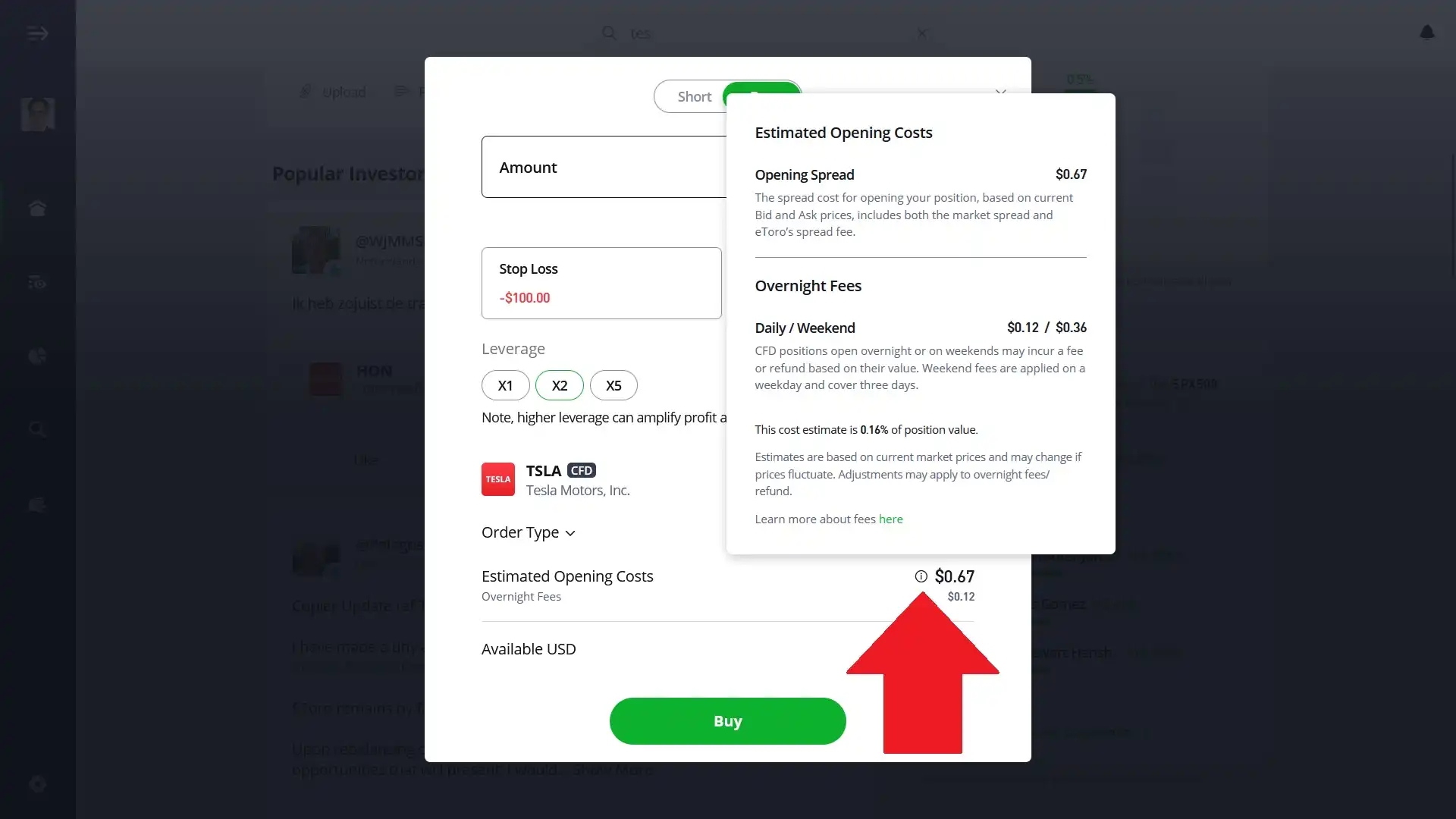

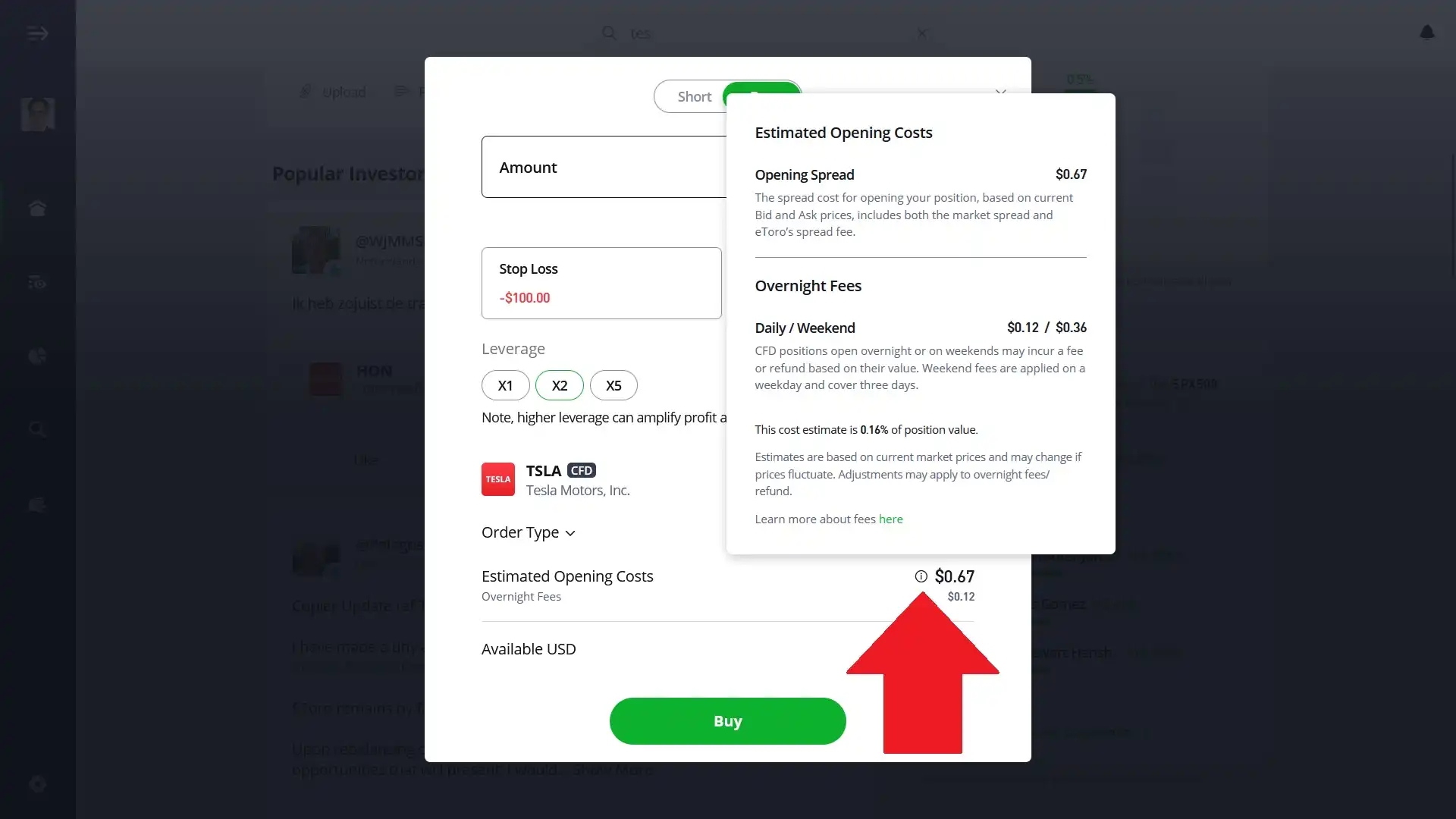

Want to see the overnight charge on a trade? Click the little “i” icon next to the position in your portfolio. I find this to be really useful as it shows me both the daily fee and any weekend multiplier.

You’ll also find a record of all deducted fees in your Account Activity under your Account Statement.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.