Are eToro Fees High?

- No deposit fees

- No account management fees

- No fees to open an account

- Commission-free for real stocks and ETF trading

- Transparent fee structure

61% of retail investor accounts lose money

eToro's fee structure varies depending on the type of asset and trading activity. For long-term investors focusing on stocks and ETFs, the platform offers cost-effective options. However, if you're frequently trading or dealing with leveraged products, fees can accumulate and may affect your profits.

eToro provides commission-free trading for real stocks (US residents only), which makes it appealing for buy-and-hold investors. This means you can purchase and sell these assets without incurring direct trading fees, which is advantageous for those looking to invest over the long term.

When trading cryptocurrencies on eToro, a 1% fee is applied to both buying and selling transactions. This results in a total round-trip cost of 2%, which is higher compared to some other platforms like Binance or Coinbase. This fee structure is acceptable for occasional traders or those prioritizing security and user experience.

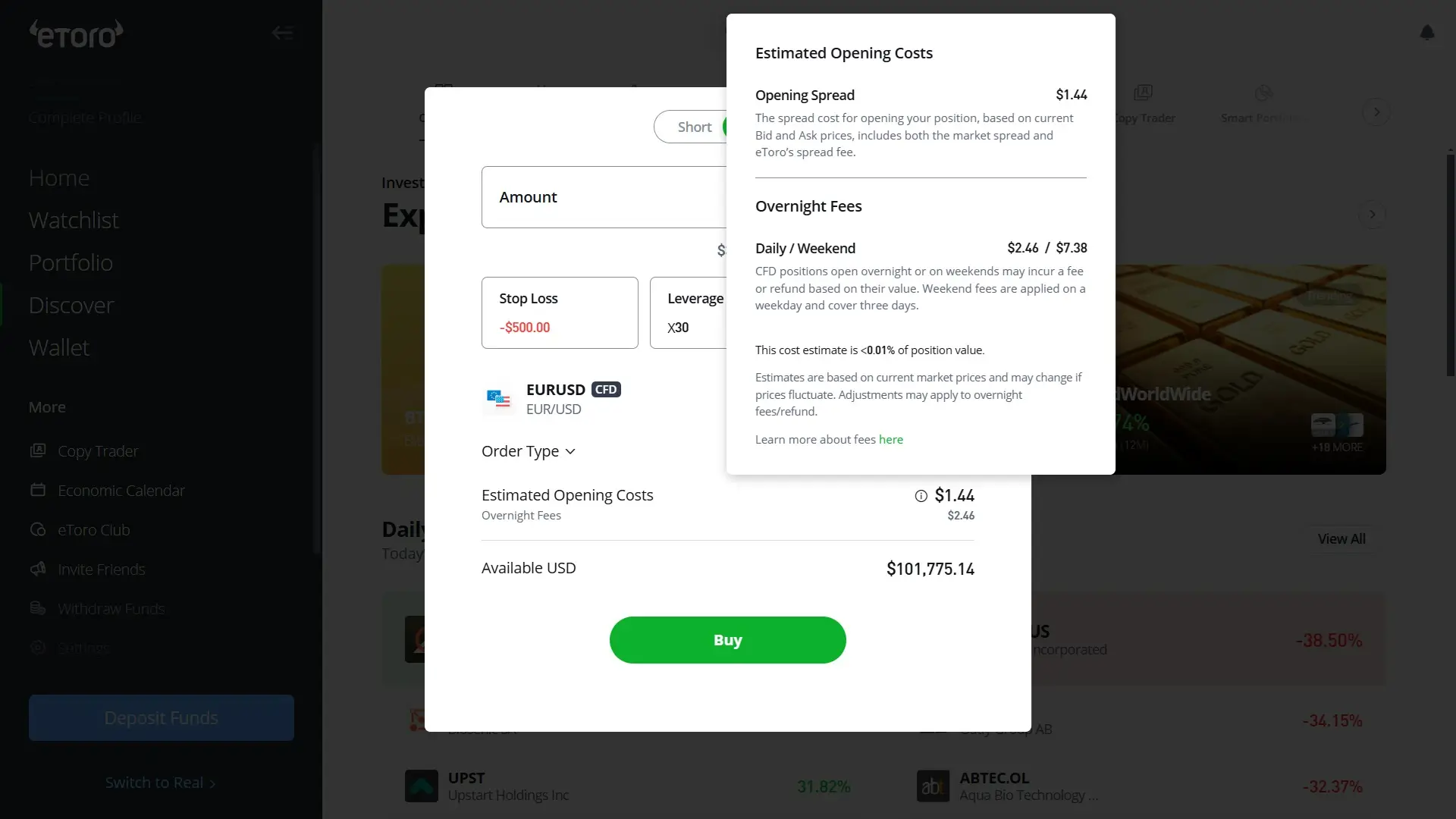

For Contracts for Difference (CFDs) and leveraged positions, eToro charges a 0.09% commission on both buying and selling. In addition, overnight fees apply for positions held beyond a single day. These costs can vary and may become significant over time, especially for traders who maintain positions for extended periods.

eToro also has several non-trading fees that you should be aware of:

My personal take:

eToro offers competitive fees for certain investment strategies, particularly for those investing in stocks and ETFs without leverage. Now, for those involved in frequent crypto transactions, leveraged positions, or those dealing with multiple currency conversions, the associated fees can be higher (which I think is still reasonable in general) compared to some other platforms.

I suggest that you assess your trading habits and investment goals to determine if this broker's fee structure matches with your financial strategy.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

About Mike Druttman

About Mike Druttman